Trade Setup for March 19: The stock market has been on a strong bullish streak over the last two sessions, with the Nifty 50 decisively breaking key resistance levels. However, today’s session could be different. Experts suggest a possible consolidation phase, with 22,720 acting as a crucial support level. If the index holds above this, we might see an upward move towards 23,000–23,400 in the coming sessions.

Meanwhile, the Bank Nifty has outperformed, rallying 2% in the last session and reclaiming critical levels. But with the index approaching the upper Bollinger Band, traders must be cautious about potential resistance zones.

So, is this rally set to continue, or should traders brace for a breather? Let’s break it down.

Trade Setup for March 19

1. Nifty 50’s Technical Picture

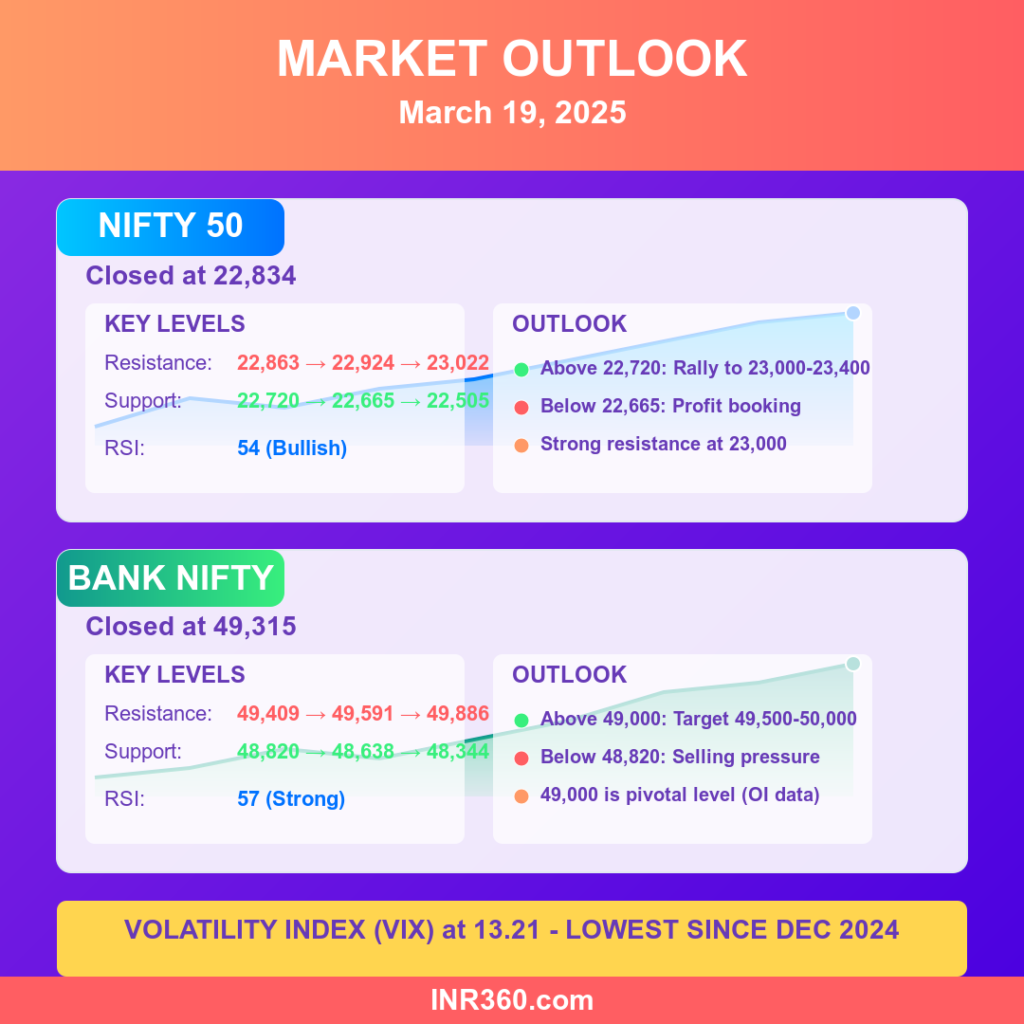

The Nifty 50 closed at 22,834 on March 18, after decisively bridging the bearish gap of February 24. This is a significant move, as it eliminates past weakness and strengthens the bullish outlook.

Key indicators suggest:

✔ Long bullish candlestick pattern – negates previous bearish structure.

✔ Trading above 10 & 20-day EMAs – indicating continued momentum.

✔ RSI at 54 – signaling strength but not overbought yet.

✔ MACD showing a positive bias – although still below the zero line.

🔹 Key levels to watch today:

- Immediate resistance: 22,863, 22,924, 23,022

- Critical support: 22,720, 22,665, 22,505

If the index sustains above 22,720, the rally may continue. However, a break below 22,665 could lead to profit-booking, dragging the index lower.

2. Bank Nifty’s Strength: How Long Will It Last?

Bank Nifty has been a driving force behind the market’s uptrend, closing at 49,315. It has now reclaimed its 10, 20, and 50-day moving averages and is heading toward the upper Bollinger Band.

Key technical observations:

✔ Strong green candle on the daily chart – confirming bullish strength.

✔ RSI at 57 – higher than Nifty, suggesting more momentum in banking stocks.

✔ Near resistance at 49,409 & 49,591 – potential hurdles for further gains.

🔹 Crucial levels to monitor today:

- Resistance zones: 49,409, 49,591, 49,886

- Support levels: 48,820, 48,638, 48,344

If Bank Nifty stays above 49,000, we may see an attempt towards 50,000+ levels. However, a slip below 48,820 might trigger short-term weakness.

Options Data: What Are Traders Betting On?

Nifty 50 Options: Signs of Resistance at 23,000

- Highest Call Open Interest (OI): 23,000 strike (1.32 Cr contracts) → strong resistance.

- Put Writers dominating 22,500–22,700 zone → suggesting firm support.

- PCR (Put-Call Ratio) at 1.29 → bullish sentiment remains strong.

This data suggests that Nifty may struggle near 23,000, but downside support remains intact around 22,500–22,700.

Bank Nifty Options: Support at 49,000

- Highest Call OI: 49,000 strike (14.56 Lakh contracts) → immediate resistance.

- Maximum Put OI at 49,000 → strong support level.

With both Call and Put writers active at 49,000, Bank Nifty is likely to stay range-bound unless a decisive breakout happens.

Volatility & Market Sentiment: Should You Be Cautious?

A key factor driving market confidence is India VIX (Volatility Index), which fell to 13.21, its lowest since December 2024. This suggests:

✔ Low fear among traders – supporting a bullish outlook.

✔ Lower probability of sudden market shocks.

However, low volatility can also mean complacency, so traders should watch for any spikes in VIX, which could indicate upcoming volatility.

Stock-Specific Trends: Where’s the Action?

Bullish Signs (Long Build-up)

A long build-up was seen in 108 stocks, where price gains were accompanied by rising open interest (OI). These are potential buy candidates.

Short-Covering Rally in 102 Stocks

Short-covering was witnessed in 102 stocks, indicating that traders are closing bearish positions and shifting towards bullish trades.

Caution Zones: High Short Build-up

9 stocks showed short build-up, signaling weak sentiment in these counters. Traders should be cautious before entering long trades in such stocks.

What’s in the F&O Ban List?

Stocks under F&O ban due to excessive derivative positions:

- BSE, IndusInd Bank, Hindustan Copper, Manappuram Finance, SAIL

Traders should avoid aggressive positions in these stocks until restrictions are lifted.

Trade Strategy for Today: How to Approach the Market?

For Nifty Traders:

🔹 Bullish scenario: If 22,720 holds, expect a move towards 22,900, 23,000, and 23,400.

🔹 Bearish scenario: A fall below 22,665 may push Nifty towards 22,500.

Trading idea:

- Buy on dips near 22,720, with a target of 22,900–23,000.

- Stop-loss: Below 22,600.

For Bank Nifty Traders:

🔹 Bullish scenario: Holding above 49,000 could drive Bank Nifty towards 49,500 and 50,000.

🔹 Bearish scenario: A break below 48,820 could invite selling pressure.

Trading idea:

- Buy near 49,000, targeting 49,500 & 50,000.

- Stop-loss: Below 48,800.

Final Thoughts: Will the Bulls Stay in Control?

- Nifty’s structure remains bullish, but 23,000 remains a tough barrier.

- Bank Nifty is showing strength, but needs to break above 49,500 for further gains.

- Low VIX favors stability, but traders should watch for profit-booking.

The market trend remains positive, but today could see consolidation before the next leg of the rally. Smart traders should follow technical levels, manage risk, and stay adaptive to market movements.

Trade wisely and stay profitable! 🚀

Stock Market Trade Setup for March 18: Key Levels and Insights for a Profitable Session

Visual Recap: Trade Setup for March 19