Market Overview: NIFTY50 & Bank NIFTY Performance

NIFTY50 Trade Setup: The NIFTY50 index struggled to reclaim the 23,800 resistance zone, failing to sustain positive momentum for the second consecutive session. As the market awaits the RBI monetary policy outcome, traders should closely watch the 23,800–23,400 range. A decisive close above or below this range could offer clearer directional cues.

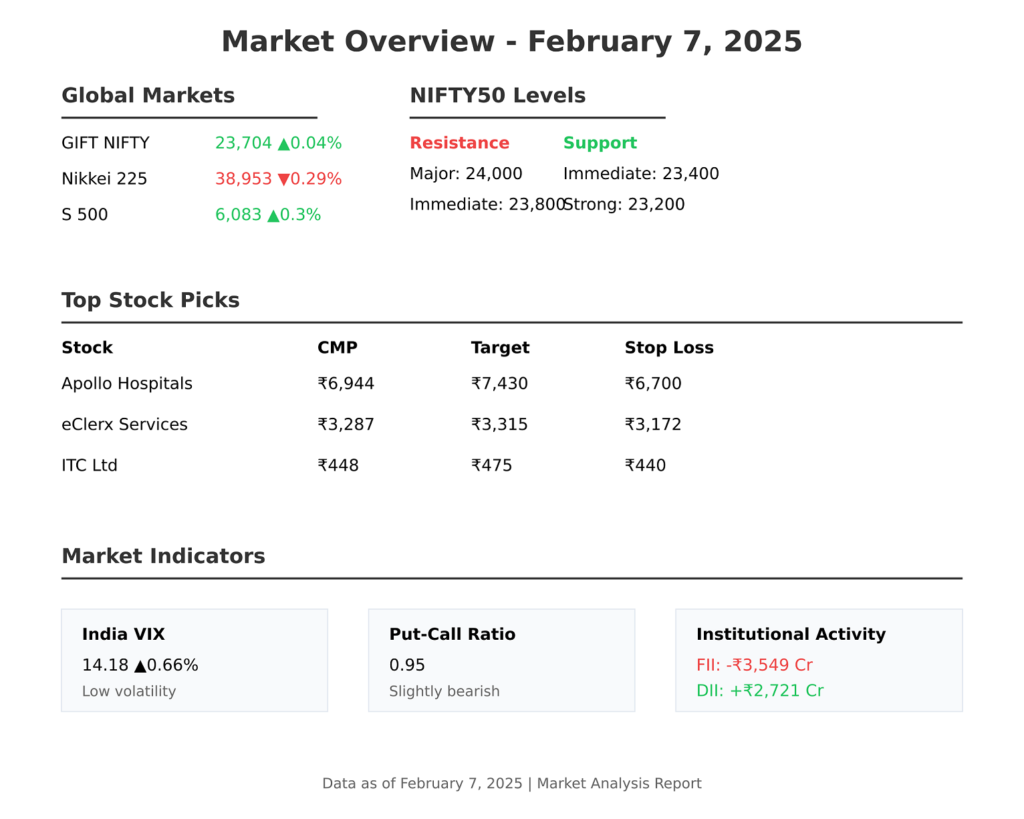

Asian & US Market Updates @ 7 AM

| Index | Current Value | Change |

|---|---|---|

| GIFT NIFTY | 23,704 | ▲ 0.04% |

| Nikkei 225 | 38,953 | ▼ 0.29% |

| Hang Seng | 20,858 | ▼ 0.16% |

| Dow Jones | 44,747 | ▼ 0.2% |

| S&P 500 | 6,083 | ▲ 0.3% |

| Nasdaq Composite | 19,791 | ▲ 0.5% |

Key Developments:

- US indices ended mixed, with investors focusing on Amazon’s earnings and Trump’s policy changes.

- Ford Motor dropped 7%, forecasting a tough 2025.

- Honeywell fell 5%, weighing down the Dow after weak earnings guidance.

- Tech stocks showed resilience, led by semiconductor and AI-based stocks.

NIFTY50 Trade Setup: Support & Resistance Levels

| NIFTY50 Key Levels | Value |

| Immediate Resistance | 23,800 |

| Major Resistance | 24,000 |

| Immediate Support | 23,400 |

| Strong Support | 23,200 |

- Technical Outlook: The index is consolidating in the 23,400–23,800 range. A breakout above 23,800 can push NIFTY50 towards 24,000. On the downside, a break below 23,400 may signal deeper correction to 23,200.

Bank NIFTY Trade Setup: Support & Resistance Levels

| Bank NIFTY Key Levels | Value |

| Immediate Resistance | 50,600 |

| Major Resistance | 51,500 |

| Immediate Support | 50,000 |

| Strong Support | 49,800 |

- Technical Outlook: Bank NIFTY has been outperforming NIFTY50, showing resilience. A breakout above 50,600 could trigger a rally towards 51,500. However, if it drops below 50,000, we may see profit booking.

FII & DII Activity: Institutional Flows

| Investor Type | Net Activity (₹ Crore) |

| Foreign Institutional Investors (FIIs) | -3,549 (Selling) |

| Domestic Institutional Investors (DIIs) | +2,721 (Buying) |

- FIIs remained net sellers, extending their selling streak due to global market uncertainties.

- DIIs absorbed the selling pressure, providing stability.

Stock-Specific Trade Ideas for February 7

1. Apollo Hospitals Enterprise Ltd (CMP: ₹6,944)

- Buy Zone: ₹6,944

- Target: ₹7,430

- Stop Loss: ₹6,700

- Rationale: Strong bullish breakout with rising trading volume.

2. eClerx Services Limited (CMP: ₹3,286.90)

- Buy Zone: ₹3,286.90

- Target: ₹3,315

- Stop Loss: ₹3,172

- Rationale: Breakout from a falling trendline on weekly charts.

3. The Ramco Cements Limited (CMP: ₹900)

- Buy Zone: ₹900

- Target: ₹925

- Stop Loss: ₹884

- Rationale: Bullish reversal pattern indicates further upside.

4. Adani Ports & SEZ (CMP: ₹1,145)

- Buy Zone: ₹1,145

- Target: ₹1,177

- Stop Loss: ₹1,120

- Rationale: Major support at ₹1,120 with reversal signs.

5. ITC Ltd (CMP: ₹448)

- Buy Zone: ₹448

- Target: ₹475

- Stop Loss: ₹440

- Rationale: Strong demand at support levels, bullish momentum.

Market Sentiment Indicators

| Indicator | Value | Trend |

| India VIX (Volatility Index) | 14.18 | ▲ 0.66% |

| Nifty Put-Call Ratio (PCR) | 0.95 | Slightly Bearish |

| Max Nifty Call OI (Resistance) | 24,500 | |

| Max Nifty Put OI (Support) | 23,600 |

- VIX below 15 suggests low volatility, favorable for bulls.

- PCR below 1 indicates more call selling, reflecting a cautious stance.

Frequently Asked Questions (FAQs)

1. What should traders watch before taking a position in NIFTY50?

2. Is Bank NIFTY showing strength or weakness?

Bank NIFTY is outperforming NIFTY50, holding above key EMAs.

If 50,600 breaks, the next upside target is 51,500.

3. How will RBI’s monetary policy impact the market?

A dovish stance (rate cuts) will boost liquidity and drive stocks higher.

A neutral stance could lead to consolidation.

A hawkish stance (no cuts) might cause short-term weakness.

4. Which sectors are showing strength?

IT & Pharma are witnessing long build-ups.

Banking stocks remain in focus ahead of RBI policy.

5. What are the immediate trading strategies?

NIFTY50 above 23,800 → Go long with targets of 24,000.

NIFTY50 below 23,400 → Short with targets of 23,200.

Bank NIFTY above 50,600 → Buy for 51,500.

Final Thoughts & Trade Strategy

- NIFTY50 Trade Setup: NIFTY50 is at a crucial juncture, with 23,800 acting as resistance and this range will act as a Trap.

- Bank NIFTY remains resilient, trading near breakout zones.

- Traders should wait for RBI policy clarity before making aggressive moves.

- Stay cautious with proper stop-losses, as volatility may increase post-policy.

📢 For real-time trade setups and expert market insights, stay connected with us! 🚀

You might also like to read: State Bank Q3 Results: SBI Posts 84% Surge in Net Profit – Full Analysis

NIFTY50 Trade Setup: Visual Recap