Table of Contents

Introduction: RBI’s Historic Rate Cut and Its Implications

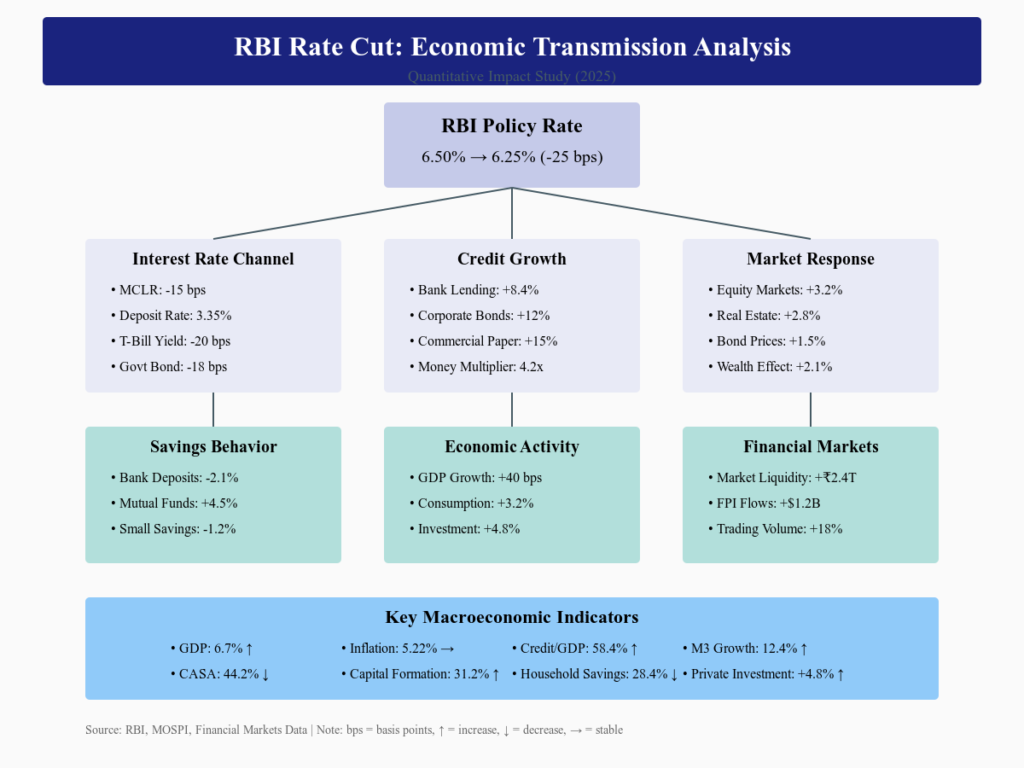

After maintaining a stable repo rate (The Repurchase Agreement) for nearly five years, the Reserve Bank of India (RBI) has cut the repo rate by 25 basis points to 6.25%. This decision marks the first rate cut since May 2020 and signals a shift in India’s monetary policy stance.

The move comes amid slowing GDP growth, inflationary concerns, and global economic uncertainties. The RBI’s Monetary Policy Committee (MPC) aims to stimulate borrowing and investment, encourage economic expansion, and ensure financial stability in a volatile global environment.

Understanding the Repo Rate & Its Role in the Economy

What is the Repo Rate?

The repo rate is the interest rate at which the RBI lends short-term funds to commercial banks in India. It is one of the most powerful monetary policy tools that the central bank uses to control liquidity, inflation, and economic growth.

When the repo rate is lowered:

- Loans become cheaper: Home loans, auto loans, and business loans see lower interest rates.

- Deposit rates decline: Fixed deposit (FD) and savings account interest rates may fall.

- Stock markets react: Interest rate-sensitive sectors like banking, real estate, and automobiles benefit.

Why Did the RBI Cut the Repo Rate?

The decision to lower the repo rate is influenced by multiple factors:

- Economic Slowdown: India’s GDP growth projection for FY26 is revised to 6.7%, down from 7.2% in FY25. Lower growth necessitates stimulus measures.

- Easing Inflation: The Consumer Price Index (CPI) inflation is expected to average 4.2% in FY26, giving the RBI room to ease monetary policy.

- Global Monetary Easing: Major central banks, including the Federal Reserve, European Central Bank (ECB), and Bank of England, have indicated dovish stances.

- Credit Growth & Liquidity Needs: Banks need cheaper capital to sustain credit growth, particularly for MSMEs and infrastructure projects.

Historical Context: How Past Repo Rate Cuts Have Impacted India

India has witnessed significant rate cuts in the past, each with varied economic impacts:

| Year | Repo Rate Cut | Economic Context |

|---|---|---|

| 2020 | From 5.15% to 4.00% | COVID-19 pandemic economic crisis |

| 2019 | From 6.50% to 5.15% | Slowdown in consumption and investment |

| 2015-16 | From 8.00% to 6.50% | Deflationary concerns and weak global demand |

| 2008-09 | From 9.00% to 4.75% | Global Financial Crisis |

Key Takeaway: Repo rate cuts are usually aimed at reviving economic activity, though their effectiveness depends on other macroeconomic conditions.

Impact of the Repo Rate Cut on Different Sectors

1. Stock Market: How Will Equities React?

- Positive for Banking Stocks: Lower borrowing costs could increase lending activity and boost bank profits.

- Boost for Real Estate & Automobiles: Home loans and auto loans become cheaper, improving demand.

- Impact on IT & Export-Oriented Stocks: A weaker INR due to the rate cut could benefit IT exporters.

2. Fixed Deposits & Savings Accounts

- FD interest rates are expected to drop by 25-50 bps in the coming months.

- Senior citizens may see lower returns on their retirement savings.

- PPF, EPF, and Small Savings Schemes might remain unchanged as they are government-backed.

3. Impact on Borrowers

- Home Loans: A ₹50 lakh loan with a 20-year tenure could see EMI savings of ₹750-₹1,000 per month.

- Car & Personal Loans: Interest rates are likely to drop by 0.25% – 0.50%, making borrowing cheaper.

Global Comparisons: How Other Central Banks Are Reacting

| Country | Recent Rate Decision | Current Rate |

| USA (Federal Reserve) | No change | 5.25% – 5.50% |

| UK (Bank of England) | Cut by 25 bps | 4.50% |

| Eurozone (ECB) | Cut by 25 bps | 3.75% |

| China (PBOC) | Cut by 10 bps | 3.45% |

Key Takeaway: The RBI’s rate cut aligns with a global trend where major economies are shifting towards monetary easing to counter economic slowdown risks.

What Happens Next? RBI’s Future Roadmap

- Will there be more rate cuts? The RBI has maintained a neutral stance, indicating it will assess inflation trends before making further decisions.

- Focus on Fiscal & Credit Growth: Policymakers will monitor credit expansion and fiscal policies to balance growth and inflation.

- Global Trade & Oil Prices Impact: Fluctuations in crude oil and geopolitical risks will remain key factors in RBI’s future moves.

Frequently Asked Questions (FAQs) About Repo Rate

1. How does a repo rate cut affect home loan EMIs?

Lower repo rates reduce bank lending rates, making home loans cheaper, thereby lowering EMIs.

2. Will FD rates drop immediately after the repo rate cut?

Yes, but the impact may be gradual as banks adjust their deposit rates over the next few months.

3. How does a rate cut impact inflation?

Lower interest rates increase liquidity and spending, which can lead to mild inflationary pressures.

4. What should investors do in response to the rate cut?

Consider investing in rate-sensitive sectors (real estate, banking, auto).

Lock in higher FD rates before banks revise them down.

Keep an eye on mutual fund NAVs, particularly debt funds.

5. Is this the beginning of an easing cycle?

It depends on inflation trends and global economic stability. If inflation remains under control, more rate cuts could follow in FY26.

Conclusion: The Road Ahead for the Indian Economy

The RBI’s repo rate cut after five years signals a shift in monetary policy, aimed at stimulating growth. While borrowers and businesses stand to benefit from lower borrowing costs, savers may need to explore alternative investment avenues as deposit rates decline.

With inflation projected to remain around 4.2% in FY26, the RBI’s next steps will depend on global economic conditions and domestic fiscal policies. Investors should keep a close watch on market reactions, credit growth, and liquidity trends to navigate the changing economic landscape effectively.

You Might Also be interested in: RBI MPC Meeting 2025: RBI Cuts Repo Rate by 25 Basis Points to 6.25%, First Cut in 5 Years

Your Attractive Heading