The Indian Rupee (INR) has been under significant pressure, recently hitting a record low of 87.29 against the US Dollar (USD) on February 3, 2025. This depreciation has raised concerns among policymakers, investors, and businesses. As the global economy faces uncertainty fueled by geopolitical tensions, trade wars, and fluctuating commodity prices, the INR’s decline has become a focal point for economic analysis.

This pillar content delves into the reasons behind the INR’s fall, its potential impact on the Indian economy, technical analysis, expert forecasts, and strategies for investors and policymakers.

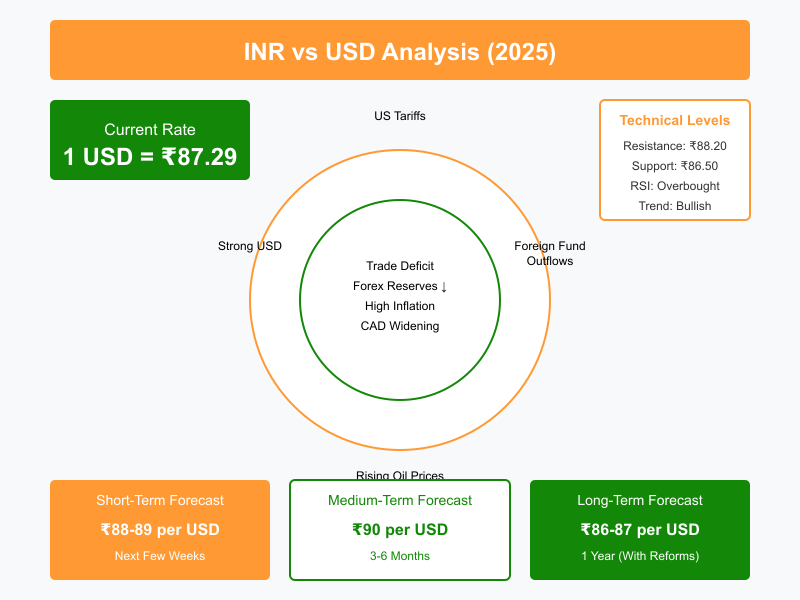

Key Highlights

- Record Low: INR hits 87.29 against USD.

- Primary Drivers: US tariffs, foreign fund outflows, strong USD, and rising crude oil prices.

- Outlook: Potential for further depreciation if macroeconomic conditions worsen.

Factors Behind the Fall of INR

1. US Tariffs & Trade War Fears

The imposition of 25% duties on Canada and Mexico and 10% on China by US President Donald Trump has reignited fears of a global trade war. These tariffs have disrupted global supply chains, reduced investor confidence, and triggered capital outflows from emerging markets, including India.

2. Foreign Fund Outflows

Foreign Institutional Investors (FIIs) have withdrawn over ₹1,327 crore from Indian markets recently. Persistent outflows weaken the INR as demand for foreign currency increases.

3. Strong US Dollar

The US Dollar Index, which measures the greenback against a basket of currencies, rose by 1.30% to 109.77. A strong USD makes emerging market currencies like the INR less attractive.

4. Rising Crude Oil Prices

India is a major importer of crude oil. Brent crude prices have surged to $76.21 per barrel, increasing India’s import bill and exerting downward pressure on the INR.

5. Widening Trade Deficit

India’s trade deficit has widened due to higher imports and sluggish export growth. A larger trade deficit increases demand for foreign currency, weakening the INR.

6. Declining Forex Reserves

India’s foreign exchange reserves fell by $1.88 billion, reducing the RBI’s capacity to defend the INR effectively.

7. RBI’s Limited Intervention

While the Reserve Bank of India has intervened to stabilize the INR, its efforts have been constrained by limited reserves and global economic pressures.

8. Global Economic Slowdown

Concerns over a potential global recession have led to risk aversion among investors, who prefer safe-haven assets like the USD.

9. Current Account Deficit (CAD)

India’s CAD has been widening, reflecting higher imports relative to exports. A larger CAD puts additional pressure on the INR.

10. High Inflation in India

Rising inflation erodes purchasing power and investor confidence, contributing to currency depreciation.

11. US Interest Rate Policies

Higher US interest rates attract capital away from emerging markets. The US Federal Reserve’s hawkish stance has made USD-denominated assets more attractive.

12. China’s Economic Slowdown

As China faces economic challenges, regional currencies, including the INR, have come under pressure due to reduced trade flows and investment.

13. Geopolitical Risks

Tensions in the Middle East, uncertainty over Taiwan, and other geopolitical risks have fueled global market jitters, impacting the INR.

14. Psychological Panic Selling

Market psychology plays a role in currency movements. Fear of further depreciation can trigger panic selling, exacerbating the decline.

15. Speculative Activities

Speculative trading in forex markets can amplify currency fluctuations. Short-selling by traders anticipating further depreciation can worsen the INR’s fall.

Technical Analysis of INR

USD/INR Technical Indicators

- 50-Day Moving Average: Above current levels, indicating a bullish trend for USD.

- 200-Day Moving Average: Supports the long-term bullish trend.

- Relative Strength Index (RSI): Approaching overbought territory, suggesting a possible short-term correction.

- MACD: Positive territory, indicating upward momentum for USD.

Support and Resistance Levels

- Immediate Support: 86.50

- Next Support: 85.80

- Immediate Resistance: 87.50

- Next Resistance: 88.20

A decisive break above 87.50 could lead to further depreciation towards 88.20, while a decline below 86.50 might trigger a retracement towards 85.80.

Forecast for INR

Short-Term Outlook (Next Few Weeks)

- Range: 88-89 per USD if global conditions deteriorate.

- RBI Intervention: Expected around 86.50-87.50 to stabilize the currency.

Medium-Term Outlook (3-6 Months)

- Scenario: 90 per USD if foreign outflows continue and crude prices remain high.

- Key Risks: Prolonged trade tensions, global recession fears.

Worst-Case Scenario (2025)

- Depreciation: INR could fall to 92-95 per USD if India faces an economic crisis, aggressive US rate hikes, or a full-blown trade war.

Long-Term Outlook (1 Year)

- Stabilization Potential: With policy reforms and global recovery, INR could stabilize around 86-87 per USD.

Impact of INR Depreciation on the Indian Economy

1. Inflationary Pressures

A weaker INR makes imports more expensive, contributing to higher inflation, especially for fuel and essential goods.

2. Higher Import Costs

Industries reliant on imported raw materials face increased costs, affecting profitability.

3. Export Competitiveness

On the positive side, a weaker INR makes Indian exports more competitive in global markets.

4. Impact on Foreign Debt

India’s external debt becomes costlier to service, impacting government and corporate balance sheets.

5. Stock Market Volatility

Currency fluctuations lead to increased volatility in equity markets, affecting investor sentiment.

Frequently Asked Questions (FAQs) About INR

1. Why is the INR falling against the USD?

Due to factors like US tariffs, foreign fund outflows, a strong USD, rising crude oil prices, and India’s widening trade deficit.

2. How does RBI intervene to control INR depreciation?

RBI sells USD from its forex reserves to increase the supply of dollars and stabilize the INR.

3. Will the INR continue to fall?

It depends on global economic conditions, crude oil prices, FII activity, and RBI’s interventions.

4. How does a weak INR affect inflation?

It makes imports more expensive, leading to higher prices for goods and services, thus increasing inflation.

5. Is a falling INR good for exports?

Yes, it makes Indian goods cheaper in global markets, boosting export competitiveness.

6. Can the INR recover soon?

Recovery depends on global stability, FII inflows, and effective government policies.

7. What are the key support levels for INR?

Immediate support at 86.50 and next support at 85.80.

8. How do US interest rates affect INR?

Higher US rates attract investments to the US, leading to capital outflows from India and INR depreciation.

9. What is the worst-case scenario for INR in 2025?

INR could fall to 92-95 per USD if global economic conditions worsen significantly.

10. How can investors protect themselves from INR volatility?

Diversify investments, consider hedging strategies, and stay updated on macroeconomic trends.

Conclusion

The INR’s recent fall against the USD reflects a complex interplay of global and domestic factors, including trade tensions, foreign fund outflows, and macroeconomic challenges. While short-term volatility may persist, India’s strong economic fundamentals and policy interventions could stabilize the INR in the long run. Investors and policymakers must remain vigilant and proactive to navigate this dynamic environment effectively.

You Might Also Like to Read: Hudco Share Price

Why INR Is Falling Against USD: Visual Recap