The geopolitical landscape of global oil trade has been significantly reshaped by the United States’ recent sanctions targeting Russia’s oil industry. These measures have profound implications for countries like India, which have become major consumers of Russian crude. This article delves into the multifaceted impact of these sanctions on India’s oil trade, analyzing the challenges and potential strategies for adaptation.

Background of U.S. Sanctions on Russian Oil

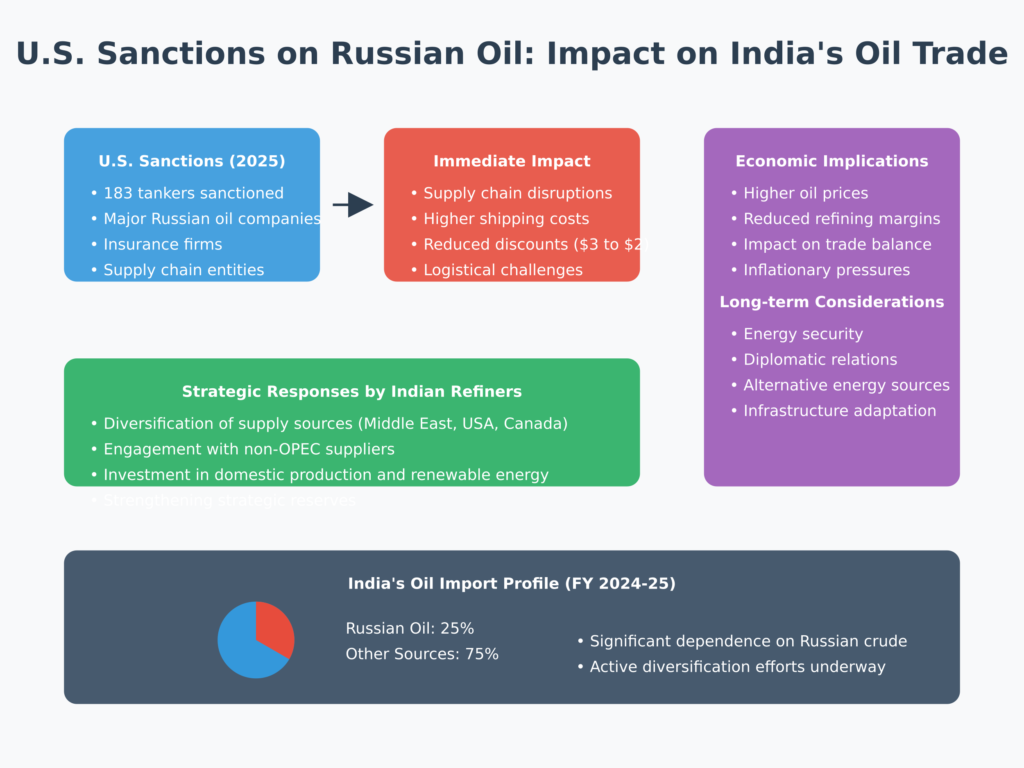

In January 2025, the U.S. government intensified its economic pressure on Russia by imposing comprehensive sanctions aimed at curbing Moscow’s oil revenues. These sanctions encompass:

- Targeting the Shadow Fleet: The U.S. sanctioned 183 tankers, a significant portion of the so-called “shadow fleet” that has been instrumental in transporting Russian oil to countries like India and China.

- Sanctioning Key Entities: Major Russian oil companies, including Gazprom Neft and Surgutneftegas, along with associated insurance firms and other entities involved in the oil supply chain, have been subjected to these sanctions.

India’s Reliance on Russian Oil

In the wake of the Ukraine conflict and subsequent European sanctions on Russian energy, India emerged as a significant importer of Russian crude. Attracted by discounted prices, Indian refiners increased their intake of Russian oil, which accounted for approximately 25% of Indian Oil Corporation’s (IOC) crude imports in the first nine months of the fiscal year ending March 31, 2025.

Immediate Impacts of the Sanctions on India

- Supply Chain Disruptions: The sanctions on the shadow fleet have led to logistical challenges. Indian refiners are experiencing difficulties in securing Russian oil supplies due to increased scrutiny and the reluctance of shipping companies to engage with sanctioned entities.

- Rising Shipping Costs: The sanctions have caused a surge in tanker freight rates, as many buyers and ports in India are avoiding sanctioned ships. This escalation in shipping costs directly impacts the landed cost of crude oil for Indian refiners.

- Reduced Discounts: The price advantage that made Russian crude attractive is diminishing. Discounts on Russian oil have decreased from $3 to around $2 per barrel, reducing the economic incentive for Indian importers.

Strategic Responses by Indian Refiners

In response to these challenges, Indian refiners are exploring alternative strategies:

- Diversification of Supply Sources: To mitigate the risk of over-reliance on Russian crude, Indian refiners are seeking to increase imports from the Middle East and other regions. Industry officials assert that sufficient oil supply is available globally, and replacing the lost Russian volumes should not be difficult.

- Engagement with Non-OPEC Suppliers: Countries like the United States, Canada, Brazil, and Guyana are being considered as potential alternative sources, given their capacity to augment oil production.

Economic Implications for India

The sanctions’ ripple effects extend beyond immediate supply concerns:

- Potential Increase in Oil Prices: The disruption in Russian oil supplies, coupled with increased shipping costs, may lead to higher global oil prices. This scenario could adversely affect India’s trade balance and exacerbate inflationary pressures.

- Impact on Refining Margins: Elevated crude costs can compress the profit margins of Indian refiners, potentially leading to higher prices for end consumers.

Geopolitical Considerations

India’s energy strategy must navigate complex geopolitical dynamics:

- Balancing Relations: While India has deepened its energy ties with Russia, it must also consider its strategic partnership with the United States. Navigating these relationships requires diplomatic finesse to avoid potential secondary sanctions.

- Long-Term Energy Security: The current scenario underscores the need for India to bolster its energy security through diversification and investment in alternative energy sources.

Future Outlook

As the situation evolves, India faces several considerations:

- Monitoring Sanction Developments: Continuous assessment of international sanctions and their implications is crucial for timely strategic adjustments.

- Investment in Domestic Production: Enhancing domestic oil production and investing in renewable energy can reduce dependence on volatile international markets.

- Strengthening Strategic Reserves: Building robust strategic petroleum reserves can provide a buffer against supply disruptions.

FAQs

Q1: What are the recent U.S. sanctions on Russian oil about?

The U.S. has imposed sanctions targeting Russia’s oil industry, including 183 tankers of the “shadow fleet” and major Russian oil companies, to curb Moscow’s oil revenues.

Q2: How dependent is India on Russian oil?

Russian oil accounted for about 25% of Indian Oil Corporation’s crude imports in the first nine months of the fiscal year ending March 31, 2025.

Q3: How will the sanctions affect India’s oil supply?

The sanctions may lead to supply chain disruptions, increased shipping costs, and reduced discounts on Russian oil, prompting Indian refiners to seek alternative sources.

Q4: What steps are Indian refiners taking in response?

Indian refiners are diversifying their supply sources, engaging with non-OPEC suppliers, and exploring imports from the Middle East and other regions to mitigate risks.

Q5: Could these sanctions lead tohigher oil prices in India?

Yes, disruptions in Russian oil supplies and increased shipping costs may lead to higher global oil prices, potentially affecting India’s trade balance and inflation.

Q6: Could these sanctions lead to higher oil prices in India?

Yes, disruptions in Russian oil supplies, coupled with increased shipping costs and potential shifts in global supply chains, may contribute to rising oil prices. This could have a cascading effect on India’s economy, impacting inflation, foreign exchange reserves, and energy security.

Q7: Will Indian refiners continue buying Russian oil despite the sanctions?

While Indian refiners remain interested in Russian crude due to its cost-effectiveness, they are likely to tread carefully to avoid violating U.S. sanctions. To navigate this, India may negotiate alternative payment mechanisms, seek diplomatic assurances, or increase purchases from non-sanctioned Russian oil suppliers.

Q8: Can India shift away from Russian oil entirely?

In the short term, fully replacing Russian oil is challenging due to its price advantage and India’s refining infrastructure, which has been adjusted to process Russian crude. However, in the long term, India may explore diversification strategies, such as increasing imports from the Middle East, the U.S., and Latin America.

Q9: What role does China play in this scenario?

China, along with India, has been a major buyer of Russian oil post-Ukraine war. If India reduces its imports, China may absorb more Russian crude. However, if U.S. sanctions intensify, even Chinese refiners could face restrictions, reshaping the global oil trade.

Q10: What long-term strategies should India adopt?

India must focus on:

Energy Diversification: Investing in alternative energy sources, including renewables and natural gas.

Strategic Oil Reserves: Expanding emergency reserves to cushion against disruptions.

Strengthening Diplomatic Channels: Engaging with the U.S., Russia, and OPEC nations to ensure stable energy supplies.

Enhancing Domestic Production: Boosting domestic oil and gas exploration to reduce import dependency.

Conclusion

The U.S. sanctions on Russian oil present a complex challenge for India, impacting its energy security, economic stability, and geopolitical positioning. While immediate supply chain disruptions and cost escalations are concerns, India’s response—through diversification, diplomatic engagement, and strategic planning—will determine its resilience in the evolving global energy landscape.

India’s long-term strategy should prioritize balancing economic pragmatism with geopolitical realities, ensuring that its energy needs remain insulated from unpredictable international developments.

You might also be interested in: Central Bank Digital Currency (CBDC): A Complete Guide