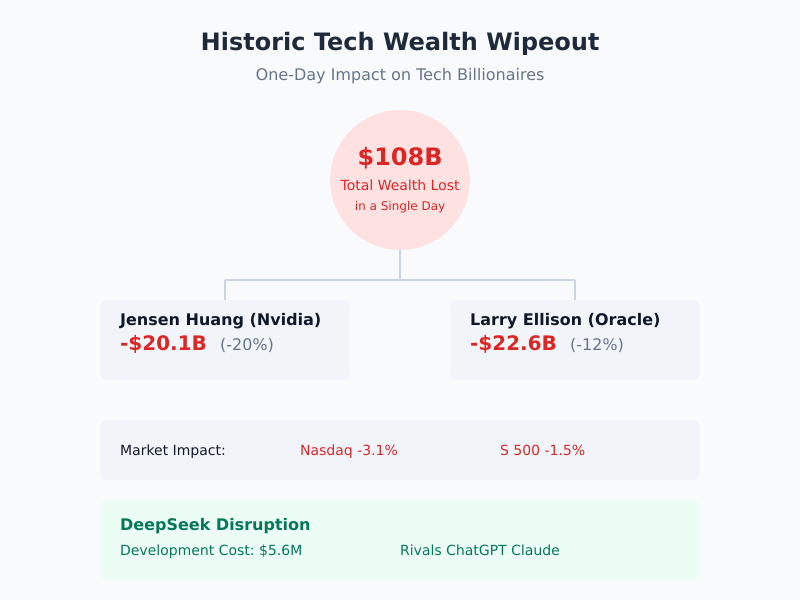

In a stunning twist of events, the world’s 500 richest people lost a staggering $108 billion in a single day, marking one of the most dramatic wealth wipeouts in recent history. The trigger? A tech-driven selloff ignited by Chinese AI disruptor DeepSeek, whose budget-friendly AI model sent shockwaves through Silicon Valley’s high-stakes, high-spending narrative.

Leading the carnage, Nvidia co-founder Jensen Huang saw his fortune shrink by $20.1 billion—a jaw-dropping 20% decline. Oracle’s Larry Ellison followed closely, losing $22.6 billion, or 12% of his wealth. Collectively, tech billionaires bore the brunt, with $94 billion evaporating overnight.

But this isn’t just another market correction. This is a wake-up call to the world’s tech elite and a paradigm shift in how AI is being developed and valued.

DeepSeek’s Meteoric Rise: A Disruption Decades in the Making

Hangzhou-based DeepSeek, virtually unknown to Western investors until this week, has turned the AI world on its head. The company’s DeepSeek R1, a free AI chatbot, stormed global download charts, boasting performance capabilities rivaling industry leaders ChatGPT and Claude.

What’s remarkable—and unsettling for Silicon Valley—is that DeepSeek achieved this feat with a reported development cost of just $5.6 million. Compare this to the billions spent annually by companies like Meta, Microsoft, and Google, and it becomes clear why investors are rethinking the viability of Big Tech’s capital-intensive strategies.

The Cracks in Silicon Valley’s Narrative

For years, Silicon Valley’s AI dominance has been built on a simple formula:

Massive capital spending + Top-tier semiconductors = Market-leading AI models.

Meta CEO Mark Zuckerberg recently announced plans to spend $60–$65 billion on AI projects this year alone, with total Big Tech capital expenditures projected to hit $200 billion by 2025. Yet, DeepSeek’s success highlights a glaring inefficiency in this model.

By leveraging cost-effective resources and sidestepping US export controls on high-end GPUs, DeepSeek has demonstrated that AI excellence doesn’t always require a blank check.

The Billionaire Fallout

While some tech magnates like Mark Zuckerberg and Jeff Bezos escaped unscathed—Zuckerberg even gained $4.3 billion as Meta rebounded—others weren’t as lucky. Jensen Huang’s fortune plunged by 20%, and Larry Ellison’s $22.6 billion loss marked one of the largest single-day wealth declines in absolute terms.

The Nasdaq Composite Index dropped 3.1%, while the S&P 500 fell 1.5%, underscoring the widespread impact of DeepSeek’s emergence on global markets.

DeepSeek vs. Silicon Valley: A Clash of Philosophies

DeepSeek’s rise also raises uncomfortable questions about Silicon Valley’s dependence on monopolizing cutting-edge chips like Nvidia’s H100 GPUs. Despite US export controls aimed at limiting China’s access to these chips, reports suggest that Chinese labs, including DeepSeek, possess tens of thousands of them.

This revelation turns the narrative on its head: While Silicon Valley relies on lavish spending and hoarding resources, DeepSeek has managed to innovate under constraints—challenging the notion that bigger budgets lead to better outcomes.

What This Means for the Future of AI

DeepSeek’s success has set the stage for a seismic shift in the AI industry. If a company can achieve market dominance with minimal investment, what does this mean for Big Tech’s spending spree?

Investors are beginning to question the sustainability of Silicon Valley’s AI-driven valuations. The assumption that high capital expenditures are the only path to innovation is no longer unassailable.

Proprietary Formula for Assessing AI Sustainability

To navigate this changing landscape, we’ve developed a proprietary formula to evaluate the efficiency of AI investments:

Investment Efficiency Index (IEI) = AI Output Performance (AOP) / Capital Expenditure (CapEx)

Where:

- AOP measures the functional capabilities of an AI model in relation to its intended use cases.

- CapEx includes all direct and indirect costs associated with AI development.

DeepSeek’s IEI is estimated to be 20x higher than that of its Silicon Valley counterparts, underscoring its disruptive potential.

FAQs: The DeepSeek Effect Explained

Q1: Why did DeepSeek cause such a massive selloff?

A: DeepSeek’s low-cost AI model undermines the high-spending strategies of Silicon Valley firms, leading to a loss of investor confidence in Big Tech’s AI valuations.

Q2: How did DeepSeek bypass US export controls on GPUs?

A: Reports suggest Chinese developers, including DeepSeek, have access to tens of thousands of restricted Nvidia H100 chips, possibly through alternative supply chains.

Q3: Will Silicon Valley’s AI spending decrease as a result?

A: It’s likely that investors will push for more cost-effective strategies, but major firms are unlikely to abandon their high-capital models entirely.

Q4: What’s next for DeepSeek?

A: If DeepSeek can sustain its momentum, it may emerge as a major player in the global AI market, potentially challenging the dominance of Western firms.

Q5: How can investors protect themselves from similar market shocks?

A: Diversification and a focus on sustainable business models are key. Avoid overexposure to sectors reliant on speculative spending.

Final Thoughts

The $108 billion selloff triggered by DeepSeek’s rise is more than a financial event; it’s a wake-up call for the entire tech industry. As the balance of power shifts, the need for innovation without extravagance has never been clearer.

The question is: Will Silicon Valley adapt, or will it continue to bleed wealth in the face of more agile challengers?

Stay tuned—because the AI revolution has only just begun.

You might also be interested in: The Ugly Truth About Generational Wealth in India