On March 4, 2025, former U.S. President Donald Trump announced his plan to impose reciprocal tariffs (Also being called out as Trump Tariffs) on India and China starting April 2, 2025. The move is part of his broader strategy to counter what he calls unfair trade practices by these countries. Trump declared, “We’ll tax them. If they tax us, we tax them the same or more.”

This policy is expected to shake global trade relations, impacting industries across the board. The question remains: Will this be a strategic masterstroke or a costly trade war escalation?

Understanding Trump’s Reciprocal Tariffs Also Known as Trump Tariffs

Reciprocal tariffs or Trump Tariffs are a protectionist measure where a country imposes equivalent or higher tariffs on imports from another nation that has levied tariffs on its exports. Trump’s argument is simple: India and China impose higher tariffs on U.S. goods, and he wants to balance the equation.

Why India and China?

- India: The U.S. has long criticized India’s high tariff barriers, particularly in sectors like automobiles, agriculture, and technology.

- China: The trade war between the U.S. and China (2018-2019) saw both sides imposing hundreds of billions in tariffs. Trump’s new move signals a renewed economic confrontation with Beijing.

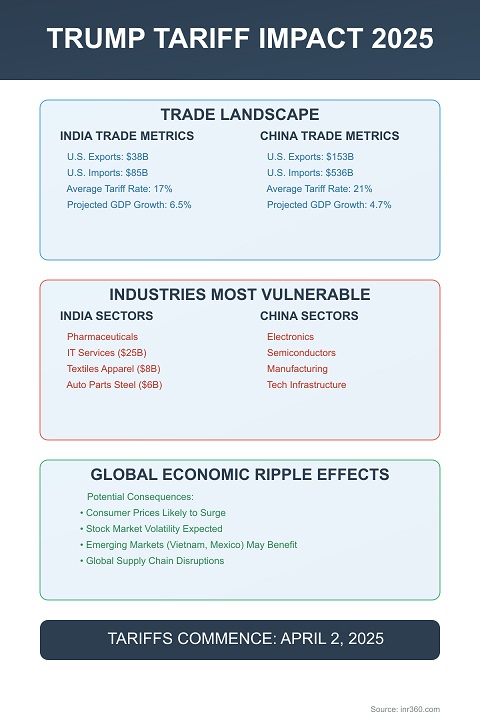

Current U.S.-India-China Trade Snapshot

| Indicator | India | China |

|---|---|---|

| U.S. Exports | $38B | $153B |

| U.S. Imports | $85B | $536B |

| U.S. Tariffs on Imports | 2.4% avg. | 19.3% avg. |

| Tariffs Imposed on U.S. Goods | 17% avg. | 21% avg. |

(Source: U.S. Trade Representative, 2024)

Expected Impact on India from Trump Tariffs

1. Indian Exports at Risk

The U.S. is a top trading partner for India, importing key goods such as:

- Pharmaceuticals ($9B)

- Textiles and Apparel ($8B)

- IT Services ($25B)

- Auto Parts & Steel ($6B)

If tariffs on these products increase, Indian exporters will face reduced competitiveness in the U.S. market. Companies like Tata, Infosys, and Sun Pharma could see revenue drops.

2. Economic Slowdown?

India’s economic growth relies heavily on exports. If trade barriers increase, this could lead to:

- Lower GDP growth (Currently projected at 6.5% in 2025)

- Job losses in export-heavy industries

- Rupee depreciation due to reduced foreign trade earnings

3. Possible Retaliation from India

India might respond by increasing tariffs on American imports, affecting:

- Harley-Davidson motorcycles

- Apples and Almonds (key U.S. exports to India)

- Technology products (India could target U.S. software giants)

Expected Impact on China from Trump Tariffs

1. Tech and Electronics Industry Hit Hard

China’s biggest exports to the U.S. are smartphones, computers, and semiconductors. If Trump raises tariffs, companies like Apple and Tesla, which manufacture in China, will face higher costs.

2. China’s Economy Faces a Tougher Year

China is already facing slow GDP growth (4.7% forecasted for 2025). Additional tariffs will:

- Weaken factory output

- Slow down foreign investment

- Increase inflation in China

3. Beijing’s Response: Trade War 2.0?

China may retaliate by:

- Restricting American companies like Boeing and Qualcomm

- Cutting agricultural imports from the U.S. (soybeans, pork, wheat)

- Devaluing the Yuan to offset trade losses

Global Economic Ramifications from Trump Tariffs

1. Inflation in the U.S.

Higher tariffs mean higher costs for American consumers. Prices of:

- Electronics (iPhones, laptops)

- Clothing (apparel from India and China)

- Automobiles will likely increase, worsening inflation.

2. Stock Market Volatility

Markets tend to react negatively to trade wars. Previous tariffs (2018) triggered a 10% drop in the S&P 500. Expect volatility in:

- Tech stocks (Apple, Nvidia, Tesla)

- Retail stocks (Walmart, Amazon)

- Industrial stocks (Boeing, Caterpillar)

3. Emerging Market Opportunities

Countries like Vietnam, Mexico, and Bangladesh could benefit as companies shift production away from China and India to avoid tariffs.

Trump’s Political Strategy: Election Play or Economic Necessity?

Trump’s tariff move aligns with his 2024 election promises of prioritizing U.S. manufacturing. But critics argue that previous tariffs hurt American businesses more than they helped.

Is it a good move? ✅ Yes, if: It forces India and China to lower their tariffs and creates fairer trade.

❌ No, if: It escalates into a full-blown trade war that hurts global economic stability.

Conclusion: Will Trump Tariffs Work?

Trump’s reciprocal tariffs could lead to a fairer global trade landscape, but they also carry the risk of economic disruption. While India and China may be forced to reconsider their tariff policies, the bigger question is whether the U.S. economy can withstand another tariff war.

FAQs About Trump Tariffs affecting India

1. What are reciprocal tariffs?

Reciprocal tariffs impose the same or higher taxes on imports from countries that have high tariffs on U.S. goods.

2. How will Trump’s tariffs impact U.S. consumers?

Prices for imported goods like electronics, clothing, and steel products could increase.

3. Will India and China retaliate?

Yes, they may impose higher tariffs on U.S. goods, restrict American companies, or devalue their currencies.

4. What industries will be most affected?

In India: IT, pharmaceuticals, textiles

In China: Electronics, manufacturing, agriculture

5. Could this lead to a new trade war?

Yes. If both India and China retaliate aggressively, it could escalate into a full-blown trade war with global economic consequences.

Final Verdict

Trump’s tariffs are a high-risk, high-reward strategy. They could reshape trade in America’s favor or plunge the global economy into another period of instability. Either way, April 2, 2025, marks the beginning of a new phase in global trade politics.

You Might Also Like to Read: Nifty 50 Records Longest Losing Streak Since 1996: Is the Indian Stock Market Oversold?

Visual Recap: Trump Tariffs: Trump Vows Reciprocal Tariffs Against India and China From April 2