Introduction: The Money Leak You Don’t See

Most people believe financial ruin happens in an instant—a failed business, a stock market crash, a bad investment. But the truth is far scarier. Wealth erosion doesn’t disappear overnight; it erodes over time.

Just like a mighty oak tree that looks strong on the outside but is slowly rotting within, financial erosion happens beneath the surface—silent, unnoticed, and dangerously underestimated. By the time you realize it, it’s often too late to stop the collapse.

This article, inspired by insights from my book, The Surefire Way to Bankruptcy, will show you how small, seemingly harmless financial habits gradually destroy wealth. More importantly, it will teach you how to recognize and stop wealth erosion before it’s too late.

Wealth Erosion and the Oak Tree Metaphor: A Lesson from Nature

Imagine a towering oak tree that has stood for generations. Its branches stretch toward the sky, and its roots run deep underground. It seems invincible. But beneath the bark, decay has set in—a tiny fungus, an unnoticed insect infestation, or internal weakness that slowly eats away at its core.

Year after year, the tree stands tall. To an outsider, it appears strong. But then, one day, a storm comes, and with no warning, the mighty oak crashes to the ground.

This is exactly how wealth erosion works. People assume they are financially stable because they still have money in their accounts, a house to live in, or a job that pays well. But they fail to see the silent dangers eating away at their financial foundation. Then, one unexpected event—a medical emergency, job loss, or market downturn—topples everything.

Financial Erosion vs. Financial Collapse

- Financial Collapse is dramatic, sudden, and obvious (bankruptcy, major financial loss, or liquidation).

- Wealth Erosion is subtle, gradual, and unnoticed (poor spending habits, overconfidence, hidden debts, declining investments).

How Wealth Erosion Happens in Real Life

You don’t wake up one morning broke. It happens slowly, through small, everyday financial mistakes that don’t seem like a big deal—until they snowball. Here’s how it happens:

1. Lifestyle Inflation: Spending More as You Earn More

When your income increases, your expenses tend to rise just as fast. This is known as lifestyle inflation.

- You get a raise, so you upgrade your car.

- You get a bonus, so you book a luxury vacation.

- Your business does well, so you move into a bigger house.

None of these seem like poor financial decisions at the time, but they create a dangerous cycle—your cost of living keeps rising, leaving you vulnerable when income slows down.

2. The Small Leak That Sinks the Ship: Unnoticed Daily Expenses

Wealth erosion isn’t just about big purchases. It’s the small, unnoticed leaks that drain your finances over time.

- Subscription Overload – Streaming services, gym memberships, and software tools you don’t use.

- Impulse Spending – Grabbing a coffee every day, ordering food instead of cooking, unnecessary online shopping.

- Late Fees & Interest Payments – Credit card interest, missed bill payments, bank charges.

One $10 expense seems harmless. But over a year, these micro-spends can add up to thousands of dollars.

3. Overconfidence in Investments

Many people assume that just because they’ve made good investment decisions in the past, they will continue to do so. But the market doesn’t work that way.

- Rajesh, a middle-class IT professional, started trading stocks with caution. As he gained confidence, he began taking bigger risks—trading on margin, ignoring risk management, and chasing high returns. When the market crashed, he lost everything.

- Michael, an heir to a manufacturing empire, believed wealth was infinite. He made reckless business decisions, diversifying into industries he didn’t understand. His fortune slowly drained away, and by the time he realized it, the family business was gone.

4. The Ego Trap: Thinking You’re Immune to Financial Ruin

One of the most dangerous financial mistakes is believing you’re too smart to fail.

- “I’ll always make money; I don’t need a budget.”

- “I can afford to take risks; I’ve made good decisions before.”

- “I’ll fix my finances later when I start earning more.”

This mindset leads to risky behavior—ignoring financial planning, taking on excessive debt, and making overconfident investments.

5. Ignoring Financial Education

Most people learn about money the hard way—after they’ve lost it. Financial illiteracy is one of the biggest contributors to wealth erosion.

- Not understanding taxes – Losing money to inefficient tax planning.

- Falling for Ponzi schemes – Investing in scams that promise high returns.

- Ignoring inflation – Thinking money sitting in a bank account is “safe” while inflation slowly reduces its value.

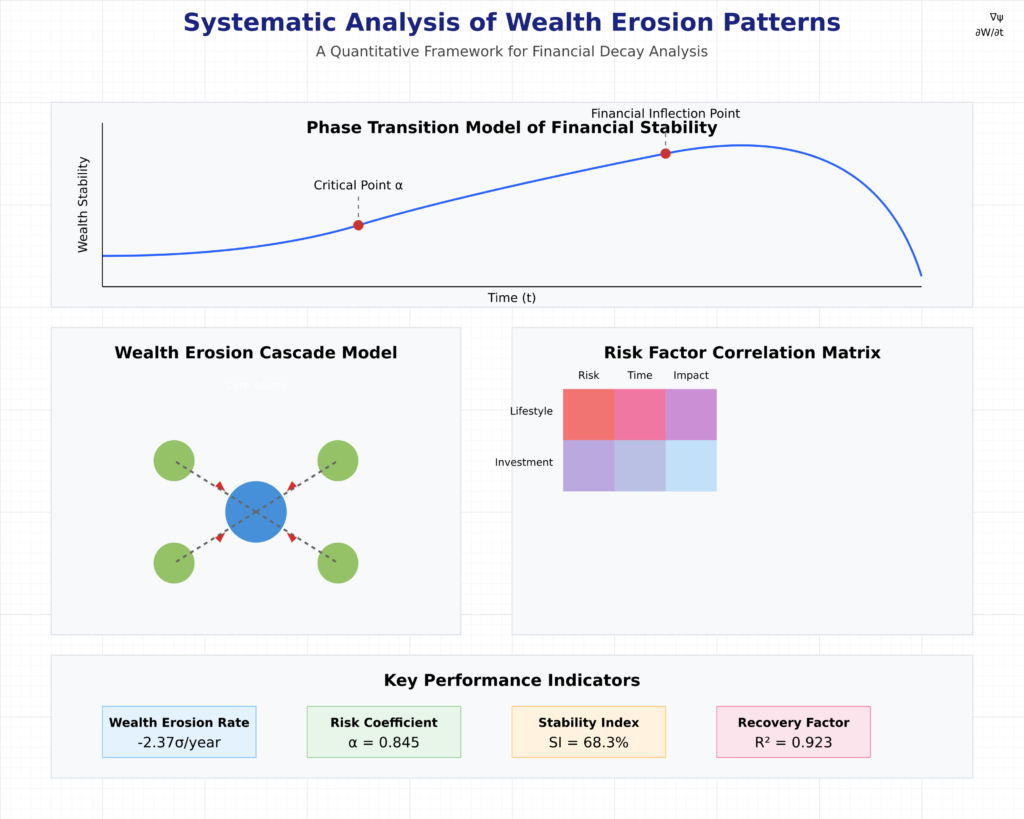

The Domino Effect of Wealth Erosion

One financial mistake rarely ruins a person. It’s the chain reaction that follows.

1️⃣ A small financial loss happens. 2️⃣ To recover, you take a riskier financial decision. 3️⃣ That decision creates more financial strain. 4️⃣ Now, you’re forced into debt or liquidation. 5️⃣ Your entire financial foundation collapses.

How to Stop Wealth Erosion Before It’s Too Late

✅ Step 1: Track Every Rupee

If you don’t know where your money is going, you can’t control it. Use budgeting apps, financial audits, or a simple notebook.

✅ Step 2: Adopt the “Delay Rule” for Purchases

Before making a major purchase, wait 48 hours. This helps eliminate impulse spending and unnecessary upgrades.

✅ Step 3: Build an Emergency Fund

Financial ruin often happens because people don’t have a safety net. Aim for at least 6 months of expenses in savings.

✅ Step 4: Continually Educate Yourself About Wealth Erosion

You don’t need to be a financial expert, but understanding basic investing, taxes, and financial risks can save you from costly mistakes.

✅ Step 5: Protect Yourself from Overconfidence

Regularly review your financial strategy. Get advice from financial mentors and avoid making decisions based solely on gut feeling.

Final Thoughts: Wealth Erosion Is a Choice

You don’t have to go broke to learn financial discipline. Recognizing the signs of wealth erosion and making smarter decisions today can save you from disaster later.

If you want to dive deeper into these financial traps and learn how to safeguard your wealth, grab a copy of The Surefire Way to Bankruptcy. It’s better to learn from others’ mistakes than to experience them firsthand.

💡 Was this article helpful? Share it with someone who needs to hear this!

You Might Also Be Interested in: DeepSeek AI’s Game-Changing Model: Implications for Silicon Valley, India, and the Global AI Race