Table of Contents

Central Bank Digital Currency (CBDC): A Complete Guide

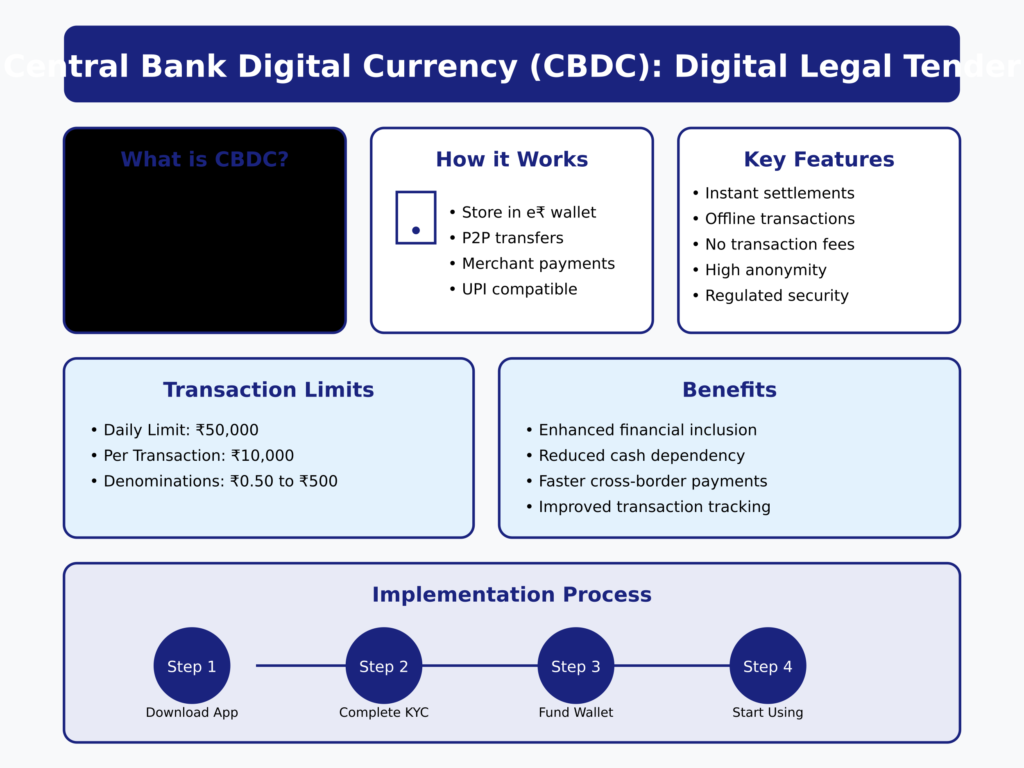

What is CBDC?

The Central Bank Digital Currency (CBDC), also known as the Digital Rupee (e₹) in India, is a digital legal tender issued by the Reserve Bank of India (RBI). Unlike cryptocurrencies, which are decentralized, CBDCs are backed by the government and maintain the same value as physical cash.

CBDCs aim to modernize the financial system by introducing secure, efficient, and government-regulated digital money. The e₹ functions as a direct liability of the RBI and can be exchanged at a 1:1 ratio with existing banknotes and coins.

How Does CBDC Work?

CBDC is designed to function similarly to physical cash but in a digital format. Here’s how it works:

- Issuance: The RBI issues CBDC directly, distributing it through selected banks and fintech platforms.

- Storage: Users store their digital rupees in an e₹ wallet, which can be accessed through mobile apps like MobiKwik and Cred.

- Transactions: CBDC can be used for peer-to-peer (P2P) transfers and peer-to-merchant (P2M) payments.

- Interoperability: CBDC wallets support Unified Payments Interface (UPI) QR codes, making transactions seamless and widely accepted.

- Security & Regulation: The RBI ensures all transactions are traceable, regulated, and secure, unlike cryptocurrencies that operate on decentralized networks.

How to Acquire CBDC (e₹)?

To start using CBDC in India, follow these steps:

- Download a Supported App: Install the MobiKwik or Cred app on your Android device.

- Complete KYC: Existing users with completed Know Your Customer (KYC) verification can activate an e₹ wallet instantly.

- Fund Your e₹ Wallet: Transfer funds from your linked bank account via UPI.

- Start Transacting: Use your e₹ wallet to make purchases, send money, or pay merchants by scanning UPI QR codes.

Impact of CBDC in India

1. Financial Inclusion

CBDC enhances financial accessibility for unbanked populations by offering a digital payment alternative with minimal infrastructure requirements.

2. Reduction in Cash Dependency

With CBDC adoption, the reliance on physical cash decreases, leading to lower printing costs and a more efficient payment system.

3. Secure & Transparent Transactions

Since CBDC transactions are recorded and regulated, they minimize risks related to money laundering and fraud.

4. Improved Cross-Border Payments

CBDCs enable faster, cheaper international transactions, reducing reliance on SWIFT and conventional banking intermediaries.

5. Strengthening Digital Economy

The e₹ integrates seamlessly with existing UPI infrastructure, boosting the adoption of digital transactions nationwide.

Current CBDC Rollout in India

MobiKwik & Cred Partnership with RBI

- MobiKwik has launched a full-scale e₹ wallet for Android users, allowing instant activation for KYC-verified accounts.

- Cred is rolling out a beta version of the e₹ wallet, available to a limited user base.

- Yes Bank serves as the primary sponsor bank, facilitating CBDC issuance for both platforms.

- Transaction Limits:

- Daily limit: ₹50,000

- Per transaction limit: ₹10,000

- Supports denominations from ₹0.50 to ₹500

How is CBDC Different from UPI?

| Feature | CBDC (e₹) | UPI |

|---|---|---|

| Nature | Digital currency | Payment interface |

| Issuer | RBI | Banks & Fintech |

| Storage | e₹ Wallet | Linked Bank Account |

| Transactions | Offline & Online | Only Online |

| Anonymity | High (like cash) | Low (linked to bank) |

Global CBDC Developments

United States and CBDC

- US President Donald Trump has banned the development and issuance of CBDCs in the country.

- The US government cites privacy concerns, financial stability risks, and national independence as key reasons for opposing CBDCs.

- Instead, the US is supporting private sector-led digital assets, such as dollar-backed stablecoins.

FAQs: Everything You Need to Know About CBDC (e₹)

1. What is the difference between CBDC and cryptocurrency?

CBDC is issued and regulated by a central bank, whereas cryptocurrencies (like Bitcoin) are decentralized and not backed by any government.

2. Can I withdraw physical cash from my e₹ wallet?

No, e₹ wallets are strictly digital and do not allow cash withdrawals. However, you can transfer funds back to your bank account.

3. Can I use CBDC for offline transactions?

The RBI is exploring offline transaction capabilities, allowing users to make payments even without internet connectivity.

4. Will CBDC replace physical cash in India?

No, CBDC will coexist with physical currency, offering an additional digital alternative for payments.

5. Are there any fees for using CBDC?

Currently, there are no transaction fees for using e₹ wallets.

6. How do I ensure the security of my e₹ wallet?

Use official apps, enable multi-factor authentication (MFA), and never share your private keys or wallet credentials.

7. Can I transfer CBDC to another country?

While cross-border transfers are possible, the RBI is still working on international CBDC integration.

8. What happens if I lose access to my e₹ wallet?

Contact the customer support of your wallet provider (MobiKwik, Cred, Yes Bank) for recovery options.

9. How is the government monitoring CBDC transactions?

The RBI ensures traceability and regulation, making it harder to use CBDC for illicit activities.

10. What’s next for CBDC in India?

The RBI aims to expand CBDC adoption through more banks, fintech partnerships, and government-backed incentives.

Final Thoughts

The introduction of CBDC (e₹) in India marks a major shift towards a digital economy. With MobiKwik, Cred, and Yes Bank pioneering CBDC adoption, users can experience a secure, government-backed digital currency with seamless transactions and financial inclusion benefits.

As CBDC evolves, it promises to redefine banking, payments, and global trade, making India a leader in digital financial innovation. 🚀

🔗 Stay updated and explore CBDC by activating your e₹ wallet today!

You might also be interested in: How to Participate in the Printr Airdrop: A Complete Guide