Budget 2025 Impact on Cryptocurrency Taxation: The Union Budget 2025-26 presented by Finance Minister Nirmala Sitharaman brought significant updates across various sectors. However, for cryptocurrency investors, the much-anticipated reforms in the taxation regime were largely absent. This article delves into the key takeaways from Budget 2025 concerning cryptocurrency taxation, examining what has changed, what remains the same, and the implications for Bitcoin and other crypto asset investors.

Budget 2025 Impact on Cryptocurrency Taxation: Key Highlights

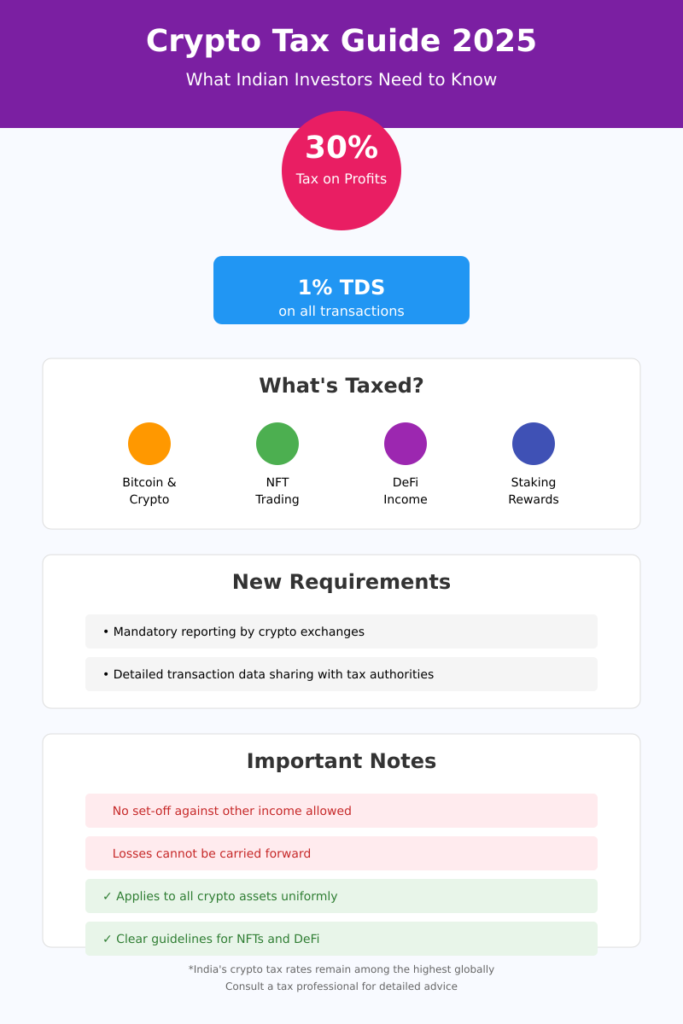

- No Major Tax Relief: The Union Budget did not offer any significant tax relief for crypto investors. The existing tax structure—a flat 30% tax on profits from crypto transactions and a 1% TDS (Tax Deducted at Source) on all transactions—remains intact.

- Mandatory Reporting of Crypto Transactions: An important amendment was proposed to the Income Tax Act, mandating prescribed entities such as crypto exchanges to furnish detailed transaction data of crypto assets to tax authorities. This move aims to improve transparency and curb tax evasion in the crypto sector.

- Clarifications on Taxation Framework: While no new taxes were introduced, the government provided additional guidelines on how existing tax laws apply to different types of crypto assets, including NFTs (Non-Fungible Tokens), DeFi (Decentralized Finance) transactions, and staking rewards.

Budget 2025 Impact on Cryptocurrency Taxation: Detailed Analysis

1. Continuation of 30% Tax on Crypto Gains

Since the introduction of the 30% tax on crypto profits in the 2022 budget, investors have hoped for a more favorable tax regime. However, the 2025 budget did not alter this high tax rate. This flat tax applies to all profits made from the sale of cryptocurrencies like Bitcoin, Ethereum, and others, regardless of the investor’s income bracket.

Implications:

- High Tax Burden: The continuation of the 30% tax rate may discourage retail investors from participating in the crypto market.

- No Set-Off or Carry Forward: Losses incurred from crypto trading cannot be set off against other income, nor can they be carried forward to subsequent years.

2. 1% TDS on Crypto Transactions Remains

The 1% TDS on all crypto transactions, introduced in July 2022, remains unchanged. This TDS applies to the transfer of crypto assets above a specified threshold, affecting liquidity in the market.

Implications:

- Reduced Liquidity: Frequent traders and high-volume transactions are particularly impacted, as the 1% deduction on each transaction can accumulate over time.

- Administrative Burden: Both exchanges and individual traders must continue to comply with TDS reporting requirements, adding to the complexity of tax compliance.

3. Mandatory Reporting by Prescribed Entities

One of the notable changes in Budget 2025 is the amendment to the Income Tax Act, requiring prescribed entities, such as crypto exchanges and wallet providers, to report detailed transaction information to tax authorities.

Implications:

- Increased Transparency: This move aims to improve tax compliance and reduce the scope for tax evasion within the crypto sector.

- Potential Privacy Concerns: Some investors may raise concerns over the extent of data being shared with tax authorities, especially given the decentralized and privacy-focused nature of many cryptocurrencies.

4. Clarifications on Tax Treatment of New Crypto Activities

While no new taxes were introduced, the government clarified the tax treatment of several emerging crypto-related activities:

- NFTs: Profits from the sale of NFTs are subject to the same 30% tax as other crypto assets.

- DeFi Transactions: Income generated from DeFi platforms, such as interest from lending or yield farming, is taxable under the existing framework.

- Staking Rewards: Rewards earned from staking cryptocurrencies are considered taxable income at the standard 30% rate.

Reactions from the Crypto Community

The lack of tax relief and continued stringent regulations have elicited mixed reactions from the crypto community:

- Industry Leaders: Many industry leaders expressed disappointment, noting that the high tax rates and stringent reporting requirements may stifle innovation and drive crypto activities to more favorable jurisdictions.

- Retail Investors: Small investors were hoping for tax concessions to encourage broader participation but now face the same high tax burdens.

- Regulatory Advocates: Some stakeholders welcomed the increased transparency and regulatory clarity, seeing it as a step towards legitimizing the crypto industry in India.

Comparative Analysis: India vs. Global Crypto Taxation

India’s crypto taxation regime remains among the more stringent globally. Here’s how it compares to other major markets:

- United States: The U.S. treats cryptocurrencies as property, with gains taxed at capital gains rates, which vary based on the holding period and income bracket.

- United Kingdom: Crypto assets are subject to capital gains tax, but allowances and varying rates based on income provide some relief.

- Singapore: No capital gains tax on cryptocurrencies, making it a favorable jurisdiction for crypto investors.

The continuation of high taxes and stringent regulations in India may push some investors to consider relocating their crypto activities to more favorable jurisdictions as a result of Budget 2025 Impact on Cryptocurrency Taxation.

FAQs About Budget 2025 Impact on Cryptocurrency Taxation

1. Has the tax rate on crypto profits changed in Budget 2025?

No, the tax rate remains at 30% on all crypto profits.

2. Is the 1% TDS on crypto transactions still applicable?

Yes, the 1% TDS on crypto transactions remains unchanged.

3. What are the new reporting requirements introduced in Budget 2025?

Prescribed entities like crypto exchanges must now furnish detailed transaction data to tax authorities.

4. Are there any tax benefits or deductions available for crypto investors?

No, there are no deductions or set-off provisions for losses in crypto trading.

5. How are NFTs taxed under the new guidelines?

NFTs are taxed similarly to other cryptocurrencies, with a 30% tax on profits.

6. What about income from DeFi and staking?

Income from DeFi activities and staking rewards is taxable under the existing 30% rate.

7. Will these tax rules affect the crypto market in India?

Yes, the stringent tax regime may discourage new investors and affect market liquidity.

8. How do India’s crypto tax rules compare globally?

India’s rules are among the most stringent, with higher tax rates and stricter reporting compared to many other countries.

Conclusion

Budget 2025 Impact on Cryptocurrency Taxation: The Union Budget 2025-26 has maintained the status quo on cryptocurrency taxation, offering no major relief to investors while increasing regulatory scrutiny. The unchanged 30% tax on gains, the continued 1% TDS on transactions, and mandatory reporting requirements signify the government’s cautious approach towards cryptocurrencies. While these measures aim to improve transparency and tax compliance, they may also hinder the growth and innovation of the crypto industry in India.

Investors should stay informed and consult tax professionals to ensure compliance with the evolving regulations. As the global crypto landscape continues to evolve, it remains to be seen how India’s policies will adapt in future budgets.

You Might Also Be Interested in: The New Tax Regime 2025: A Game-Changer or a Mixed Bag?