Debt can feel like a mountain that’s impossible to climb, but with the right strategies, you can conquer it and regain control of your finances. Whether it’s mounting credit card bills, personal loans, or student loans, debt reduction requires a structured approach. This guide dives into debt reduction strategies that will help you take actionable steps to become debt-free faster than you think.

Why Reducing Debt Is Critical

Reducing debt isn’t just about paying off what you owe—it’s about freeing up your income for better opportunities like saving, investing, or pursuing personal goals. Here’s why reducing debt matters:

- Financial freedom: With less debt, more of your income is yours to keep and use productively.

- Improved mental health: Debt can be a significant stressor; eliminating it leads to peace of mind.

- Better credit score: Lower debt utilization positively impacts your credit score, unlocking access to better financial products.

- Wealth-building opportunities: With no debt eating into your paycheck, you can focus on growing your wealth.

Effective Debt Reduction Strategies

The journey to becoming debt-free starts with choosing the right Debt Reduction Strategies for your situation. Here are proven methods that work:

The Snowball Method

This method focuses on paying off your smallest debts first, creating momentum as you eliminate them one by one.

How It Works:

- List your debts from smallest to largest, ignoring interest rates.

- Pay the minimum on all debts except the smallest.

- Direct all extra funds toward the smallest debt until it’s paid off.

- Move to the next smallest debt and repeat the process.

Example:

- ₹10,000 credit card debt (12% interest)

- ₹50,000 personal loan (14% interest)

- ₹2,00,000 car loan (8% interest)

Start with the ₹10,000 credit card debt. Once cleared, redirect its monthly payment to the ₹50,000 loan while maintaining minimum payments on the car loan.

This approach gives quick wins that boost motivation, making it easier to stay committed.

The Avalanche Method

Unlike the Snowball Method, the Avalanche Method targets high-interest debts first to minimize the overall cost of borrowing.

How it Works:

- Rank your debts by interest rate, from highest to lowest.

- Pay the minimum on all debts except the one with the highest interest rate.

- Allocate extra payments to the high-interest debt.

Example:

- ₹40,000 personal loan (15% interest)

- ₹1,00,000 car loan (10% interest)

- ₹10,00,000 home loan (8% interest)

Begin with the ₹40,000 personal loan. Once it’s paid off, focus on the car loan. This method saves money on interest, though it may take longer to see progress compared to the Snowball Method.

Debt Consolidation as part of Debt Reduction Strategies

Consolidating your debts into a single loan with a lower interest rate simplifies repayment and reduces costs.

Options for Debt Consolidation:

- Balance transfer credit cards: Transfer high-interest balances to a card with 0% introductory APR.

- Personal loans: Use a low-interest personal loan to pay off multiple high-interest debts.

- Home equity loans: Secure a loan against your home’s equity for lower rates.

Important Tip: Ensure you have a disciplined repayment plan to avoid accumulating new debt after consolidation.

Negotiating with Creditors

Many creditors are open to negotiation, especially if you’re facing financial difficulties.

Steps to Negotiate:

- Reach out to your creditor and explain your situation.

- Request lower interest rates, extended repayment terms, or a reduced settlement amount.

- Get all agreements in writing.

Example:

Raj had ₹2,50,000 in credit card debt. After explaining his financial struggles, the bank agreed to settle for ₹2,00,000 in a lump sum, saving him ₹50,000.

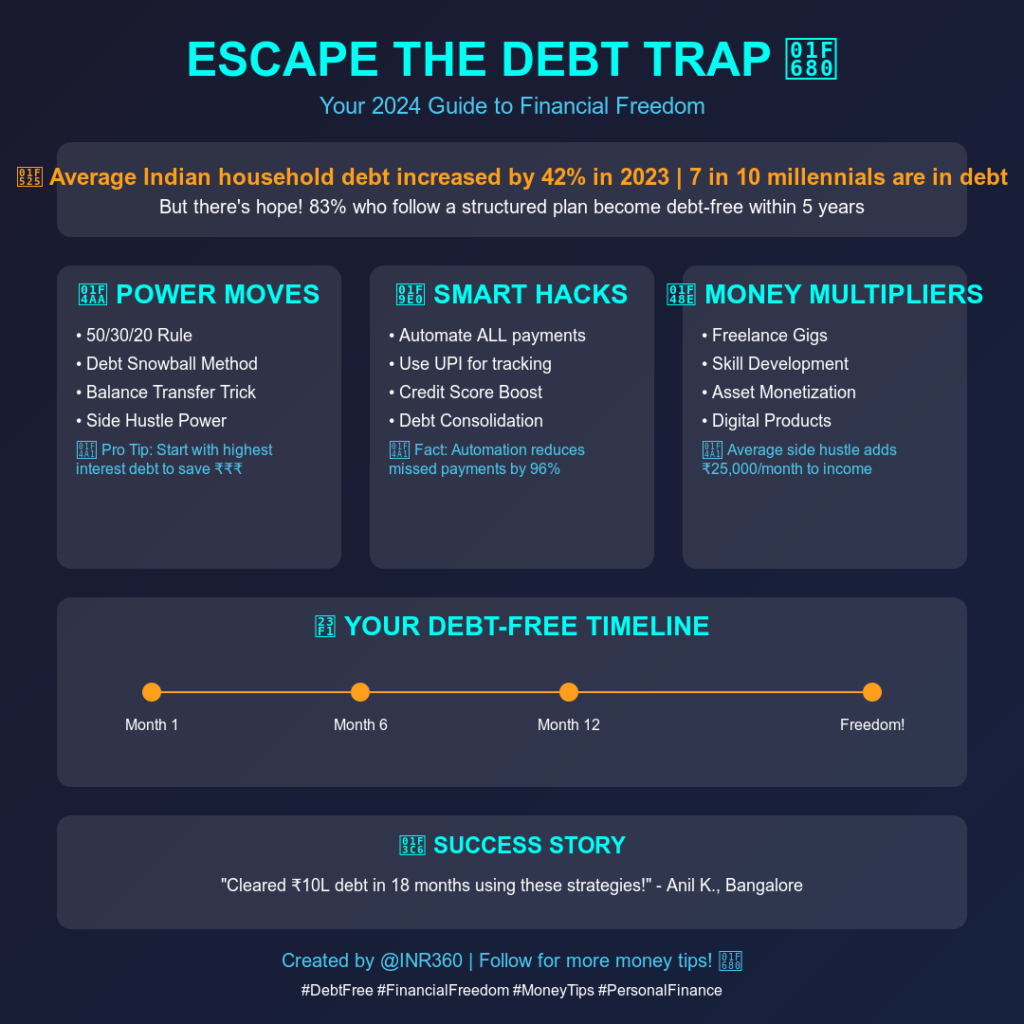

Increasing Income to Pay Off Debt

Boosting your income can accelerate your debt repayment journey.

Ideas to Increase Income:

- Freelancing: Offer services like writing, graphic design, or tutoring.

- Side hustles: Start an online store or consulting business.

- Renting assets: Rent out a spare room, car, or equipment.

Example:

Priya started freelancing on weekends, earning an extra ₹20,000 per month. She used this additional income exclusively for debt repayment, helping her pay off ₹2,40,000 in just one year. She was only able to achieve this because she had a set of Debt Reduction Strategies working for her.

Budgeting as part of Debt Reduction Strategies

A well-structured budget ensures you have enough funds to tackle your debts.

How to Create a Debt-Repayment Budget:

- Track your income and expenses using apps like Mint or YNAB.

- Identify areas to cut back on non-essential spending.

- Allocate a portion of your savings toward debt repayment.

A popular budgeting framework is the 50/30/20 rule:

- 50% for needs (rent, groceries, utilities)

- 30% for wants (entertainment, dining out)

- 20% for debt repayment and savings

Advanced Debt Reduction Strategies

Automate Payments

Set up automatic payments to ensure you never miss due dates. Late fees and penalties can derail your progress.

Reduce Fixed Expenses

- Refinance loans to secure lower interest rates.

- Switch to budget-friendly insurance or utility providers.

Leverage Windfalls

Direct bonuses, tax refunds, or unexpected income toward debt repayment instead of spending it.

Tools and Resources for Debt Reduction Strategies

Apps to Help You Stay on Track

- YNAB (You Need a Budget): Ideal for zero-based budgeting.

- Mint: Tracks spending and provides financial insights.

- Debt Payoff Planner: Visualizes your debt repayment progress.

Financial Calculators

Use online debt calculators to estimate repayment timelines and interest savings.

Real-Life Success Story About Debt Reduction Strategies

How Anil Cleared ₹10,00,000 Debt in 3 Years

Anil, a marketing executive, faced a mountain of debt—₹5,00,000 in credit card bills and ₹5,00,000 in personal loans. Here’s how he tackled it:

- Followed the Avalanche Method to prioritize high-interest credit card debt.

- Cut unnecessary expenses, saving ₹15,000 monthly.

- Started a weekend photography business, earning ₹25,000 extra per month.

- Used debt consolidation to lower interest rates.

Within three years, Anil became debt-free and built a ₹3,00,000 emergency fund. And he could only do this by applying a systematic set of Debt Reduction Strategies

FAQs about Debt Reduction Strategies

What is the fastest way to get out of debt?

The Avalanche Method is the fastest way to reduce debt by focusing on high-interest loans, paired with increased income and reduced spending.

Should I save or pay off debt first?

Build an emergency fund (3-6 months of expenses) before aggressively paying off high-interest debt.

How can I avoid new debt while paying off old debt?

Use a debit card instead of credit cards.

Create a realistic budget to manage expenses.

Build an emergency fund to avoid relying on credit during crises.

How much of my income should go toward debt repayment?

Aim for at least 20-30% of your income, depending on your financial goals and living expenses.

What should I do if I can’t pay my debts?

Contact your creditors to negotiate better terms or seek help from a financial advisor. Avoid ignoring the problem—it will only worsen over time.

Conclusion

Debt reduction requires discipline, strategy, and persistence. By following proven methods like the Snowball or Avalanche approach, leveraging tools, and staying consistent, you can reclaim your financial freedom. Start small, stay committed, and watch your debt shrink over time.

Your journey to financial independence starts today. Take the first step now, and don’t look back!

You Might Also Like to Read: Emergency Fund 101: How Much Should You Save?

Visual Recap: Debt Reduction Strategies