Generational wealth—the promise of financial security for your children and their children—feels like a distant dream for most Indian families. Why? Because the system is stacked against you, and outdated financial advice is setting you up for failure.

If you’re following the same “safe” strategies your parents used, you’re already falling behind. Inflation, stagnant savings schemes, and a lack of proactive planning are eroding wealth faster than ever. In this hard-hitting guide, we’ll expose the myths holding you back and reveal the 2025 Blueprint to Build Generational Wealth that the wealthy don’t want you to know.

Table of Contents

The Wealth Trap: Why Most Indians Are Losing the Game

Before diving into strategies, let’s uncover why most Indians fail to build generational wealth:

- Outdated Investment Choices

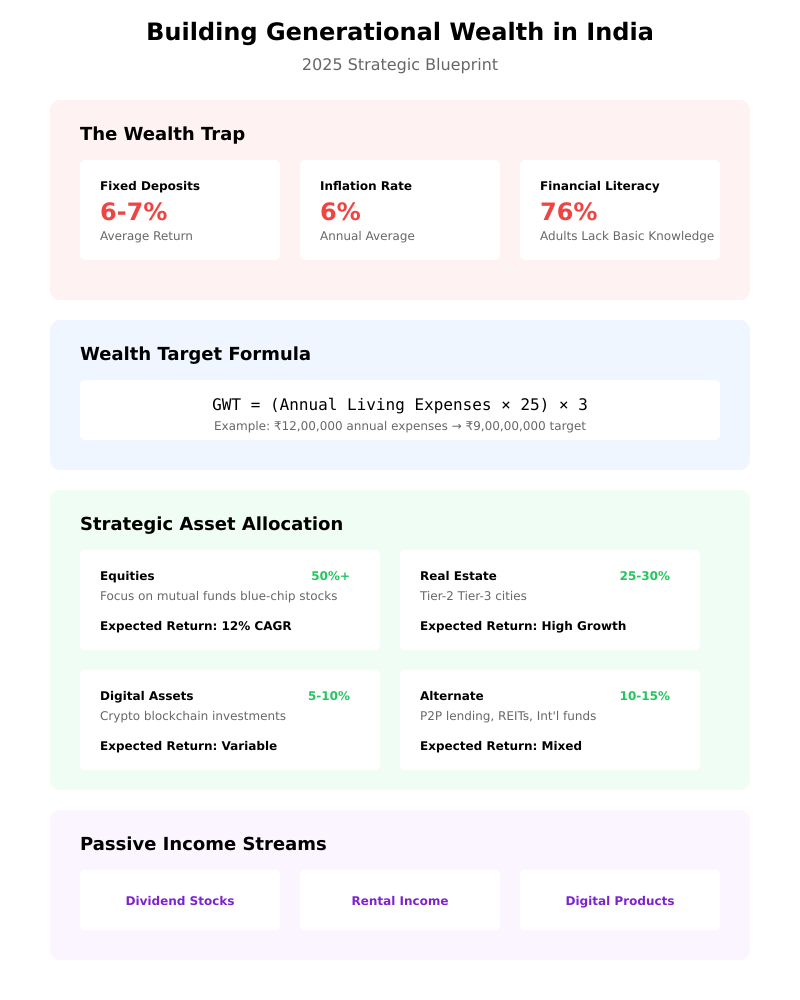

- Fixed Deposits (FDs): At an average return of 6-7%, FDs barely keep up with India’s inflation rate (averaging 6% annually). You’re not building wealth; you’re treading water.

- Gold Hoarding: While gold is culturally significant, it lacks the growth potential of equity investments over the long term.

- Lack of Financial Literacy

- 76% of Indian adults lack basic financial knowledge, according to a 2023 survey. Without understanding compounding, asset allocation, or risk management, wealth creation is nearly impossible.

- Neglecting Passive Income Streams

- Overreliance on active income (salary, business profits) leaves families vulnerable during economic downturns.

The 2025 Blueprint: Building Generational Wealth That Lasts

Here’s the actionable framework to build, grow, and preserve wealth:

Step 1: Calculate Your Generational Wealth Target (Proprietary Formula)

To secure the next three generations, use this formula:

Generational Wealth Target (GWT) = (Annual Living Expenses x 25) x 3

- Example: If your family’s annual expenses are ₹12,00,000, your GWT is:

(₹12,00,000×25)x3=₹9,00,00,000(₹12,00,000 x 25) x 3 = ₹9,00,00,000(₹12,00,000×25)x3=₹9,00,00,000

This amount ensures financial security for your family for at least three generations, adjusted for inflation.

Step 2: Diversify Strategically

- Equities:

- Allocate at least 50% of your portfolio to equity mutual funds or blue-chip stocks. Historically, the Nifty 50 index has delivered ~12% CAGR over the last two decades.

- Real Estate:

- Invest in high-growth areas, not stagnant metros. Focus on Tier-2 and Tier-3 cities with infrastructure growth.

- Digital Assets:

- Cryptocurrency and blockchain-based investments are risky but can deliver exponential returns if managed wisely.

- Alternate Investments:

- Peer-to-peer lending, REITs (Real Estate Investment Trusts), and international funds can diversify and boost returns.

Step 3: Build Passive Income Streams

Relying solely on salary or business income is a mistake. Start these immediately:

- Dividend Stocks:

Invest in stocks with a proven track record of high dividend payouts. - Rental Income:

Generate steady cash flow from rental properties or co-living spaces. - Royalties and Digital Products:

Create ebooks, courses, or apps that generate recurring income.

Step 4: Minimize Wealth Erosion

- Tax Planning:

- Utilize instruments like ELSS, PPF, and the National Pension Scheme (NPS) to reduce taxable income while investing for the future.

- Insurance:

- Protect wealth with comprehensive life, health, and liability insurance.

- Estate Planning:

- Draft a will, set up trusts, and ensure succession planning to avoid legal disputes.

Case Study: From ₹5 Lakhs to ₹5 Crores in 20 Years

Rohan, a 30-year-old software engineer, started with just ₹5 lakhs. By following this blueprint:

- Allocated 60% to equity mutual funds.

- Invested in a ₹35 lakh plot in a Tier-3 city, which appreciated to ₹1 crore in 10 years.

- Built passive income streams through dividend stocks and a digital course.

By age 50, his portfolio grew to ₹5 crores, securing his family’s financial future.

Common Questions

1. How much should I save monthly to build generational wealth?

Use the formula:

Monthly Savings = GWT ÷ (Years to Target x 12)

Example: For a GWT of ₹9 crores in 20 years:

₹9,00,00,000 ÷ (20 x 12) = ₹37,500/month.

2. Is it too late to start in my 40s?

Not at all. Focus on high-growth investments like equities and maximize savings to catch up.

3. Should I avoid traditional investments entirely?

Not necessarily. Instruments like FDs or gold can serve as stabilizers but shouldn’t dominate your portfolio.

4. What’s the best way to teach my kids about wealth?

Encourage early financial education through books, games, and involving them in minor financial decisions.

A Quick Recap

Conclusion: Act Now or Regret Later

The harsh reality is that wealth-building isn’t optional anymore—it’s a necessity. The steps you take in 2025 will determine the financial stability of your family for generations. Will you fall into the trap of outdated strategies, or will you seize control of your financial future?

The choice is yours—but time is running out. Start today, or risk being left behind in the wealth race.

You might also be interested in: The Shocking Truth About Retirement Planning in India