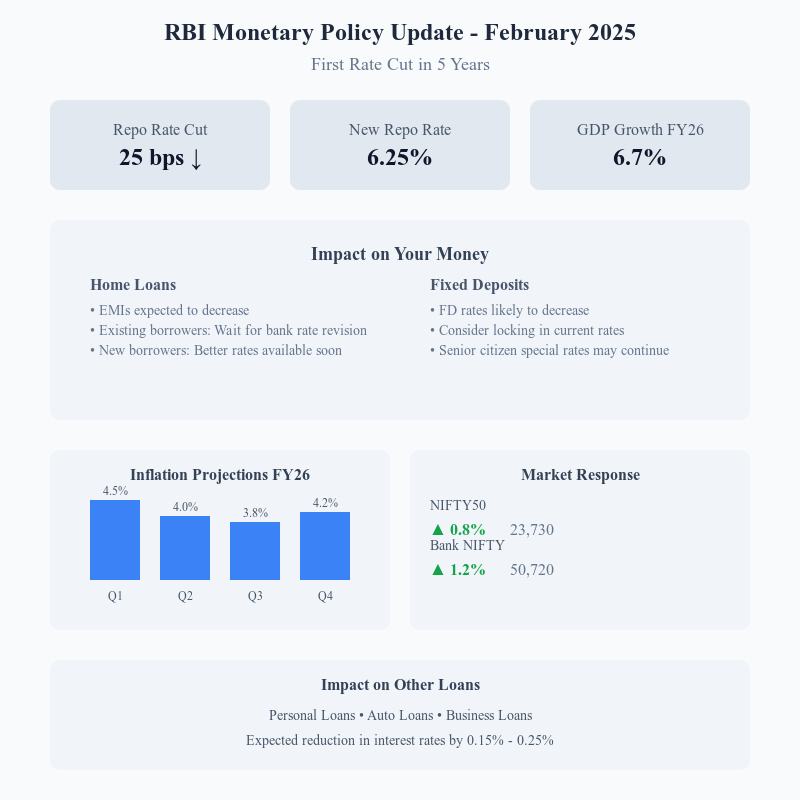

RBI MPC Meeting 2025: The Reserve Bank of India (RBI) has announced a 25 basis points cut in the repo rate, bringing it down from 6.5% to 6.25% in its Monetary Policy Committee (MPC) meeting held on February 7, 2025. This move marks the first repo rate cut in five years, aimed at stimulating economic growth amid global uncertainties. The decision aligns with the recent personal income tax cuts introduced by the government to boost consumption and investment.

Key Highlights of RBI MPC Meeting 2025

| Policy Decision | Previous Rate | Revised Rate |

|---|---|---|

| Repo Rate | 6.50% | 6.25% |

| Reverse Repo Rate | 3.35% | 3.10% |

| Standing Deposit Facility (SDF) Rate | 6.25% | 6.00% |

| Marginal Standing Facility (MSF) Rate | 6.75% | 6.50% |

| Bank Rate | 6.75% | 6.50% |

| Cash Reserve Ratio (CRR) | 4.00% | No Change |

| Statutory Liquidity Ratio (SLR) | 18.00% | No Change |

Reasoning Behind the Repo Rate Cut

According to RBI Governor Sanjay Malhotra, the decision to lower the repo rate was driven by several macroeconomic factors:

- Declining Inflation: The RBI projects retail inflation to moderate to 4.2% in FY26, down from 4.8% in FY25.

- Slowing GDP Growth: India’s GDP growth is projected at 6.7% for FY26, compared to 6.4% in FY25.

- Liquidity Management: The rate cut aims to stimulate credit growth, making borrowing cheaper for businesses and individuals.

- Global Economic Uncertainty: Trade tensions, fluctuating oil prices, and global monetary policy divergence have contributed to market volatility.

Impact on Economy & Financial Markets

1. Banking and Loan Markets

- Lower EMIs for Borrowers: The cut in repo rate will reduce lending rates, benefiting home loan, personal loan, and corporate borrowers.

- Depositors May Face Lower Interest Rates: Banks may lower fixed deposit (FD) rates, impacting returns for savers.

2. Stock Market Reaction

- NIFTY50 & SENSEX Movement:

- NIFTY50 closed at 23,730, up 0.8% following the RBI decision.

- Bank NIFTY surged to 50,720, gaining 1.2%, led by financial stocks.

- Top Gainers: SBI (+2.5%), HDFC Bank (+2.1%), Bajaj Finance (+1.8%).

- Top Losers: ITC (-0.5%), Reliance (-0.3%), Maruti Suzuki (-0.2%).

3. Bond Market Reaction

- 10-Year Government Bond Yield dropped to 6.82%, indicating stronger investor confidence.

- Lower interest rates improve bond prices, benefitting fixed-income investors.

4. Currency Market Impact

- The Indian Rupee depreciated to ₹87.10 per USD post-announcement.

- Rate cuts generally weaken a currency as capital outflows increase.

Sector-Wise Impact of RBI’s Repo Rate Cut

| Sector | Impact |

| Banking & Financials | Lower lending rates may boost credit demand. NIMs may compress in the short term. |

| Real Estate & Housing | Home loan EMIs to reduce, increasing housing demand. |

| Automobile | Lower auto loan rates could drive vehicle sales. |

| Infrastructure | Cheaper financing will support capex expansion. |

| IT & Exporters | Weakening rupee will benefit IT services and export-heavy industries. |

| FMCG & Consumer Goods | Improved consumer spending expected due to reduced borrowing costs. |

GDP & Inflation Forecasts

1. GDP Growth Projections

- FY25 GDP Growth: 6.4%

- FY26 GDP Growth: 6.7%

- Government remains optimistic, citing strong external demand, fiscal consolidation, and domestic consumption.

2. Inflation Projections

- FY25 CPI Inflation: 4.8%

- FY26 CPI Inflation: 4.2%

- Q1 FY26: 4.5%

- Q2 FY26: 4.0%

- Q3 FY26: 3.8%

- Q4 FY26: 4.2%

Expert Commentary: Abhishek Parihar’s Analysis

According to Abhishek Parihar, the RBI’s rate cut signals a pro-growth stance, balancing inflation control with economic expansion.

- Long-Term Market Impact:

- If inflation remains within control, more rate cuts could follow in H2 FY26.

- Banking sector may see improved credit offtake, benefiting NBFCs and housing finance companies.

- Real estate, auto, and infrastructure sectors stand to gain the most.

- Investor Strategy:

- Equity Investors: Focus on banking, housing finance, and consumer stocks.

- Bond Investors: Favor long-duration bonds as yields may drop further.

- Forex Traders: INR weakness may persist, favoring export-oriented stocks.

Frequently Asked Questions (FAQs) About RBI MPC Meeting 2025 & Repo Rate

1. What is Repo Rate and Why is it Important?

Repo rate is the interest rate at which RBI lends money to commercial banks. It influences loan interest rates, deposit rates, and inflation control.

2. How Will This Rate Cut Affect Home Loans?

With the repo rate reduced to 6.25%, banks are expected to lower home loan interest rates, making EMIs more affordable for borrowers.

3. Will FD Rates Fall After the Repo Rate Cut?

Yes, fixed deposit (FD) interest rates may decline as banks adjust their rates in response to lower lending costs.

4. How Does a Repo Rate Cut Impact Inflation?

A lower repo rate increases liquidity, boosting demand, which may lead to higher inflation in the long run. However, current inflation remains within the RBI’s target range.

5. How Does This Affect Stock Market Investors?

Bullish Sectors: Banking, real estate, auto, and infrastructure.

Bearish Sectors: IT & exporters (due to rupee depreciation).

6. Will There Be More Rate Cuts in 2025?

Analysts predict one more rate cut in H2 FY26 if inflation remains below 4.5% and economic growth stabilizes.

Conclusion: What Next for Investors?

The RBI’s repo rate cut signals a shift towards economic stimulus, benefiting borrowers and businesses. While stock markets have reacted positively, long-term stability will depend on inflation trends and global economic conditions.

Key Takeaways:

✔️ Lower borrowing costs for businesses & consumers ✔️ Increased liquidity in financial markets ✔️ Stock market rally led by banks & housing finance stocks ✔️ Bond yields declining, benefiting fixed-income investors ✔️ INR depreciation may impact forex markets

Investment Strategies Post Repo Rate Cut:

- Invest in housing finance, NBFC, and infrastructure stocks.

- Monitor inflation data for future rate cuts.

- Long-term investors can consider bond funds for stable returns.

Stay tuned for further updates on RBI’s monetary policy impact on markets! 🚀

You Might Also Like to Read: NIFTY50 Trade Setup for February 7: NIFTY50 Battles 23,800 Resistance, 21 EMA Support Holds the Key

Visual Recap of RBI MPC Meeting 2025 & Repo Rate Impact