The New Tax Regime 2025 has made waves with its radical tax slab restructuring and an unprecedented Rs 12 lakh exemption. While Finance Minister Nirmala Sitharaman highlights this as a move to boost disposable income and drive economic growth, many taxpayers are left wondering: How does this really impact me?

New Tax Regime 2025: Breaking Down the Rs 12 Lakh Exemption

At first glance, the announcement that individuals earning up to Rs 12 lakh annually will pay zero tax sounds like a massive relief. However, this benefit is not as straightforward as it seems.

- If your taxable income (after deductions) is Rs 12 lakh or less, you will pay zero tax due to a full rebate.

- If your income exceeds Rs 12 lakh, the slab-based taxation system applies, and you will not get the full rebate.

For instance, after considering the standard deduction of Rs 75,000, an individual can technically have a gross income of up to Rs 12.75 lakh and still pay no tax.

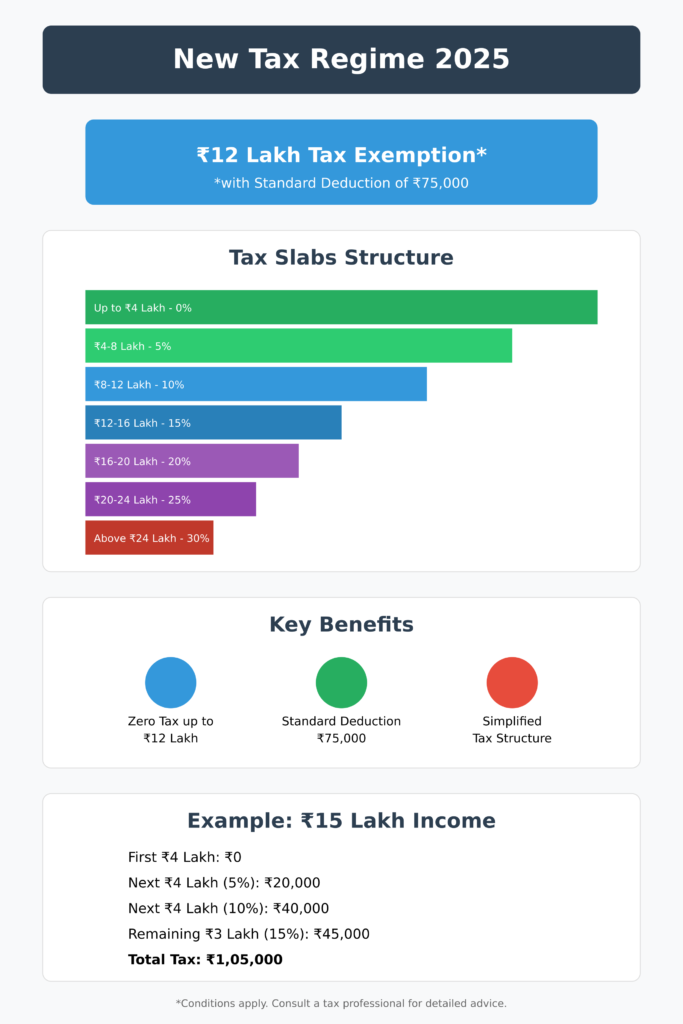

New Tax Regime 2025: New Tax Slabs for 2025

The new tax structure simplifies the slabs while reducing tax burdens for middle-income earners. Here’s how the revised system works:

- Up to Rs 4 lakh – No tax

- Rs 4 lakh – Rs 8 lakh – 5%

- Rs 8 lakh – Rs 12 lakh – 10%

- Rs 12 lakh – Rs 16 lakh – 15%

- Rs 16 lakh – Rs 20 lakh – 20%

- Rs 20 lakh – Rs 24 lakh – 25%

- Above Rs 24 lakh – 30%

This structure brings major relief to middle-income earners, while higher-income individuals will still face a progressive tax burden.

How the New Taxation Works in Practice

One common misunderstanding is that someone earning Rs 15 lakh will only be taxed on Rs 3 lakh (the amount exceeding Rs 12 lakh). That’s not the case. The slab-based system ensures different portions of income are taxed at different rates.

Example: Tax Calculation for a Salary of Rs 15 Lakh

A salaried individual earning Rs 15 lakh (after deductions) will be taxed as follows:

- First Rs 4 lakh – No tax

- Next Rs 4 lakh (5%) – Rs 20,000

- Next Rs 4 lakh (10%) – Rs 40,000

- Remaining Rs 3 lakh (15%) – Rs 45,000

Total tax liability: Rs 1,05,000

Thus, the assumption that only Rs 3 lakh is taxed is incorrect. The slab system ensures a progressive tax structure.

How Does the Rs 12 Lakh Exemption Work?

in New Tax Regime 2025, For those earning up to Rs 12 lakh, the tax slabs still apply, but the government provides a rebate equal to the tax liability. Here’s an example:

- First Rs 4 lakh – No tax

- Next Rs 4 lakh (5%) – Rs 20,000

- Next Rs 4 lakh (10%) – Rs 40,000

Total tax liability: Rs 60,000 → Full rebate applied = Rs 0 tax payable

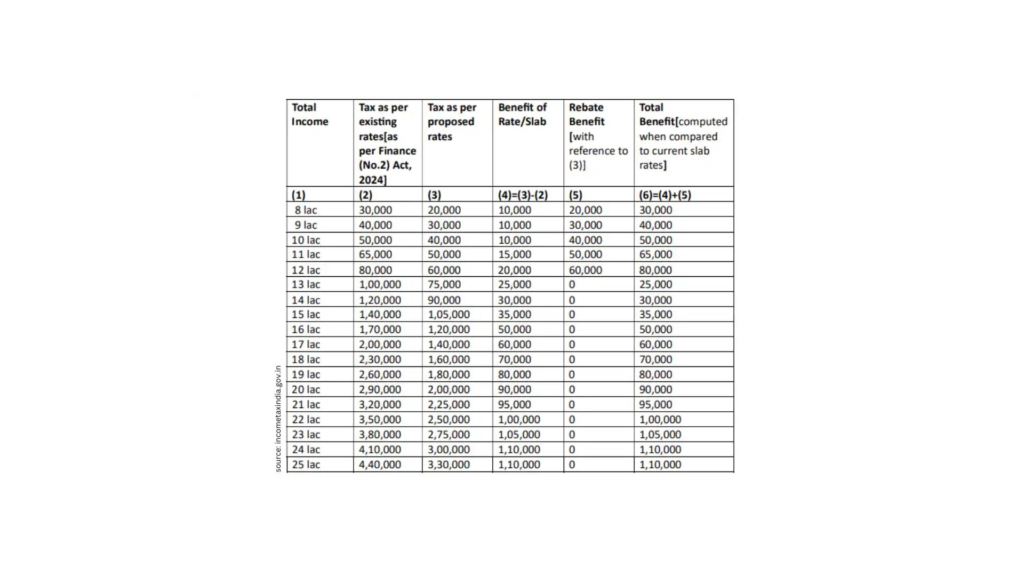

New vs. Old Tax Regime: Which One is Better?

For someone earning Rs 15 lakh:

- Under the old regime: Tax liability was Rs 1.4 lakh

- Under the new regime: Tax liability is Rs 1.05 lakh

- Savings: Rs 35,000

While middle-income earners gain significant benefits, the real winners are those earning Rs 12 lakh or less, as they get the full exemption.

How the Standard Deduction Boosts Your Exemption

The Rs 75,000 standard deduction under the new tax regime 2025 raises the effective exemption limit to Rs 12.75 lakh. For example:

- Gross Income: ₹15,75,000

- After Deduction: ₹15,00,000 (taxable income)

- Tax Liability: ₹1,05,000 (as calculated above).

Without this deduction, the taxable income would be higher.

H2: New vs. Old Tax Regime: Which Should You Choose?

| Factor | New Regime 2025 | Old Regime |

|---|---|---|

| Tax Rates | Lower (0–30%) | Higher (up to 30% + cess) |

| Exemptions | Minimal (standard deduction) | Extensive (HRA, LTA, 80C, etc.) |

| Best For | Those with few investments | Those claiming deductions |

Case Study:

- Income: ₹15 lakh

- New Regime: ₹1,05,000 tax (after standard deduction).

- Old Regime: ~₹2,62,500 (before exemptions). With ₹1.5 lakh under 80C and ₹50,000 HRA, tax drops to ~₹2,00,000.

Effect: High-income earners with investments may prefer the old regime; others benefit from the new.

FAQs: Clearing Up Tax Confusion

1. If I earn Rs 12 lakh, will I pay zero tax?

Yes, but only because of the rebate under the new tax regime 2025.

2. I earn Rs 15 lakh. Will I only be taxed on Rs 3 lakh?

No. Taxation follows a slab-wise process, meaning different portions of income are taxed at different rates.

3. What happens if my income is Rs 12.5 lakh?

The additional Rs 50,000 will be taxed at 15%, resulting in a tax liability of Rs 7,500.

4. Will the old tax regime still exist?

Yes, the old tax regime remains an option, allowing taxpayers to choose the best system for them.

5. Can I claim deductions under the new regime?

The new tax regime does not allow exemptions like HRA, LTA, or 80C investments but includes a standard deduction of Rs 75,000.

6. How does the ₹75,000 standard deduction work?

It reduces taxable income. For ₹15.75 lakh gross income, taxable income becomes ₹15 lakh.

7. Should I switch to the new regime?

Compare liabilities under both regimes. Use online calculators or consult a CA.

8. Are senior citizens exempt?

No, but they retain higher interest exemptions (e.g., ₹50,000 on FDs) under the old regime.

9. Is the ₹12 lakh exemption a rebate or slab?

A rebate. If tax liability is ≤₹60,000 (for ₹12 lakh income), it’s reduced to zero.

Common Misconceptions About the New Tax Regime 2025

- “Income above ₹12 lakh is taxed only on the excess”: False. Taxes apply slab-wise.

- “Standard deduction is optional”: It’s mandatory under the new regime.

- “The old regime is abolished”: It’s still available for FY 2025–26.

Conclusion: A Simplified Yet Complex System

The New Tax Regime 2025 aims to simplify taxation and provide relief, but it comes with trade-offs. While middle-income earners benefit the most, higher earners must carefully evaluate whether switching regimes makes sense for them.

✅ Best for: Those earning Rs 12 lakh or less (full rebate advantage).

❌ Less beneficial for: Those who rely heavily on tax-saving deductions under the old regime.

To maximize your savings, analyze your taxable income, calculate the impact, and choose the regime that works best for you.

You might Also be Intrested in: Union Budget 2025-26: Key Highlights, Insights, and Implications