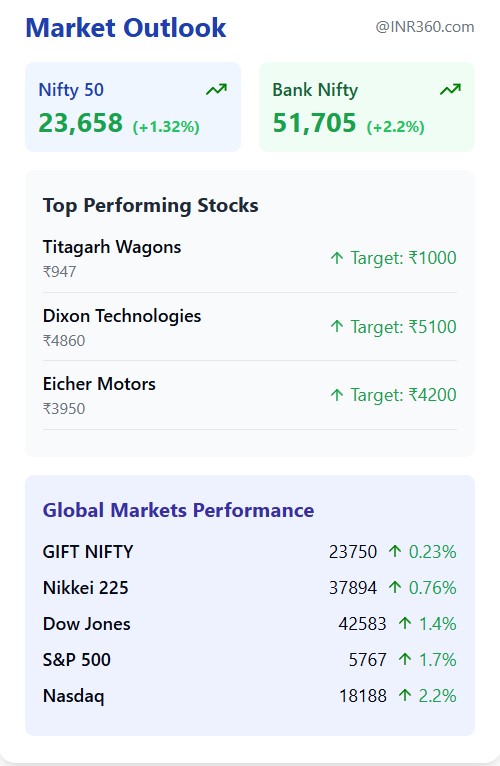

The Nifty and Bank Nifty trade setup for March 25, 2025, indicates a bullish trend as both indices continue their upward momentum. The Nifty 50 has reclaimed the 200 EMA, suggesting sustained bullish strength, with the next key resistance at 23,800. Meanwhile, the Bank Nifty surged 2.2%, reinforcing optimism in the banking sector.

In this detailed SEO-optimized analysis, we will break down:

- Market performance and key levels

- FII/DII activity and derivatives data

- Global market cues

- Stocks to buy or sell today

- Technical outlook with support and resistance levels

Let’s dive into the Nifty and Bank Nifty trade setup for March 25, 2025.

Market Performance: Nifty and Bank Nifty Extend Gains

Key Highlights (March 24, 2025)

| Index | Closing Level | Change (%) |

|---|---|---|

| Nifty 50 | 23,658.35 | ▲1.32% |

| Bank Nifty | 51,704.95 | ▲2.20% |

| Sensex | 77,984.38 | ▲1.40% |

- Nifty 50 closed above 200 EMA, signaling bullish momentum.

- Bank Nifty outperformed with strong gains in HDFC Bank, ICICI Bank, and SBI.

- FIIs bought equities worth ₹3,055 crore, while DIIs purchased ₹98 crore.

Nifty and Bank Nifty: Technical Analysis

Nifty 50 Trade Setup

| Level | Value | Significance |

|---|---|---|

| Support | 23,500 (Max Put OI) | Strong base for bulls |

| Resistance | 23,800 (Next hurdle) | Breakout can lead to 24,000 |

| 200 EMA | 23,000 | Long-term trend support |

- Call OI is highest at 24,100, indicating resistance.

- Put OI is concentrated at 23,500, acting as support.

Bank Nifty Trade Setup

| Level | Value | Significance |

|---|---|---|

| Support | 50,970 (200-DSMA) | Crucial for trend continuation |

| Resistance | 52,000 | Next target if momentum sustains |

- Banking stocks led the rally, with HDFC Bank and ICICI Bank contributing significantly.

Global Market Cues Influencing Nifty and Bank Nifty

Asian Markets (March 25, 2025)

| Index | Level | Change (%) |

|---|---|---|

| GIFT Nifty | 23,750 | ▲0.23% |

| Nikkei 225 | 37,894 | ▲0.76% |

| Hang Seng | 23,703 | ▼0.85% |

U.S. Market Update

| Index | Level | Change (%) |

|---|---|---|

| Dow Jones | 42,583 | ▲1.4% |

| S&P 500 | 5,767 | ▲1.7% |

| Nasdaq | 18,188 | ▲2.2% |

- Tesla surged 11.93%, boosting tech stocks.

- Trump tariffs impact appears narrower than expected, easing global trade fears.

Stocks to Buy or Sell Today

Top Stock Picks for March 25, 2025

| Stock | Buy Price | Target | Stop Loss | Analyst |

|---|---|---|---|---|

| Krishna Institute (KIMS) | ₹639.65 | ₹685 | ₹615 | Sumeet Bagadia |

| Bharat Dynamics (BDL) | ₹1,359.95 | ₹1,450 | ₹1,313 | Sumeet Bagadia |

| Jubilant FoodWorks | ₹658 | ₹690 | ₹640 | Ganesh Dongre |

| Power Grid (POWERGRID) | ₹292 | ₹300 | ₹287 | Ganesh Dongre |

| Macrotech (LODHA) | ₹1,220 | ₹1,260 | ₹1,190 | Ganesh Dongre |

| Paytm (One 97) | ₹765.40 | ₹820 | ₹750 | Shiju Koothupalakkal |

| Rail Vikas (RVNL) | ₹371.50 | ₹392 | ₹363 | Shiju Koothupalakkal |

| JSW Energy | ₹575 | ₹610 | ₹562 | Shiju Koothupalakkal |

F&O Data: Long Build-Up and Short Build-Up Stocks

Long Build-Up (Bullish Momentum)

- Titagarh Wagons

- Manappuram Finance

- NTPC

- Dixon Technologies

- Eicher Motors

Short Build-Up (Bearish Pressure)

- BSE

- Jindal Stainless

Key Factors Driving the Market

- FIIs Turn Net Buyers – Sustained buying indicates renewed confidence.

- Strong Global Cues – U.S. markets rallying on easing tariff fears.

- Technical Breakout – Nifty above 200 EMA confirms bullish trend.

- Banking Sector Strength – Rate-sensitive stocks gaining momentum.

FAQs: Nifty and Bank Nifty Trade Setup

1. What is the Nifty and Bank Nifty trade setup for March 25?

Nifty has support at 23,500 and resistance at 23,800.

Bank Nifty support is at 50,970, resistance at 52,000.

2. Why are FIIs buying Indian stocks?

FIIs are returning due to attractive valuations and expectations of rate cuts.

3. Which stocks are in F&O ban today?

IndusInd Bank is under the F&O ban.

4. What are the best stocks to buy today?

Top picks include KIMS, BDL, Paytm, and JSW Energy (see table above).

5. How are global markets impacting Nifty?

Positive U.S. trends and stable Asian markets are supporting bullish sentiment.

Conclusion: Nifty and Bank Nifty Outlook

The Nifty and Bank Nifty trade setup remains bullish, with indices holding key support levels. A breakout above 23,800 could push Nifty towards 24,000, while Bank Nifty eyes 52,000. Traders should watch FII activity, global cues, and OI data for further direction.

For real-time updates, visit INR360.com.

You might also like to read: Trade Setup for March 24: Nifty 50 & Bank Nifty Analysis, Key Levels, and Stock Picks

Visual Recap: Nifty and Bank Nifty trade setup