Trade Setup for March 24: As we enter the trading week starting March 24, 2025, the Indian stock market remains in focus, with the Nifty 50 and Bank Nifty indices showing strong momentum. The previous week recorded one of the best performances in years, reinforcing bullish sentiment.

In this article, we provide a detailed analysis of the market outlook, covering:

- Technical Analysis of Nifty 50 & Bank Nifty

- Support & Resistance Levels

- Sectoral Performance

- Stock Picks for the Week

- Global Market Impact on Indian Equities

This analysis will help traders, investors, and market participants make informed decisions for the upcoming week.

Trade Setup for March 24

Nifty 50 Weekly Analysis

Nifty 50 Performance & Market Trend

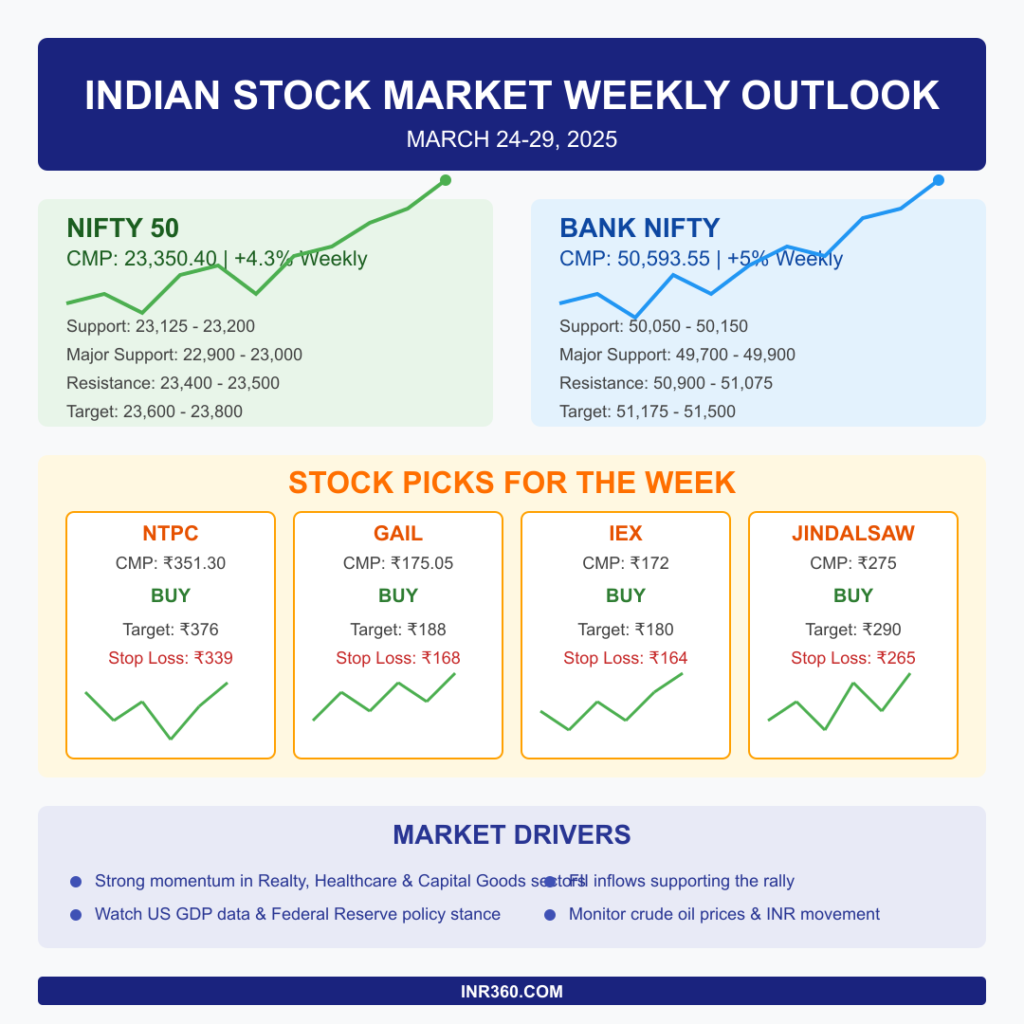

The Nifty 50 index closed at 23,350.40 on March 21, 2025, recording a 4.3% weekly gain. This marks its best week in four years, showcasing strong investor confidence and bullish momentum.

Key Support & Resistance Levels

- Immediate Support: 23,125 – 23,200 (A key buffer zone against corrections)

- Major Support: 22,900 – 23,000 (Critical level; breach may lead to deeper pullback)

- Primary Resistance: 23,400 – 23,500 (Breakout above this level will signal further gains)

- Next Resistance Zone: 23,600 – 23,700 (Crossing this level could trigger a rally toward new highs)

Technical Indicators & Outlook

- The index formed a bullish candlestick pattern, indicating further upside potential.

- The Relative Strength Index (RSI) is above 60, confirming strong momentum.

- Moving Averages (50-day & 200-day) suggest bullish continuation.

If Nifty 50 sustains above 23,400, traders can expect 23,600 and 23,800 as next targets.

Bank Nifty Weekly Analysis

Bank Nifty Performance & Trend

The Bank Nifty index surged by 5% last week, closing at 50,593.55 on March 21, 2025. The rally was driven by strong performances in realty, healthcare, capital goods, and power sectors.

Key Support & Resistance Levels

- Immediate Support: 50,050 – 50,150 (Short-term support for trend continuation)

- Major Support: 49,700 – 49,900 (Critical zone; breach could weaken bullish trend)

- Primary Resistance: 50,900 – 51,075 (Key level to watch for upward movement)

- Major Resistance: 51,175 – 51,325 (Crossing this could trigger an extended rally)

Technical Indicators & Outlook

- 50-day Moving Average (MA) is trending upward, confirming strength.

- RSI remains in the bullish zone, favoring continued upside.

- A breakout above 51,000 could lead to 51,500 and beyond.

Sectoral Performance & Market Drivers

Sectors That Outperformed Last Week

- Realty: Strong demand and rising property prices fuel bullish sentiment.

- Healthcare: Defensive sector gains amid global economic uncertainty.

- Capital Goods & Power: Increased infrastructure spending boosts the sector.

Underperforming Sectors

- IT & FMCG: Weak global cues and margin pressures impacted these sectors.

Stock Recommendations for March 24–29, 2025

Based on technical analysis and momentum indicators, here are the top stock picks for the week:

1. NTPC Ltd (NSE: NTPC)

- CMP: ₹351.30

- Recommendation: Buy

- Target: ₹376

- Stop Loss: ₹339

- Rationale: NTPC maintains higher highs and higher lows, forming a bullish pattern. A breakout could lead to further gains.

2. GAIL India Ltd (NSE: GAIL)

- CMP: ₹175.05

- Recommendation: Buy

- Target: ₹188

- Stop Loss: ₹168

- Rationale: GAIL recently broke out of a falling parallel channel, signaling trend reversal with strong volume confirmation.

3. Indian Energy Exchange Ltd (NSE: IEX)

- CMP: ₹172

- Recommendation: Buy

- Target: ₹180

- Stop Loss: ₹164

- Rationale: IEX is currently oversold, showing a bullish reversal pattern, suggesting a short-term rebound opportunity.

4. Jindal Saw Ltd (NSE: JINDALSAW)

- CMP: ₹275

- Recommendation: Buy

- Target: ₹290

- Stop Loss: ₹265

- Rationale: Strong technical breakout, with bullish volume expansion and trend continuation signs.

Global Market Impact on Indian Equities

While no major domestic economic events are scheduled for the week, the following global factors could influence the Indian stock market:

1. US Stock Market & Economic Data

- US GDP Growth Data: Any slowdown or strength could impact FII flows into India.

- Federal Reserve’s Policy Stance: Any change in interest rate expectations will affect market sentiment.

2. Foreign Institutional Investors (FII) Activity

- FII inflows into Indian markets have been strong, supporting the rally.

- Watch for any shift in FII trends, as it could dictate Nifty and Bank Nifty’s direction.

3. Crude Oil Prices & INR Movement

- Rising crude prices can impact inflation & corporate earnings.

- Rupee depreciation against the US dollar may impact market stability.

Conclusion: Trading & Investment Strategy for the Week

- Nifty 50: Watch for support at 23,125 and resistance at 23,500–23,600.

- Bank Nifty: Key support at 50,000 and resistance at 51,000–51,300.

- Stock Picks: NTPC, GAIL, IEX, and Jindal Saw are top recommendations.

- Global Cues: US GDP, FII activity, and crude oil prices will play a key role.

Traders and investors should maintain a cautious but optimistic stance, focusing on key support and resistance levels while keeping an eye on global triggers.

You Might Also Like to Read: Trade Setup for March 21: Key Market Levels, Options Data & Stock Insights

Disclaimer: The views expressed are based on market analysis and do not constitute financial advice. Investors should consult their financial advisors before making investment decisions.

Visual Recap: Trade Setup for March 24