Table of Contents

Executive Summary

Introduction: The Global EV Landscape

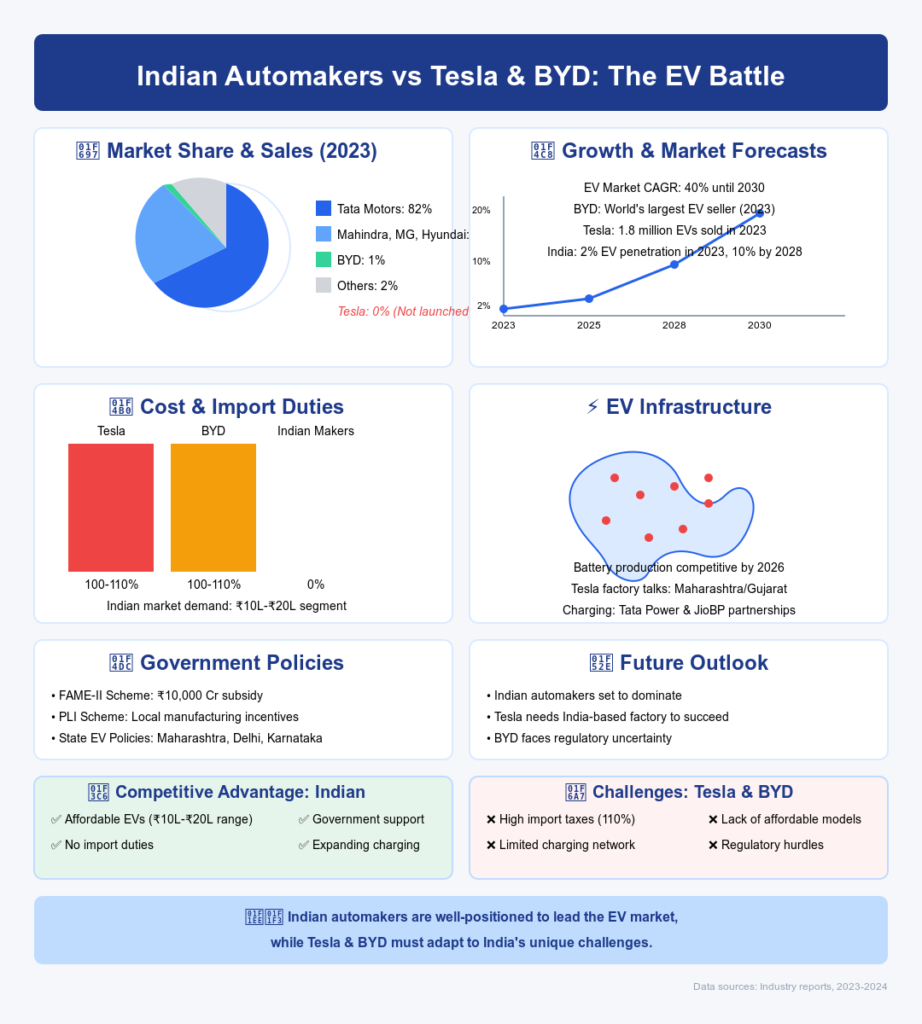

The electric vehicle (EV) industry in Indian led by Indian Automakers has witnessed unprecedented growth in the past decade, with companies like Tesla and BYD leading the charge globally. Tesla, known for its cutting-edge technology, autonomous driving capabilities, and premium branding, has dominated Western markets. Meanwhile, BYD, the Chinese powerhouse, has emerged as a serious contender, outpacing Tesla in global EV sales in 2023.

Despite their global success, India presents a uniquely challenging market for these EV giants. The country’s automotive landscape is defined by cost-conscious consumers, strong domestic brands, and stringent regulatory policies that make it difficult for foreign automakers to establish a foothold.

Tesla and BYD’s Potential Entry into India

Both Tesla and BYD have expressed interest in entering the Indian market. Tesla has been in discussions with the Indian government to establish a manufacturing facility, while BYD has already made headway with its electric vehicles and buses. However, despite their technological and financial strengths, several challenges restrict their ability to disrupt the Indian market.

India’s passenger vehicle (PV) sector, which accounts for over 3.9 million annual sales, is currently dominated by Maruti Suzuki, Tata Motors, and Mahindra & Mahindra. These homegrown brands have built a robust value chain, deep market penetration, cost-effective production models, and strong consumer trust—factors that global entrants struggle to match.

Key Reasons Why Indian Automakers Will Retain Market Dominance

- Pricing Constraints and Cost Sensitivity

- Indian consumers are extremely price-conscious, with over 80% of car sales occurring in the sub-₹10 lakh segment.

- Tesla’s cheapest model, the Tesla Model 3, costs around ₹40 lakh (~$48,000) in international markets, making it unaffordable for the majority of Indian buyers.

- Even if Tesla localizes production, its premium branding makes it difficult to compete with Tata, Maruti, and Mahindra’s affordable EVs like the Tata Nexon EV and Mahindra XUV400.

- Regulatory Barriers and Import Duties

- India’s FDI (Foreign Direct Investment) policies, especially restrictions on Chinese firms, create hurdles for companies like BYD.

- High import duties (100% on CBUs, 60% on SKD units) make direct imports of Tesla and BYD vehicles prohibitively expensive.

- The recently announced EV import policy allows companies to import only 8,000 premium EVs annually at lower duties, limiting Tesla’s initial impact.

- Slow EV Adoption in India

- EV penetration in India remains low (just 2% of total passenger vehicle sales in 2023).

- Infrastructure bottlenecks (lack of charging stations, inconsistent power supply) hinder mass EV adoption.

- Consumers still prefer hybrid and ICE (internal combustion engine) vehicles, where Toyota, Maruti, and Hyundai dominate.

- Strong Domestic Automakers and Local Expertise

- Maruti Suzuki (43% market share), Tata Motors (14%), and Mahindra & Mahindra (9%) have deep-rooted dealership networks, service centers, and supply chains across India.

- These companies have successfully localized manufacturing, reducing costs and improving accessibility.

- Tata Motors’ dominance in the EV segment (over 70% market share) gives it a first-mover advantage.

- Long Localization Timelines for Foreign Players

- Setting up manufacturing plants, sourcing local components, and building a supplier network takes at least 3-4 years.

- Tesla and BYD will struggle to match the existing ecosystem of Indian players, further delaying their competitiveness.

Summary of Findings and Key Takeaways

- Despite the global dominance of Tesla and BYD, their ability to disrupt the Indian automobile industry remains limited due to cost constraints, government regulations, market preferences, and the strong presence of local automakers.

- Indian automakers have already built a strong EV ecosystem, with affordable pricing, localized supply chains, and widespread dealer networks.

- Maruti Suzuki, Tata Motors, and Mahindra & Mahindra will continue to dominate, while Tesla and BYD will struggle to gain significant market share in the short-to-medium term.

In conclusion, while Tesla and BYD may eventually establish a presence in India, their impact on the Indian automotive landscape will be minimal in the foreseeable future. The resilience and adaptability of Indian automakers ensure they remain well-positioned to dominate the market, regardless of foreign competition.

1. Introduction

1.1 Context of the Indian Automotive Market

Overview of the Indian Automotive Industry

India is the fourth-largest automobile market in the world, with annual vehicle sales surpassing 4 million units in 2023. The Indian automotive industry contributes 7.1% to the country’s GDP and employs over 37 million people directly and indirectly. Dominated by Maruti Suzuki, Tata Motors, Mahindra & Mahindra, Hyundai, and Bajaj Auto, the sector has long been driven by internal combustion engine (ICE) vehicles, primarily in the affordable hatchback, sedan, and SUV segments.

Key statistics of the Indian automotive sector:

- Passenger Vehicle Sales (2023): ~3.9 million units

- Two-Wheeler Sales (2023): ~16.5 million units

- Automobile Export Growth: 15.2% YoY

- Market Share of Indian Automakers:

- Maruti Suzuki: ~43%

- Tata Motors: ~14%

- Mahindra & Mahindra: ~9%

- Hyundai India: ~14%

- Others (Toyota, Kia, Honda, MG, etc.): ~20%

Shift Towards Electric Vehicles (EVs) in India

The transition to electric vehicles (EVs) in India is gradual but inevitable, driven by government incentives, technological advancements, and the global push for decarbonization. However, EV penetration in the Indian passenger vehicle segment remains low (2% in 2023), significantly lagging behind markets like China (30%) and Europe (25%).

Major factors influencing EV adoption in India:

✅ Government Initiatives:

- Faster Adoption and Manufacturing of Electric Vehicles (FAME-II) scheme – ₹10,000 crore allocated for EV subsidies.

- Production-Linked Incentive (PLI) scheme – Encouraging local battery production and component manufacturing.

✅ Growing Charging Infrastructure:

- The number of public EV chargers in India grew by over 100% in 2023, but infrastructure is still lacking compared to developed markets.

- Tata Power, BPCL, and IOCL are investing in nationwide EV charging networks.

✅ Affordability and Consumer Preferences:

- Indian consumers remain price-sensitive, preferring vehicles under ₹10-15 lakh (~$12,000-$18,000).

- The best-selling EVs in India are Tata Nexon EV, MG ZS EV, and Mahindra XUV400, primarily priced for middle-class buyers.

✅ Battery Technology and Range Anxiety:

- Lithium-ion battery costs are high, making EVs 20-30% more expensive than ICE vehicles.

- Lack of charging infrastructure and range limitations deter consumers from EV adoption.

1.2 Entry of Global Players: Tesla and BYD’s Market Ambitions

Tesla’s Interest in India

Tesla has long eyed the Indian market, but its entry has been delayed due to high import duties, lack of incentives, and regulatory hurdles.

Key developments in Tesla’s India entry:

- 2016: Tesla’s CEO Elon Musk expressed interest in launching the brand in India.

- 2021: Tesla India Motors and Energy Pvt Ltd was incorporated in Bengaluru.

- 2022: Talks with the Indian government on import duty reductions stalled.

- 2023: Tesla revived discussions to set up a local manufacturing plant, following a government proposal for reduced import duties on EVs under ₹30 lakh (~$36,000).

- 2024: Plans emerged for a Tesla gigafactory in India, but no official confirmation has been made.

BYD’s Growing Presence in India

Unlike Tesla, BYD has already made inroads into the Indian market with locally assembled electric vehicles and commercial fleets.

BYD’s India entry timeline:

- 2013: Entered the Indian market with electric buses for commercial use.

- 2020: Launched the BYD e6, an all-electric MPV.

- 2022: Introduced the BYD Atto 3 SUV, expanding its passenger vehicle segment.

- 2023: BYD announced plans to invest $1 billion in India for a local EV manufacturing facility.

- 2024: The Indian government restricted new Chinese investments, slowing BYD’s expansion.

Challenges Tesla and BYD Face in India:

🚫 High Import Duties – India imposes 100% duty on CBU (Completely Built-Up) imports and 60% on SKD (Semi-Knocked Down) imports, making Tesla and BYD vehicles prohibitively expensive.

🚫 Local Manufacturing Barriers – Setting up a plant requires massive investments and supply chain integration, which takes years to establish.

🚫 Geopolitical Issues – India’s tense trade relations with China create additional hurdles for BYD’s expansion.

🚫 Lack of Market Fit – Tesla and BYD cater to premium customers, whereas Indian automakers dominate the budget and mid-range EV segments.

1.3 Objective of the Report

The objective of this report is to analyze the resilience of Indian automakers against Tesla and BYD, focusing on:

✔ Why Indian automakers will continue to dominate the market.

✔ How cost advantages, local supply chains, and government policies favor domestic players.

✔ The challenges Tesla and BYD face in competing with established Indian brands.

✔ Future scenarios and strategic recommendations for Indian automakers.

This in-depth study provides data-driven insights into the strengths of Indian manufacturers and why they hold a significant advantage over foreign EV giants.

2. Market Dynamics and Competitive Landscape

2.1 Consumer Preferences in India

Key Factors Influencing Indian Consumers

The Indian automotive market is highly price-sensitive, driven by affordability, fuel efficiency, and resale value. Unlike Western or Chinese markets where EV adoption is growing rapidly, Indian consumers prioritize cost-effective and reliable vehicles over high-tech, premium offerings.

🚗 Top factors influencing Indian car buyers:

1️⃣ Affordability & Price Sensitivity

- Over 85% of car buyers in India purchase vehicles priced under ₹15 lakh (~$18,000).

- EVs like the Tata Nexon EV (

₹15 lakh) and Mahindra XUV400 (₹16 lakh) dominate the market, whereas Tesla’s cheapest model, the Model 3 (~₹50 lakh if imported), is unaffordable for most Indian buyers.

2️⃣ Mileage and Cost of Ownership

- Range anxiety is a significant deterrent to EV adoption. Consumers prefer cars offering over 300 km per charge at an affordable price.

- ICE vehicles with higher mileage (20-25 km/l petrol, 25-30 km/l diesel) remain the top choice.

- EV charging infrastructure is still underdeveloped, making consumers hesitant to switch from petrol/diesel.

3️⃣ Resale Value & Maintenance Costs

- Indian buyers prioritize resale value, which is well-established for ICE cars but uncertain for EVs.

- Spare parts and repair costs for Tesla and BYD vehicles are expected to be higher than locally manufactured models like Tata and Mahindra.

4️⃣ Service Network & After-Sales Support

- Brands like Maruti Suzuki and Tata Motors have a wide service network with 4,000+ outlets, ensuring affordable maintenance.

- Tesla and BYD lack a strong service ecosystem in India, raising concerns about repair costs and part availability.

Market Segmentation: Income Groups and Spending Power

The Indian car market can be divided into three broad income segments:

🔹 Entry-Level Segment (₹3 lakh – ₹7 lakh) → 50% of the market

- Buyers prioritize fuel efficiency, affordability, and low maintenance costs.

- Popular models: Maruti Alto, Hyundai Santro, Tata Tiago.

- EV adoption is nearly absent in this segment due to high initial costs.

🔹 Mid-Range Segment (₹7 lakh – ₹20 lakh) → 35% of the market

- Dominated by compact SUVs, sedans, and affordable EVs.

- Popular models: Tata Nexon, Mahindra XUV300, Hyundai Creta.

- This is the most promising EV segment in India, where Tata Motors and Mahindra are aggressively competing.

🔹 Premium Segment (Above ₹20 lakh) → 15% of the market

- Comprises luxury cars, premium SUVs, and high-end EVs.

- Tesla and BYD aim to penetrate this market, but luxury EVs have limited demand.

- Consumers in this segment prefer Mercedes, BMW, and Audi over BYD.

Preference for Budget and Mid-Range Vehicles vs. Premium EVs

- 70% of Indian buyers opt for cars priced below ₹10 lakh.

- Premium EV adoption remains limited, with sales under 5,000 units per year.

- Tesla’s luxury positioning is a mismatch with India’s price-conscious market.

- BYD has a better market fit, but brand recognition and trust remain weak compared to Tata and Mahindra.

2.2 Indian Automakers’ Market Share and Strengths

Current Market Share of Key Indian Automakers

| Manufacturer | Market Share (%) | Key Strengths |

|---|---|---|

| Maruti Suzuki | 43% | Affordable pricing, extensive service network, strong brand loyalty |

| Tata Motors | 14% | Leading EV manufacturer in India, strong SUV segment, safety features |

| Mahindra & Mahindra | 9% | Strong SUV portfolio, aggressive EV expansion |

| Hyundai India | 14% | Well-balanced portfolio, premium brand perception |

| Others (Toyota, Kia, MG, Honda, etc.) | 20% | Niche players with premium and hybrid offerings |

Overview of Indian Automakers’ EV Strategies

1️⃣ Tata Motors – The EV Leader

- Tata Nexon EV (₹15 lakh) is India’s best-selling EV.

- Plans to launch 10 new EV models by 2025.

- Local battery manufacturing plans to reduce costs further.

2️⃣ Mahindra & Mahindra – Aggressive Expansion

- XUV400 EV and upcoming Born Electric SUVs targeting the mid-range segment.

- Strategic partnerships with Volkswagen for battery technology.

3️⃣ Maruti Suzuki – Entering the EV Race in 2025

- First electric SUV set for 2025 launch.

- Focus on hybrid-electric models before full EV adoption.

4️⃣ Hyundai & MG Motors – Targeting Premium EV Market

- Hyundai Kona EV and Ioniq 5 cater to the premium segment.

- MG ZS EV gaining traction in the ₹22 lakh range.

2.3 Tesla and BYD’s Product Positioning and Challenges

Tesla’s Model 3 and Model Y Pricing vs. Indian Consumer Preferences

Tesla Model 3 (₹50-60 lakh)

- Nearly 3x the price of Tata Nexon EV, making it inaccessible to the majority.

- Limited public charging infrastructure makes long-range EVs less attractive.

Tesla Model Y (₹60-70 lakh)

- Competes with Mercedes-Benz EQB and BMW iX, both of which have stronger brand appeal.

- High maintenance costs and lack of service centers are major drawbacks.

BYD’s Strategy and Existing Presence in India

BYD has adopted a gradual entry strategy in India:

✅ Introduced electric buses in 2013 (fleet segment).

✅ Launched Atto 3 and e6 MPV, targeting fleet operators and premium EV buyers.

✅ Plans to invest $1 billion in India for local EV production.

Challenges for Tesla and BYD in India

🚫 High Import Duties & Manufacturing Barriers

- India imposes 100% import duty on CBU vehicles, making Tesla and BYD twice as expensive.

- To compete, they must establish local manufacturing, which requires years of investment.

🚫 Weak Charging Infrastructure

- Less than 10,000 public charging stations vs. 2 million in China.

- Indian consumers still fear range anxiety, slowing EV adoption.

🚫 Competition from Indian EV Players

- Tata Motors and Mahindra offer affordable, locally-produced EVs.

- Government incentives favor domestic brands, putting Tesla and BYD at a disadvantage.

🚫 Regulatory & Geopolitical Hurdles

- India has restricted new Chinese investments, impacting BYD’s expansion.

- Tesla’s push for import duty cuts has been rejected, forcing them to reconsider their India strategy.

Conclusion

The Indian automotive market is dominated by budget and mid-range buyers, while Tesla and BYD cater to premium consumers. Tata Motors, Mahindra, and Maruti Suzuki have a stronghold due to localized production, lower costs, and widespread service networks.

While BYD has a better chance than Tesla due to its gradual entry and fleet presence, both companies face significant barriers to mass adoption.

3. Key Factors Supporting Indian Automakers’ Market Dominance

3.1 Understanding of Local Market Dynamics

How Maruti Suzuki and Mahindra Have Adapted to Local Preferences

Indian automakers such as Maruti Suzuki, Mahindra, and Tata Motors have built their success on a deep understanding of consumer preferences. Unlike Tesla and BYD, which primarily cater to premium EV buyers, Indian automakers focus on affordability, fuel efficiency, and practicality—factors that resonate with the average Indian consumer.

- Affordability & Price Sensitivity: Indian consumers are highly price-conscious, favoring cars priced under ₹2 million. Maruti Suzuki, for instance, dominates the market with budget-friendly models that provide a balance of cost, mileage, and durability.

- ICE to EV Transition: While Tesla and BYD focus exclusively on electric vehicles (EVs), Indian brands offer hybrid and alternative fuel vehicles to ease consumer transition from internal combustion engines (ICE) to EVs.

- Feature Customization: Indian automakers equip their vehicles with features tailored for local preferences, such as robust air conditioning systems, higher ground clearance, and fuel-efficient engines, making them more suitable for Indian road conditions.

Cost-Effective Vehicle Production and Pricing Strategies

The cost of vehicle production plays a major role in determining market success. Indian automakers have successfully optimized their supply chains, reducing reliance on imports and maintaining lower price points.

- Localized Sourcing: Maruti Suzuki and Mahindra rely on domestic component suppliers, reducing production costs compared to Tesla and BYD, which depend on expensive imports.

- Small & Mid-Sized Vehicles: The majority of Indian consumers prefer hatchbacks and compact SUVs, a segment largely overlooked by Tesla and BYD, which prioritize premium sedans and SUVs.

- Affordability vs. Luxury: Tesla’s Model 3, expected to be priced above ₹40 lakh, faces a stark contrast to Tata’s Nexon EV, priced around ₹15-₹20 lakh, making local brands more accessible.

3.2 Manufacturing and Supply Chain Advantages

Domestic Production vs. Imported EVs

Indian automakers benefit significantly from local manufacturing, avoiding the hefty import duties imposed on Tesla and BYD. Maruti Suzuki and Mahindra operate extensive production facilities within India, allowing them to control costs and logistics efficiently.

- Local Manufacturing Hubs: Maruti Suzuki and Tata Motors have multiple plants across India, reducing dependence on global supply chains.

- Reduced Tariffs: Unlike Tesla, which faces up to 110% import duties on fully assembled cars, domestic manufacturers can leverage government incentives to keep costs low.

- Faster Market Penetration: BYD and Tesla’s reliance on importing cars delays their ability to reach Indian customers quickly, while local brands maintain a continuous supply.

Role of Mahindra’s Existing EV Production and Ecosystem

Mahindra’s early investment in electric mobility through models like the eVerito and XUV400 gives it a significant advantage in infrastructure and production efficiency.

- Battery Production Capabilities: Mahindra has partnered with Indian and global battery manufacturers to ensure cost-effective production.

- EV Charging Network Expansion: Unlike Tesla, which is still negotiating entry into India, Mahindra and Tata are actively collaborating with government agencies to expand charging infrastructure.

3.3 Regulatory and Policy Landscape

India’s EV Policies and Their Impact on Foreign vs. Domestic Players

Government regulations play a pivotal role in shaping the Indian EV industry. Indian automakers benefit from policies that prioritize local production and innovation.

- FAME-II (Faster Adoption and Manufacturing of Electric Vehicles): The policy provides substantial incentives to domestic EV manufacturers, making it difficult for Tesla and BYD to compete without setting up local manufacturing plants.

- PLI (Production-Linked Incentive) Scheme: This initiative encourages local EV and battery manufacturing, benefiting companies like Tata and Mahindra.

Government Incentives Favoring Local Manufacturing

Indian automakers gain a competitive edge due to government-backed financial incentives.

- Subsidies on EVs: Tata’s Nexon EV and Mahindra XUV400 qualify for government subsidies, reducing their effective cost to buyers.

- State-Level Benefits: Various states offer road tax exemptions, lower registration fees, and additional subsidies for domestically manufactured EVs.

Impact of Import Duties on Tesla and BYD

- High Tariffs: Tesla and BYD face import duties of up to 110% on completely built-up (CBU) units, making their vehicles significantly more expensive.

- Negotiations for Local Manufacturing: Tesla has been in discussions with the Indian government for local production, but until that materializes, their price disadvantage remains a significant hurdle.

3.4 Distribution and After-Sales Service Networks

Extensive Dealership and Service Network of Indian Automakers

Maruti Suzuki, Mahindra, and Tata have an extensive dealership and service network across urban and rural India. In contrast, Tesla relies on direct sales and a limited service presence.

- Rural & Tier-2 City Presence: Indian brands have penetrated smaller cities and towns, ensuring higher accessibility.

- Service Centers: Maruti Suzuki alone operates over 3,500 service centers, whereas Tesla would need to build a similar network from scratch.

Comparison with Tesla’s Limited Service Reach in India

- Mobile Service Model: Tesla’s strategy relies on mobile servicing and centralized locations, which may not be feasible in India’s diverse geography.

- Spare Part Availability: Local manufacturers maintain a strong inventory of spare parts, whereas Tesla’s reliance on imports could lead to delays and higher costs.

Importance of After-Sales Services in Indian Consumer Decision-Making

Indian buyers prioritize long-term reliability and easy maintenance over premium technology. The ability to access affordable and quick service gives Indian automakers a significant advantage.

3.5 Product Customization for Indian Roads and Conditions

Challenges Tesla and BYD Face in Adapting to Indian Roads

- Road Infrastructure Issues: Tesla’s low ground clearance and software-dependent navigation may struggle with India’s pothole-ridden roads.

- Extreme Climate Adaptation: Indian summers demand highly efficient air conditioning, an area where domestic brands have an advantage.

Features of Indian Automakers’ Vehicles Suited for Local Conditions

- Ground Clearance Optimization: Mahindra and Tata’s SUVs are designed for Indian terrain, unlike Tesla’s lower-slung sedans.

- Battery Optimization for Hot Climates: Indian EVs are engineered to withstand extreme temperatures, improving battery life and efficiency.

3.6 Strategic Government Collaborations and Partnerships

How Indian Automakers Benefit from Government Initiatives Like FAME-II

Government collaborations enable Indian automakers to lead the EV transition, securing subsidies, infrastructure support, and favorable policies.

- State Government Collaborations: Tata and Mahindra actively work with state governments to set up EV charging infrastructure and manufacturing plants.

- Public-Private Partnerships: Joint ventures between automakers and government agencies accelerate EV adoption in India.

Collaborations with State Governments and Infrastructure Projects for EV Adoption

- Expansion of Charging Stations: Tata Power’s collaboration with state governments ensures a growing EV charging network.

- Battery Swapping & Recycling Initiatives: Local automakers are investing in circular economy initiatives to make EV adoption more sustainable.

Conclusion

While Tesla and BYD are global EV leaders, Indian automakers hold a decisive advantage in their home market due to deep market understanding, local manufacturing, and favorable government policies. Factors such as affordability, supply chain strength, after-sales services, and product customization make Indian brands like Maruti Suzuki, Tata, and Mahindra the dominant forces in India’s evolving EV landscape. Tesla and BYD must navigate regulatory challenges, establish local production, and adapt their vehicles to Indian conditions if they wish to compete effectively in this high-growth market.

4. Case Studies: Indian Automakers vs. Foreign Entrants

4.1 Success of Tata Motors in EVs: A Blueprint for Local Success

Tata’s Early EV Entry and Market Strategy

Tata Motors has emerged as the undisputed leader in India’s electric vehicle (EV) segment, setting a benchmark for how domestic automakers can counter foreign entrants like Tesla and BYD. The company strategically entered the EV market early with the Tata Nexon EV, which became India’s best-selling electric car.

Key Success Factors for Tata Motors in the Indian EV Market:

- Affordability and Price Sensitivity: Tata introduced EVs that cater to the budget-conscious Indian consumer. The Nexon EV, priced between ₹14–17 lakh, is significantly more affordable than Tesla’s Model 3, which is expected to cost ₹60–70 lakh if imported.

- Localized Manufacturing: Unlike Tesla, which relies on imports (due to India’s high tariffs), Tata manufactures EVs locally, benefiting from reduced production costs.

- Government Incentives: Tata’s EVs qualify for FAME-II subsidies, making them more attractive to buyers. Tesla, on the other hand, has struggled to secure similar benefits without committing to local production.

- Existing Dealership and Service Network: Tata Motors leveraged its widespread dealership and after-sales service network to instill confidence in buyers—an area where Tesla still faces major challenges.

- Battery Localization and Cost Optimization: Tata has partnered with Tata Chemicals for localized battery production, reducing dependence on expensive imports.

Nexon EV’s Market Dominance and Customer Adoption

The Nexon EV has consistently held over 70% market share in India’s electric SUV segment, indicating strong consumer trust. The following factors contribute to its success:

- Range Optimization for Indian Conditions: The Nexon EV offers a 312 km ARAI-certified range, optimized for urban and highway conditions.

- Battery Safety and Performance: Built for Indian climates, Nexon EV’s battery packs offer better heat resistance, unlike Tesla’s LFP batteries, which face overheating issues in high temperatures.

- Competitive Financing and EMI Plans: Tata provides financing solutions tailored for Indian middle-class buyers, making EV ownership accessible.

Implications for Tesla and BYD

- Tesla’s premium pricing strategy makes it unsuitable for mass-market adoption in India.

- BYD, despite offering more affordable EVs, faces branding and trust issues in India compared to Tata.

- Tata’s localization advantage gives it a pricing edge over foreign competitors relying on imports.

4.2 Suzuki’s Plans to Make India a Global EV Hub

Maruti Suzuki’s EV Roadmap

Suzuki, through its Indian arm Maruti Suzuki, has been a market leader in India’s internal combustion engine (ICE) vehicles. While it was initially slow in EV adoption, Suzuki has now laid out a robust EV strategy, aiming to make India a global export hub for electric vehicles.

Key Steps Taken by Maruti Suzuki to Dominate the EV Market:

- $1.3 Billion Investment in Gujarat EV Plant:

- Suzuki has committed a ₹10,440 crore investment to set up an EV battery manufacturing plant in Gujarat, ensuring self-reliance.

- Targeting Mass Market EVs:

- Unlike Tesla and BYD, which focus on premium EVs, Suzuki plans to introduce a sub-₹10 lakh electric hatchback, leveraging its dominance in the budget car segment.

- Hybrid-Electric Vehicle (HEV) Strategy:

- Maruti is focusing on hybrids before fully transitioning to EVs, ensuring smoother consumer adoption.

- Shared Supply Chain with Toyota:

- Through its partnership with Toyota, Suzuki gains access to cutting-edge EV technology while maintaining cost advantages.

Projected EV Models and Market Positioning

- Maruti Suzuki’s first mass-market EV is expected in 2025 with a 300-400 km range.

- The company is leveraging its deep market penetration in rural and urban India, giving it a massive distribution advantage over Tesla and BYD.

Implications for Tesla and BYD

- Tesla has no budget segment vehicle to counter Maruti’s mass-market focus.

- BYD’s brand awareness in India is weak compared to Maruti’s decades-long trust factor.

- Suzuki’s strategic partnership with Toyota strengthens its technological edge.

4.3 Tesla’s Struggles in China: Lessons for India

How Tesla Faced Stiff Competition in China

Tesla initially saw success in China, but its dominance was quickly challenged by local EV players like NIO, Xpeng, and BYD. The same challenges Tesla faced in China may repeat in India.

Key Challenges Tesla Faced in China:

- Price Wars with Local Brands:

- Chinese automakers like BYD slashed EV prices, forcing Tesla to reduce margins.

- Similar price competition in India, led by Tata and Mahindra, could threaten Tesla’s profitability.

- Government Policies Favoring Local Players:

- The Chinese government provided huge subsidies to domestic EV makers while limiting Tesla’s access to certain incentives.

- India’s policies, like high import duties (110%) on CBU EVs, put Tesla at a similar disadvantage.

- Cultural and Consumer Behavior Differences:

- Chinese consumers preferred brands that tailored EVs to their specific needs.

- Indian buyers exhibit similar nationalism-driven purchase behavior, favoring homegrown brands like Tata, Mahindra, and Maruti.

- Charging Infrastructure Controlled by Local Players:

- Tesla struggled with reliance on China’s state-owned charging networks.

- In India, Tata Power and Indian Oil Corporation are expanding EV charging stations, limiting Tesla’s influence.

Key Takeaways for Tesla and BYD in India

- Tesla cannot rely on its brand name alone to succeed in India.

- BYD, despite its success in China, will struggle due to geopolitical concerns and lack of brand familiarity in India.

- Indian automakers, particularly Tata and Maruti Suzuki, are better positioned to dominate the EV market through cost advantages and deep market penetration.

Conclusion: Indian Automakers’ Competitive Edge Over Tesla and BYD

These case studies highlight why Indian automakers have a strategic advantage over Tesla and BYD.

- Tata Motors has successfully created an EV ecosystem, making it difficult for Tesla to compete on pricing, local adaptation, and service networks.

- Maruti Suzuki’s massive upcoming EV push and local manufacturing investments will make it a formidable force.

- Tesla’s struggles in China show that its business model is vulnerable to competition from cost-efficient, homegrown brands—a challenge it will also face in India.

As India continues its EV transformation, Tesla and BYD must either localize manufacturing, adapt pricing strategies, and expand service networks—or risk losing out to domestic champions like Tata, Mahindra, and Maruti Suzuki.

5. Future Outlook: How Indian Automakers Can Maintain Their Edge

5.1 Innovations in Affordable EV Models

India’s Focus on Affordable EVs

One of the biggest challenges for the Indian electric vehicle (EV) market has been affordability. Unlike the U.S. or Europe, where EV adoption is driven by premium buyers, India’s growth hinges on sub-₹1.5 million EVs that cater to the mass market.

Upcoming Budget EVs from Indian Automakers

Indian manufacturers are aggressively developing affordable EVs to counter the dominance of Tesla and BYD. Key upcoming models include:

- Maruti Suzuki eVX (Expected 2025): A sub-₹1.5 million compact SUV designed to offer a range of over 400 km.

- Tata Punch EV (2024): Expected to be the most affordable Tata EV, positioned under ₹1.2 million.

- Mahindra XUV.e2OO (2025): A compact SUV leveraging Mahindra’s Born Electric platform, designed for city commutes.

How Indian Automakers are Reducing Costs

The price gap between EVs and ICE vehicles remains a major adoption barrier. Indian companies are tackling this by:

- Localized Battery Manufacturing:

- Tata Chemicals and Amara Raja are ramping up lithium-ion cell production to reduce dependence on Chinese imports.

- The Indian government’s Production-Linked Incentive (PLI) Scheme incentivizes domestic battery production, aiming to cut battery costs by 40% by 2030.

- Indigenous Battery Technology:

- Research into sodium-ion batteries and solid-state batteries is accelerating, potentially replacing costly lithium-ion imports.

- Ola Electric and Reliance New Energy are investing in in-house battery gigafactories.

- Use of Existing ICE Platforms:

- Maruti Suzuki and Mahindra are developing EVs on their existing platforms, minimizing development costs compared to Tesla’s dedicated EV architecture.

Why Tesla and BYD Struggle in India’s Budget EV Market

- Tesla’s Premium Pricing: The cheapest Tesla (Model 3) costs ₹60-70 lakh, making it inaccessible for most Indian buyers.

- BYD’s Branding Issue: Despite affordability, BYD lacks consumer trust and brand recall in India compared to Tata and Maruti.

- Import Dependency: Tesla and BYD rely on CBU (Completely Built Unit) imports, which attract 110% import duties, making their vehicles uncompetitive in pricing.

5.2 Expanding Charging Infrastructure and Ecosystem

India’s Rapid Charging Infrastructure Expansion

While Tesla boasts an extensive Supercharger network globally, India is making significant strides in EV charging infrastructure:

- Charging Stations Growth:

- From 1,742 stations in 2021 to over 12,000 in 2024.

- The government aims for 50,000 charging stations by 2026 under FAME-II and private investments.

- Key Players in India’s Charging Network:

- Tata Power: Over 4,000 public charging points nationwide.

- IOCL & BPCL: Indian Oil and Bharat Petroleum are setting up EV fast-chargers at fuel stations.

- Adani Total Gas & Jio-BP: Investing in a nationwide ultra-fast charging network.

Comparison: Indian Charging Network vs. Tesla’s Supercharger Network

| Feature | Tesla Supercharger (Global) | India’s EV Charging Network |

|---|---|---|

| Fast Charging Speed | Up to 250 kW | Mostly 50-100 kW |

| Coverage | Extensive in U.S./Europe | Expanding, with urban focus |

| Open Access | Exclusive to Tesla (limited opening to others) | Open to all EVs |

| Network Expansion | Tesla controls infrastructure | Government + Private partnerships |

Challenges & Opportunities for Tesla and BYD in India

- Lack of Superchargers: Tesla would need to build its own fast-charging infrastructure to match its experience in other markets.

- BYD’s Slow Expansion: BYD has partnered with Indian firms for charging solutions but still lags behind Tata Power and Adani.

- Battery Swapping Potential: Indian startups like Sun Mobility are working on battery swapping models, which could reshape EV charging strategies.

5.3 Long-Term Growth Strategy for Indian Automakers

India’s Potential as a Global EV Export Hub

With rising domestic EV production, Indian automakers are well-positioned to export EVs to emerging markets. Key factors driving this opportunity:

- Cost-Competitive Manufacturing: India offers lower production costs than China, making it an attractive EV manufacturing base.

- Growing EV-Friendly Policies: The government’s PLI scheme for EVs encourages exports.

- Strategic Shipping Advantage: India’s proximity to Southeast Asia, Africa, and the Middle East allows cost-effective exports.

Export Targets & Market Focus

- Tata Motors: Targeting African and South American markets with affordable EVs.

- Mahindra: Expanding its Born Electric lineup to Europe and Australia.

- Maruti Suzuki: Plans to make India its global EV export hub under Suzuki-Toyota partnership.

Technology Collaborations & Future Partnerships

To compete with Tesla and BYD in advanced EV technology, Indian automakers are exploring global collaborations:

| Indian Automaker | Foreign Partner | Collaboration Area |

| Tata Motors | Jaguar Land Rover | Battery & platform sharing |

| Mahindra | Volkswagen | MEB platform for EVs |

| Maruti Suzuki | Toyota | Hybrid & EV co-development |

Tesla’s India Entry: A Threat or Opportunity?

- If Tesla localizes production, it could become a formidable competitor to Indian brands.

- Tesla’s potential partnership with Tata or Mahindra could open new market opportunities.

- If Tesla remains focused on premium EVs, Indian automakers will continue dominating the mass market.

Conclusion: The Road Ahead for Indian EV Automakers

Indian automakers have successfully built a strong foundation for EV growth, leveraging affordable models, localized battery production, and charging infrastructure expansion. However, competition from Tesla and BYD remains a challenge.

Key Takeaways for Indian Automakers:

- Affordable EV Models: Focusing on sub-₹1.5 million EVs will drive mass adoption.

- Charging Ecosystem Development: Expanding fast-charging networks is crucial for long-term success.

- Export and Collaboration Strategy: India can become a global EV manufacturing hub with strong export potential.

Tesla & BYD: Key Challenges in India

- Tesla’s localization dilemma: Without an Indian plant, Tesla cannot compete on price.

- BYD’s geopolitical risks: Government scrutiny over Chinese investments could slow BYD’s India expansion.

- Domestic advantage: Tata, Mahindra, and Maruti Suzuki have the home-ground advantage in consumer trust and affordability.

The future of Indian automakers vs Tesla and BYD will depend on innovation, policy support, and strategic investments in infrastructure and global expansion. As the EV revolution unfolds, India has the potential to lead the charge in emerging markets while keeping global giants at bay.

6. Conclusion and Key Takeaways

The competition between Indian automakers vs Tesla and BYD marks a defining moment in India’s automotive and electric vehicle (EV) evolution. While Tesla and BYD bring global expertise, advanced technology, and aggressive expansion plans, Indian automakers hold key advantages that ensure their sustained dominance in the market.

6.1 Recap: Why Indian Automakers Are Poised to Win

The resilience of Indian automakers against foreign entrants stems from several interlinked factors, including deep market understanding, competitive pricing strategies, local manufacturing advantages, extensive service networks, and government policy support.

1. Deep Understanding of Indian Consumer Behavior

- Indian automakers such as Maruti Suzuki, Tata Motors, and Mahindra have tailored their vehicles to meet local demands, focusing on affordability, durability, and fuel efficiency—factors critical to the Indian middle class.

- Tesla’s premium positioning creates a market mismatch, as most Indian consumers prioritize cost-effective mobility over high-tech luxury.

- BYD faces trust and brand recognition challenges, as Indian consumers are generally more inclined to opt for brands with a proven track record.

2. Cost-Effective Manufacturing and Competitive Pricing

- Tesla and BYD rely on imports, making their pricing uncompetitive due to India’s high import duties of up to 110%. In contrast, Indian automakers benefit from localized production, leading to significantly lower costs.

- Tata Motors and Mahindra have leveraged existing infrastructure to scale up EV production affordably, while Maruti Suzuki is investing heavily in indigenous EV technologies.

- Indian automakers are actively working on sub-₹1.5 million EVs, which align with mainstream consumer affordability—something Tesla’s Model 3 and BYD’s premium offerings struggle to match.

3. Established Service and Distribution Networks

- Maruti Suzuki, Tata Motors, and Mahindra boast a vast dealership and after-sales service network spanning urban and rural India.

- Tesla’s direct-to-customer model faces limitations in after-sales service, spare part availability, and roadside assistance.

- Indian automakers are prioritizing low-cost, widespread service availability, a major decision-making factor for Indian buyers.

4. Policy and Regulatory Support for Domestic Players

- The Indian government’s FAME-II scheme and production-linked incentives (PLI) favor local automakers in EV development.

- High import duties on Tesla and BYD vehicles act as a protective barrier, ensuring foreign companies set up domestic manufacturing before enjoying full market access.

- Tata Motors, Mahindra, and Maruti Suzuki are actively collaborating with state governments to develop localized EV supply chains, making them long-term winners.

6.2 Future Strategies for Indian Automakers to Maintain Leadership

Although Indian automakers have a strong foothold, continued innovation and market adaptation are crucial to maintaining their competitive edge. The following strategies will be key:

1. Developing Affordable EVs for Mass Adoption

- Maruti Suzuki’s upcoming EVs, Tata’s Tiago EV, and Mahindra’s XUV400 show clear intent toward making EVs more affordable.

- Indigenous battery technology development is critical to reducing costs and achieving price parity with internal combustion engine (ICE) vehicles.

2. Expanding the Charging Infrastructure

- Partnerships between automakers and private players will be necessary to expand the EV charging network.

- India’s EV adoption hinges on affordable and accessible fast-charging networks, an area where domestic automakers need to accelerate efforts.

3. Enhancing R&D for Advanced Battery and Vehicle Technology

- Local EV battery production and solid-state battery research will determine long-term cost-effectiveness and sustainability.

- Collaborations with tech companies and global EV pioneers can help Indian automakers bridge the technology gap.

4. Global Expansion and Export Potential

- India can position itself as a global EV manufacturing hub, exporting affordable EVs to emerging markets.

- Strategic partnerships with countries in Africa, Southeast Asia, and South America could create a strong market presence for Indian EV brands.

5. Strengthening Brand Perception and Innovation

- Indian automakers should focus on brand-building and innovation to compete with Tesla’s futuristic appeal.

- AI-driven smart features, autonomous driving capabilities, and connected car technology will be critical to attracting younger consumers.

6.3 Final Verdict: Can Tesla and BYD Outcompete Indian Automakers?

While Tesla and BYD bring innovation and global dominance, the Indian automotive industry is well-positioned to retain its leadership due to:

✅ Affordability and market alignment—Indian brands offer cost-effective, consumer-friendly solutions.

✅ Local manufacturing advantages—Lower costs and favorable policies keep Indian automakers ahead.

✅ Strong distribution and after-sales networks—A critical advantage over Tesla’s limited infrastructure.

✅ Government policies that favor local players—Ensuring long-term competitiveness for domestic automakers.

✅ Fast-growing R&D investments—Keeping Indian automakers technologically competitive in the EV space.

For Tesla and BYD to truly challenge Indian automakers, they must:

- Localize manufacturing and reduce costs.

- Expand service networks and build consumer trust.

- Develop budget-friendly EVs tailored for Indian buyers.

Ultimately, Indian automakers hold the upper hand in the domestic market. While Tesla and BYD may capture a niche luxury segment, the future of mass EV adoption in India will be driven by homegrown brands like Tata Motors, Mahindra, and Maruti Suzuki.

7.1 Government of India Policies and Reports

The Indian government has played a crucial role in shaping the electric vehicle (EV) ecosystem. Several policies have had a direct impact on the competitive landscape between domestic and foreign automakers.

Key Government Reports & Policies

- Faster Adoption and Manufacturing of Electric Vehicles (FAME) India Scheme

- Source: Ministry of Heavy Industries, Government of India

- Impact: Provides incentives for electric vehicle buyers and favors local manufacturing.

- Latest Update: FAME-II policy (2024 extension) with ₹10,000 crore budget allocation.

- Production-Linked Incentive (PLI) Scheme for Automobiles and Auto Components

- Source: Department of Heavy Industries (DHI)

- Impact: Encourages domestic production of EV components, especially batteries.

- GST and Import Duty Regulations on Electric Vehicles

- Source: Central Board of Indirect Taxes and Customs (CBIC)

- Impact: 100%–110% import duty on fully assembled EVs, favoring domestic brands.

- NITI Aayog Reports on EV Infrastructure Development

- Source: NITI Aayog, Government of India

- Impact: Targets 30% EV adoption by 2030 and rapid expansion of charging infrastructure.

- State Government EV Policies (Maharashtra, Delhi, Karnataka, Tamil Nadu)

- Source: Respective state transport departments

- Impact: State-specific incentives for EV buyers and manufacturers.

7.2 Market Research Reports and Sales Statistics

Sales and market share data help assess the actual competition between Indian automakers and global players like Tesla and BYD.

Sales and Market Share Reports

- Society of Indian Automobile Manufacturers (SIAM) Reports

- Key Data:

- Tata Motors led the Indian EV market with 82% share in 2023.

- Mahindra, MG, and Hyundai together hold about 15% of the market.

- Tesla and BYD have no significant sales presence in India yet.

- Key Data:

- JATO Dynamics India EV Market Study (2024)

- Key Insights:

- EV penetration in India crossed 2% in 2023 (up from 0.5% in 2020).

- Sub-₹2 million EVs dominate demand, making it difficult for Tesla’s high-end models to compete.

- Key Insights:

- Reuters India: EV Market Projections (2024–2030)

- Data Analysis:

- India’s EV market expected to grow at CAGR of 40% until 2030.

- BYD’s entry limited due to geopolitical restrictions and import costs.

- Data Analysis:

- Bloomberg NEF Electric Vehicle Outlook (2023–2024)

- Findings:

- India’s battery production expected to become cost-competitive by 2026.

- Tesla may need to establish a local factory to avoid import duties.

- Findings:

- Rystad Energy: Global EV Supply Chain Analysis (2024)

- Key Observation:

- Indian automakers are increasing local battery sourcing, reducing reliance on China.

- Key Observation:

7.3 Tesla and BYD: Global Performance vs. India Strategy

To evaluate Tesla and BYD’s potential in India, their global sales, pricing strategies, and manufacturing plans must be analyzed.

Tesla’s Global and India-Specific Reports

- Tesla’s Q4 2023 Financial Report (SEC Filings)

- Source: Tesla Investor Relations

- Key Data:

- Tesla sold 1.8 million EVs globally in 2023, with 60% market share in the U.S.

- Struggles in price-sensitive markets like China and India due to high costs.

- Reuters India: Tesla’s India Strategy (2024 Update)

- Key Insights:

- Talks with the Indian government for a local factory in Gujarat or Maharashtra.

- Import duties remain a major barrier.

- Key Insights:

- CNBC: Elon Musk’s India Plans (2024)

- Summary:

- Musk confirmed India as a priority market but acknowledged pricing challenges.

- Summary:

BYD’s Market Analysis Reports

- BYD Annual Report 2023

- Source: BYD Investor Relations

- Key Data:

- BYD became the world’s largest EV manufacturer, surpassing Tesla in Q4 2023.

- India expansion limited due to government restrictions on Chinese firms.

- Indian Ministry of Corporate Affairs: BYD India Operations Report

- Findings:

- BYD committed to $1 billion investment in India, but faces political scrutiny.

- Findings:

7.4 Indian Automakers’ Performance and Market Position

To compare Indian automakers’ success against Tesla and BYD, their latest sales reports, investments, and future plans are analyzed.

Tata Motors EV Sales and Strategy

- Tata Motors FY 2023–24 Investor Presentation

- Key Data:

- Tata Nexon EV led the market with 50%+ share in India’s EV segment.

- Investments in lithium-ion battery plants to reduce dependency on China.

- Key Data:

- Economic Times: Tata’s Next EV Models (2024)

- Insight:

- Plans to introduce ₹1 million EVs, undercutting Tesla and BYD.

- Insight:

Maruti Suzuki’s EV Roadmap

- Maruti Suzuki India Ltd. Annual Report 2023

- Key Plans:

- Aims to launch its first EV by 2025 and become a global export hub.

- Collaborating with Toyota for hybrid and EV technology.

- Key Plans:

Mahindra’s EV Expansion

- Mahindra Auto Investor Call Q3 2023

- Key Data:

- XUV400 EV sales expected to increase by 200% in 2024.

- Partnering with Volkswagen for battery sourcing.

- Key Data:

7.5 Industry Expert Opinions and Analyst Reports

Apart from numerical data, expert opinions help predict future trends in India’s EV market.

Analyst Insights

- Goldman Sachs India EV Outlook (2024)

- Forecast:

- India’s EV penetration to hit 10% by 2028 due to aggressive local manufacturing.

- Tesla and BYD will struggle without affordable models.

- Forecast:

- McKinsey & Company: India’s EV Consumer Preferences Study

- Findings:

- 72% of Indian buyers prioritize cost over brand value when choosing EVs.

- Findings:

- ICRA Ratings: India’s EV Credit Outlook (2024–2025)

- Key Observations:

- Government subsidies and financing options will boost domestic EV makers.

- Key Observations:

7.6 Summary of Data Insights

| Category | Indian Automakers (Tata, Mahindra, Maruti Suzuki) | Tesla | BYD |

|---|---|---|---|

| Market Share (India, 2023) | 82% | 0% | 1% |

| EV Sales Growth (YoY) | 40% | Not launched | <2% |

| Import Duty Impact | None (local production) | 110% (if imported) | 110% (if imported) |

| Government Incentives | High (FAME-II, PLI) | None until local factory | Limited due to geopolitical concerns |

| Pricing Strategy | ₹1M–₹2M EVs | ₹30L+ Models | ₹25L+ Models |

| Charging Network | Expanding (Tata, JioBP partnerships) | Limited | Limited |

Final Thoughts

Indian automakers dominate the EV market due to cost advantages, government support, and deep consumer understanding. Tesla and BYD must localize production, reduce prices, and expand service networks to compete effectively.

You Might Also Like to Read: Lloyds Banking Group Shifts IT Jobs from the UK to India: What It Means for the Future of Banking Jobs

Visual Recap: Resilience of Indian Automakers Against Global EV Giants: A Report