Trade Setup for April 2: As Indian markets enter the new financial year (2025-26), investors remain on edge ahead of US President Donald Trump’s impending tariff announcement on April 2. The trade setup for April 2 suggests heightened volatility, with export-driven sectors like IT and pharmaceuticals likely to react sharply to the policy decision.

This article provides a comprehensive trade setup for April 2, analyzing key support and resistance levels, sectoral trends, and expert insights to help traders navigate the uncertainty.

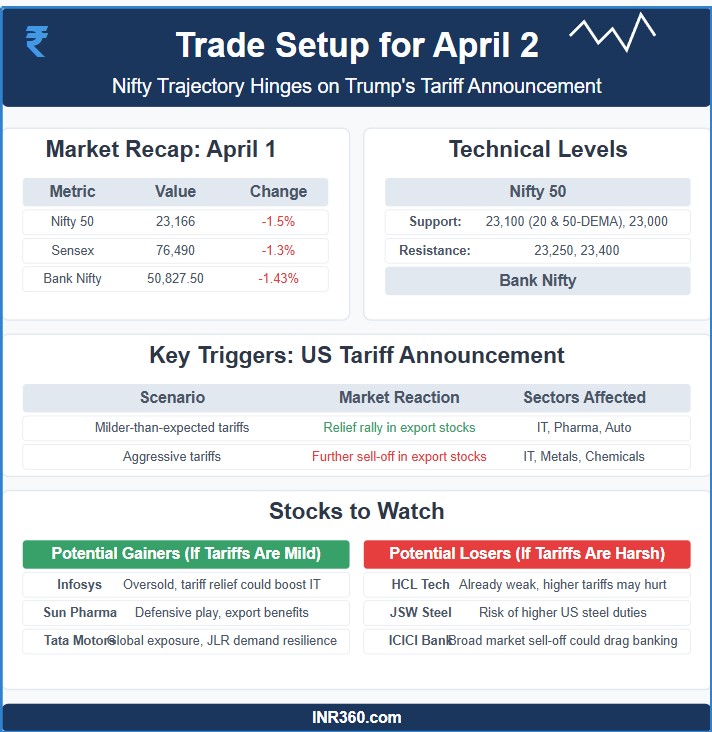

Market Recap: April 1 Session

Indian equities started FY25 on a weak note, with the Nifty 50 plunging 1.5% (354 points) to close at 23,166, while the Sensex dropped 1.3%. The Nifty Bank underperformed, falling 1.43% to 50,827.50.

Key Observations from April 1 Session:

| Metric | Value | Change |

|---|---|---|

| Nifty 50 Close | 23,166 | -1.5% |

| Sensex Close | 76,490 | -1.3% |

| Nifty Bank Close | 50,827.50 | -1.43% |

| Top Nifty Loser | HCL Tech | -4% |

| Gold Price (Spot) | $3,120/oz | Record High |

| USD/INR | 83.42 | +0.2% |

Sectoral Performance (April 1)

- Realty (-3.1%) – Worst-performing sector

- IT (-2.8%) – Hit by tariff fears

- Financials (-2.1%) – Banks under pressure

- Pharma (-1.4%) – Defensive buying seen

Trade Setup for April 2: Key Triggers

1. US Tariff Announcement (Crucial for April 2 Trade Setup)

The trade setup for April 2 hinges on Trump’s tariff decision, expected to impact:

- IT stocks (TCS, Infosys, HCL Tech) – Higher tariffs could hurt margins

- Pharma (Sun Pharma, Dr. Reddy’s) – Export-dependent sector

- Auto (Tata Motors, M&M) – If steel/aluminum tariffs rise

Possible Scenarios:

| Scenario | Market Reaction | Key Sectors Affected |

|---|---|---|

| Milder-than-expected tariffs | Relief rally in IT, Pharma, Auto | IT, Pharma, Auto |

| Aggressive tariffs | Further sell-off in export-heavy stocks | IT, Metals, Chemicals |

2. Technical Levels to Watch (Nifty & Bank Nifty)

Nifty 50 Trade Setup for April 2

- Support: 23,100 (20 & 50-DEMA), 23,000 (Psychological level)

- Resistance: 23,250 (Immediate hurdle), 23,400 (Key reversal level)

Expert Take:

“A decisive break below 23,115 could trigger a deeper correction towards 22,900. However, if Nifty holds 23,100, a rebound towards 23,400 is possible.” – Rupak De, LKP Securities

Bank Nifty Trade Setup for April 2

- Support: 50,390 (38.2% Fibonacci retracement)

- Resistance: 51,400 (Key swing high)

Expert Take:

“Bank Nifty has broken below 51,000; if it sustains below this level, further downside to 50,390 is likely.” – Om Mehra, SAMCO Securities

3. FII/DII Activity

- FIIs: Net sellers (₹1,200 crore on April 1)

- DIIs: Mild buying (₹800 crore)

Stocks to Watch on April 2

Potential Gainers (If Tariffs Are Mild)

| Stock | Reason | Key Level |

|---|---|---|

| Infosys | Oversold, tariff relief could boost IT | ₹1,550 (Support) |

| Sun Pharma | Defensive play, export benefits | ₹1,480 (Resistance) |

| Tata Motors | Global exposure, JLR demand resilience | ₹950 (Support) |

Potential Losers (If Tariffs Are Harsh)

| Stock | Reason | Key Level |

|---|---|---|

| HCL Tech | Already weak, higher tariffs may hurt | ₹1,380 (Support) |

| JSW Steel | Risk of higher US steel duties | ₹810 (Support) |

| ICICI Bank | Broad market sell-off could drag banking | ₹1,020 (Support) |

Derivatives Data: Key Insights for April 2 Trade Setup

Nifty Options Data (April 2 Expiry)

- Max Call OI: 23,500 (Strong resistance)

- Max Put OI: 23,000 (Strong support)

FII Activity in Index Futures

- Net Shorts Increased: FIIs added 12,000 short contracts, indicating bearish bias.

Global Cues Impacting Trade Setup for April 2

- US Markets: Dow futures down 0.4% ahead of tariff news

- Gold Prices: At record highs ($3,120/oz) – Safe-haven demand

- Crude Oil: Brent at $87/barrel – Could impact inflation expectations

Final Trading Strategy for April 2

Bullish Case (If Tariffs Are Mild)

- Buy IT & Pharma stocks on dips

- Nifty target: 23,400-23,500

- Bank Nifty target: 51,400-51,800

Bearish Case (If Tariffs Are Aggressive)

- Short rallies in Nifty near 23,250

- Bank Nifty could drop to 50,000-50,390

- Defensive plays: Gold ETFs, FMCG stocks

Conclusion: How to Navigate April 2 Trade Setup

The trade setup for April 2 is highly event-driven, with Trump’s tariff decision dictating market direction. Traders should:

- Monitor global cues at market open

- Watch Nifty’s reaction at 23,100 (support) and 23,250 (resistance)

- Stay cautious in IT, Pharma, and Auto stocks

A mild tariff announcement could trigger a relief rally, while harsh measures may extend the correction. Adjust positions accordingly and use strict stop-losses.

Final Word: The trade setup for April 2 is all about risk management. Stay alert, trade with discipline, and capitalize on volatility-driven opportunities.

You might also like to read: Intraday Trading Strategy for 1st April: Nifty at 22,450 – Key Levels & Setup

Visual Recap: Trade Setup for April 2