Introduction

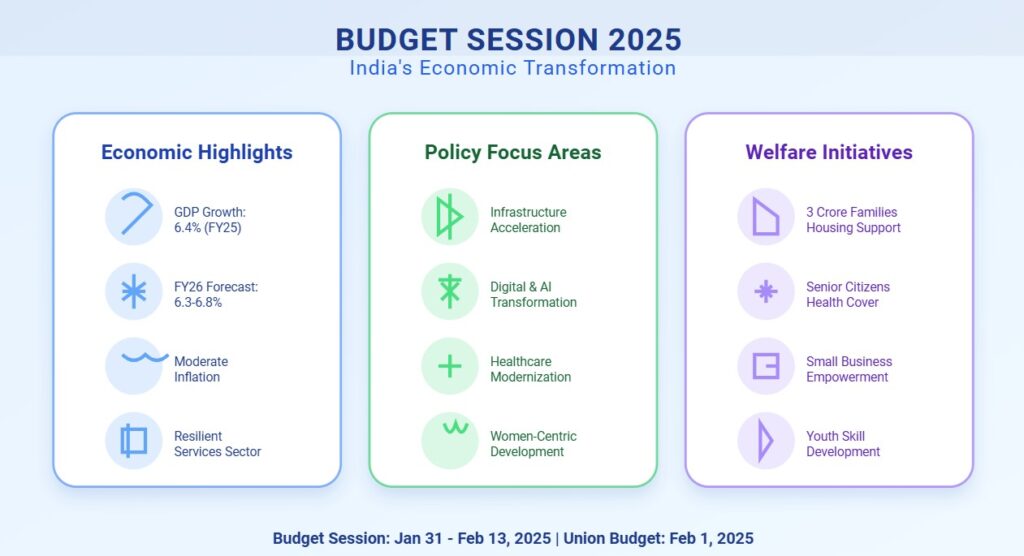

The Budget Session 2025 of the Indian Parliament commenced on January 31, 2025, with a joint address by President Droupadi Murmu. This session, crucial for shaping India’s economic and legislative framework, is scheduled to be held in two phases: January 31 to February 13 and March 10 to April 4.

The session began with the tabling of the Economic Survey 2024-25, setting the stage for the Union Budget 2025, to be presented by Finance Minister Nirmala Sitharaman on February 1, 2025. With key policy measures aimed at economic growth, financial stability, and social welfare, this session will play a vital role in defining India’s path forward.

President Murmu’s Address: Key Takeaways Budget Session 2025

President Droupadi Murmu highlighted India’s growth trajectory and its resilience in the global economy. Some key points from her speech include:

- India’s Rise as a Global Pillar: India continues to be a pillar of economic, social, and political stability, setting an example for emerging economies.

- Women-Led Development: Increased emphasis on women empowerment across various sectors.

- Ayushman Bharat Expansion: Health insurance benefits extended to six crore senior citizens (70+ years).

- Housing for All: Under the Pradhan Mantri Awas Yojana, an additional three crore families will receive housing support.

- Small Business & Entrepreneurship Support: The PM SVANidhi Scheme will include street vendors and small shopkeepers in the banking system.

- Youth Achievements: Contributions of young Indians in startups, space exploration, and sports were acknowledged.

Economic Survey 2024-25: Key Insights (Budget Session 2025)

The Economic Survey, prepared by Chief Economic Advisor V Anantha Nageswaran and his team, serves as a roadmap for economic reforms and growth strategies. Here are the main findings:

1. GDP Growth Projection

- India’s real GDP growth for FY25 is estimated at 6.4%, down from previous years due to weaker manufacturing output and slower investments.

- The forecast for FY26 stands between 6.3% and 6.8%, supported by a strong services sector and infrastructure spending.

2. Inflation & Commodity Prices

- Limited inflation risk is expected in FY26 despite high commodity prices.

- Geopolitical uncertainties remain a concern.

- Good Rabi crop production is likely to stabilize food prices.

3. Fiscal Policy & Reforms

- India’s fiscal deficit is under control, with a push for structural reforms and deregulation to improve global competitiveness.

- Taxation reforms are expected to streamline indirect tax collections and boost investor confidence.

4. Key Sectoral Insights

| Sector | Growth Outlook & Policy Changes |

|---|---|

| Infrastructure | Increased capital spending on highways, railways, and smart cities. |

| Technology & AI | Major push for AI and Digital India initiatives. |

| Healthcare | Strengthening of Ayushman Bharat with broader coverage. |

| Agriculture | Focus on rural credit and sustainable farming techniques. |

Legislative Agenda for the Budget Session 2025

Apart from economic discussions, several key legislative proposals have been listed for debate, including:

- The Finance Bill 2025: Provisions for taxation, investments, and government spending.

- The Waqf (Amendment) Bill: Aimed at addressing governance and administration issues in Waqf properties.

- One Nation, One Election: Discussions around conducting simultaneous elections for Lok Sabha and State Assemblies.

- Cybersecurity Laws: Strengthening measures to combat digital fraud and cybercrime.

Future Economic Outlook & Market Impact

1. Stock Market & Investor Sentiment

- Market experts anticipate a bullish trend in the equity market post-budget, especially in sectors like infrastructure, banking, and technology.

- Focus on taxation and fiscal incentives for businesses could influence foreign direct investments (FDI).

2. Employment & Rural Development

- Job creation efforts through MSME support, ease of doing business reforms, and skilling programs.

- Expansion of rural banking and financial inclusion under PM SVANidhi.

3. Global Economic Positioning

- India’s manufacturing exports and energy independence remain crucial for GDP growth.

- International trade partnerships to be strengthened to counter global recessionary trends.

FAQs: Budget Session 2025

1. What is the significance of the Budget Session 2025?

The Budget Session sets the financial and legislative roadmap for the government, impacting tax policies, spending, and sectoral reforms.

2. What are the major takeaways from the Economic Survey 2024-25?

The survey projects 6.4% GDP growth, moderate inflation, fiscal prudence, and reforms in infrastructure, agriculture, and technology.

3. What key reforms are expected in Budget 2025?

Possible income tax slab adjustments, higher infrastructure spending, rural economy boost, and expansion of welfare programs.

4. How will Budget 2025 impact the stock market?

Markets may react positively to tax cuts, capital expenditure plans, and economic reforms, benefiting sectors like banking, real estate, and energy.

5. What measures are being taken to control inflation?

The government is focusing on better supply chain management, increased Rabi crop production, and stable fiscal policies to keep inflation in check.

6. What are the challenges to India’s economic growth in 2025?

Challenges include geopolitical risks, global trade uncertainties, rising crude oil prices, and domestic demand fluctuations.

7. What role does AI and technology play in Budget 2025?

The government is expected to boost investments in AI research, digital infrastructure, and cybersecurity to drive long-term economic growth.

Conclusion

The Budget Session 2025 is expected to lay down a progressive economic roadmap for India. With expanding welfare schemes, tax reforms, and increased investments, the government aims to strengthen economic stability and boost long-term growth. The Union Budget, set to be presented on February 1, 2025, will reveal detailed policy measures, shaping India’s financial future.

As investors, businesses, and citizens await key decisions, this session holds significant importance in determining India’s economic and social landscape for years to come.

You Might also Be Interested in: L&T Q3 FY25 Results, Financial Analysis & Future Outlook