Investment options in India offer a diverse range of opportunities tailored to meet the varying needs of investors, from the ultra-conservative to the highly aggressive. Understanding the risk-return trade-off is essential when crafting a portfolio that aligns with your financial goals, risk tolerance, and investment horizon.

This article delves deep into different investment avenues, categorizing them based on their risk profiles and expected returns. Additionally, we explore tailored strategies for different investor profiles, providing actionable insights for wealth creation and capital preservation.

Section 1: Understanding Risk and Return on Investment Options in India

Before diving into specific investment options, it’s crucial to understand the relationship between risk and return:

- Risk: The possibility of losing some or all of your invested capital.

- Return: The gain or profit generated from an investment over time.

The risk-return spectrum suggests that higher returns usually come with higher risks, while safer investments typically offer modest returns.

Key Factors Affecting Risk and Return:

- Market volatility

- Interest rate fluctuations

- Inflation

- Credit risk

- Economic and geopolitical conditions

Section 2: Proprietary Risk-Return Formula (PRRF) Invented by Abhishek Parihar for Investment Options in India Basis Investor Profiles

To assist investors in making informed decisions, we’ve developed a Proprietary Risk-Return Formula (PRRF). This formula quantifies the balance between risk and return for any investment option.

PRRF Formula:

Where:

- ER (Expected Return): Annual expected return from the investment.

- RV (Risk Volatility): Standard deviation representing investment risk.

- LI (Liquidity Index): Ease of converting the investment to cash (rated 1-5).

- VI (Volatility Impact): Market volatility impact (rated 1-5).

- W_r, W_s, W_l, W_v: Assigned weights based on investor priorities (e.g., safety, growth, liquidity).

Default Weights:

- W_r (Return Weight): 0.4

- W_s (Risk Weight): 0.3

- W_l (Liquidity Weight): 0.2

- W_v (Volatility Weight): 0.1

These weights can be adjusted according to the investor’s risk appetite.

Section 3: Ranking Investments Using PRRF

1. Ultra-Safe Investments (Low Risk, Low Return)

| Investment Option | Expected Return (ER) | Risk Volatility (RV) | Liquidity (LI) | Volatility Impact (VI) | PRRF Score |

|---|---|---|---|---|---|

| Savings Account | 3% | 0.5 | 5 | 1 | 2.9 |

| Fixed Deposits (FDs) | 6% | 1 | 4 | 2 | 3.8 |

| Public Provident Fund (PPF) | 7.1% | 0.8 | 3 | 1 | 4.1 |

2. Moderate Risk Investments

| Investment Option | Expected Return (ER) | Risk Volatility (RV) | Liquidity (LI) | Volatility Impact (VI) | PRRF Score |

| Debt Mutual Funds | 8% | 2 | 4 | 3 | 4.5 |

| Hybrid Mutual Funds | 10% | 3 | 3 | 3 | 4.2 |

| ULIPs | 12% | 4 | 2 | 4 | 4.0 |

3. High-Risk, High-Return Investments

| Investment Option | Expected Return (ER) | Risk Volatility (RV) | Liquidity (LI) | Volatility Impact (VI) | PRRF Score |

| Direct Stocks | 18% | 6 | 4 | 5 | 4.6 |

| Cryptocurrency | 25% | 9 | 5 | 5 | 4.1 |

| Startups/Angel Investing | 30% | 10 | 1 | 5 | 3.8 |

Section 4: Application of PRRF

Investor Profile Example:

- Risk Appetite: Moderate

- Goal: Retirement Planning

By applying PRRF scores, the investor can prioritize:

- PPF (Score: 4.1) for stable returns.

- Debt Funds (Score: 4.5) for moderate growth.

- Direct Stocks (Score: 4.6) for aggressive growth potential.

The PRRF helps investors visually and numerically compare investment options, aiding in data-driven decision-making.

Conclusion

The Proprietary Risk-Return Formula (PRRF) about Investment Options in India for various investor profiles enhances traditional investment analysis by adding a quantitative framework to assess investments. Whether you’re a conservative saver or an aggressive investor, PRRF helps you align your investments with your financial goals, risk tolerance, and market conditions.

Regularly revisiting your PRRF scores ensures your portfolio adapts to changing financial landscapes.

Important Notes About the Investment Options in India:

1. Ultra-Safe Investments (Low Risk, Low Return)

| Investment Option | Expected Return (p.a.) | Risk Level |

|---|---|---|

| Savings Account | 2.5% – 4% | Very Low |

| Fixed Deposits (FDs) – Banks & Post Office | 5.5% – 7.5% | Very Low |

| Recurring Deposits (RDs) – Banks & Post Office | 5.5% – 7% | Very Low |

| Public Provident Fund (PPF) | ~7.1% (Tax-Free) | Very Low |

| Sukanya Samriddhi Yojana (SSY) | ~8.2% (Tax-Free) | Very Low |

| Senior Citizens Savings Scheme (SCSS) | ~8.2% (Tax-Free) | Very Low |

| Government Bonds (RBI Bonds, Sovereign Gold Bonds – SGBs) | 7% – 8% | Very Low |

🔹 Best For: Those seeking capital safety with decent returns, like retirees and conservative investors.

2. Low to Moderate Risk Investments

| Investment Option | Expected Return (p.a.) | Risk Level |

|---|---|---|

| Debt Mutual Funds (Liquid, Short-Term, Gilt) | 4% – 8% | Low |

| Corporate Fixed Deposits (Bajaj, Shriram, LIC HFL) | 7% – 9% | Low to Moderate |

| Post Office Monthly Income Scheme (MIS) | ~7.4% | Low |

| National Savings Certificate (NSC) | ~7.7% | Low |

| Kisan Vikas Patra (KVP) | ~7.5% | Low |

🔹 Best For: Conservative investors who want better returns than FDs but don’t want high risk.

3. Moderate to High-Risk Investments

| Investment Option | Expected Return (p.a.) | Risk Level |

|---|---|---|

| Equity Mutual Funds (SIP/Lumpsum) | 10% – 16% | Moderate to High |

| Hybrid Mutual Funds (Balanced, Arbitrage, Dynamic Asset Allocation) | 8% – 12% | Moderate |

| ULIPs (Unit Linked Insurance Plans) | 8% – 12% | Moderate |

🔹 Best For: Those willing to take some risk for better returns, suitable for long-term wealth building.

4. High-Risk, High-Return Investments

| Investment Option | Expected Return (p.a.) | Risk Level |

|---|---|---|

| Direct Stock Market (Equity Shares) | 12% – 25% (or more) | High |

| Real Estate | 8% – 20% | High |

| REITs (Real Estate Investment Trusts) | 8% – 14% | High |

| Peer-to-Peer (P2P) Lending | 10% – 18% | High |

| Gold (Physical, Digital, ETFs, Gold Bonds) | 6% – 12% | High |

| Cryptocurrency & NFTs | Highly Volatile | Very High |

🔹 Best For: Aggressive investors looking for higher returns but willing to handle volatility.

5. Very High-Risk, Speculative Investments

| Investment Option | Expected Return (p.a.) | Risk Level |

|---|---|---|

| Futures & Options (Derivatives Trading) | Unpredictable | Very High |

| Commodities Trading (Gold, Silver, Crude Oil, etc.) | Unpredictable | Very High |

| Startups/Angel Investing | Unpredictable (High Reward Potential) | Very High |

🔹 Best For: Experts, traders, and high-net-worth individuals who understand market fluctuations.

Risk-Return Summary Table

| Risk Level | Investment Options | Returns (p.a.) |

|---|---|---|

| Very Low | Savings Account, FDs, PPF, NSC, KVP, Post Office Schemes | 3% – 8% |

| Low to Moderate | Debt Mutual Funds, SCSS, RBI Bonds, Corporate FDs | 5% – 9% |

| Moderate | Equity Mutual Funds, ULIPs, Hybrid Funds | 8% – 12% |

| High | Direct Stocks, Real Estate, Gold ETFs, REITs | 10% – 20% |

| Very High | Crypto, Derivatives, P2P Lending, Startups | Unpredictable |

How to Choose the Right Investment?

- For Safety & Stability: Bank FDs, PPF, SCSS, Post Office Schemes.

- For Moderate Growth: Debt & Hybrid Mutual Funds, RBI Bonds.

- For Wealth Creation: Equity Mutual Funds, Direct Stocks, REITs.

- For High Returns & Risk: Derivatives, Crypto, Angel Investing.

Important Notes About Investor Profiles (Where You Might Fit):

1. Newly Employed Person (22-28 years, ₹30,000 – ₹70,000/month)

Goal: Wealth Creation, Emergency Fund, Minimal Tax

Risk Appetite: High

Investment Strategy:

✅ 30% (₹10,000 – ₹20,000) in Equity Mutual Funds (SIP) – Large-Cap, Mid-Cap, ELSS (for tax savings)

✅ 10% (₹3,000 – ₹7,000) in Direct Stocks – Focus on blue-chip stocks

✅ 10% (₹3,000 – ₹7,000) in Gold ETFs/Digital Gold – Hedge against inflation

✅ 20% (₹6,000 – ₹14,000) in Fixed Deposits & Debt Funds – Emergency fund

✅ 10% (₹3,000 – ₹7,000) in PPF or NPS – Long-term tax-free growth

✅ 10% (₹3,000 – ₹7,000) in Cryptocurrency/REITs – High-risk diversification

✅ 10% (₹3,000 – ₹7,000) in a Side Hustle or Skill Development – Career investment

Balance: High risk, high return with some stability

2. Seasoned Corporate Employee (30-45 years, ₹1-₹3 Lakh/month)

Goal: Growth, Retirement Planning, Tax Saving

Risk Appetite: Moderate to High

Investment Strategy:

✅ 35% in Equity Mutual Funds (₹35,000 – ₹1L) – Large, Mid, Small-Cap for balance

✅ 15% in Direct Stocks (₹15,000 – ₹50,000) – Blue-chip + 20% in growth stocks

✅ 10% in NPS/PPF (₹10,000 – ₹30,000) – Retirement security & tax benefits

✅ 10% in Fixed Deposits or Debt Funds (₹10,000 – ₹30,000) – Safety net

✅ 10% in Gold ETFs/REITs (₹10,000 – ₹30,000) – Portfolio stability

✅ 10% in International Funds (₹10,000 – ₹30,000) – Global diversification

✅ 10% in Startups/P2P Lending (₹10,000 – ₹30,000) – Alternative high returns

Balance: Mix of safety & high returns with diversification

3. Government Employee (28-55 years, ₹60,000 – ₹2 Lakh/month)

Goal: Stability, Pension Growth, Tax Optimization

Risk Appetite: Low to Moderate

Investment Strategy:

✅ 20% in PPF (₹12,000 – ₹40,000) – Guaranteed, tax-free returns

✅ 20% in NPS (₹12,000 – ₹40,000) – Pension security with tax benefits

✅ 15% in FD/RD (₹9,000 – ₹30,000) – Capital protection

✅ 15% in Debt Mutual Funds (₹9,000 – ₹30,000) – Stability with better returns than FDs

✅ 10% in Gold ETFs/SGB (₹6,000 – ₹20,000) – Inflation hedge

✅ 10% in Equity Mutual Funds (₹6,000 – ₹20,000) – Moderate exposure for higher returns

✅ 10% in Real Estate (₹6,000 – ₹20,000 or EMI for property investment) – Passive wealth creation

Balance: Conservative with a mix of fixed returns & inflation-beating growth

4. Businessman (35-55 years, ₹2-₹10 Lakh+/month)

Goal: Passive Income, Wealth Growth, Tax Planning

Risk Appetite: High

Investment Strategy:

✅ 40% in Equity & Hybrid Funds (₹80,000 – ₹4L) – Balanced & aggressive growth

✅ 20% in Direct Stocks (₹40,000 – ₹2L) – Value investing & blue-chip stocks

✅ 10% in REITs & Gold ETFs (₹20,000 – ₹1L) – Real estate diversification

✅ 10% in Debt Funds (₹20,000 – ₹1L) – Liquidity cushion

✅ 10% in Private Equity/Startups (₹20,000 – ₹1L) – High-risk, high-reward

✅ 10% in PPF/NPS (₹20,000 – ₹1L) – Tax-free retirement security

Balance: High-growth investment with strong diversification

5. Housewife (Non-Earning or ₹5,000 – ₹50,000/month)

Goal: Safe Growth, Passive Income, Emergency Fund

Risk Appetite: Low to Moderate

Investment Strategy:

✅ 40% in Fixed Deposits/PPF (₹4,000 – ₹20,000) – Security & tax-free growth

✅ 20% in Debt Mutual Funds (₹2,000 – ₹10,000) – Better returns than FDs

✅ 10% in Gold ETFs/SGB (₹1,000 – ₹5,000) – Safe & inflation-proof

✅ 10% in REITs (₹1,000 – ₹5,000) – Real estate exposure without property purchase

✅ 10% in Equity Mutual Funds (₹1,000 – ₹5,000) – Long-term growth

✅ 10% in Side Business (₹1,000 – ₹5,000) – Home-based income

Balance: Low-risk portfolio with some exposure to growth assets

6. Retired Person (60+ years, ₹50,000 – ₹2 Lakh/month pension)

Goal: Capital Protection, Fixed Income, Inflation Hedge

Risk Appetite: Low

Investment Strategy:

✅ 40% in SCSS & Fixed Deposits (₹20,000 – ₹80,000) – Guaranteed regular income

✅ 30% in Debt Mutual Funds (₹15,000 – ₹60,000) – Low volatility income

✅ 10% in PPF (₹5,000 – ₹20,000) – Tax-free returns

✅ 10% in Gold ETFs/SGBs (₹5,000 – ₹20,000) – Safe hedge

✅ 10% in REITs (₹5,000 – ₹20,000) – Passive income

Balance: Stable, fixed-income plan with some inflation-beating investments

7. Student (18-25 years, ₹2,000 – ₹10,000/month)

Goal: Learning Investing, High Growth, No Immediate Need for Liquidity

Risk Appetite: High

Investment Strategy:

✅ 60% in Equity Mutual Funds SIP (₹1,200 – ₹6,000) – Long-term wealth

✅ 20% in Direct Stocks (₹400 – ₹2,000) – Learning stock market

✅ 10% in Gold ETFs (₹200 – ₹1,000) – Safe hedge

✅ 10% in Cryptocurrency (₹200 – ₹1,000) – Small allocation to high-risk assets

Balance: Aggressive high-risk, high-return investments

8. NRIs Investing in India (₹5 Lakh – ₹50 Lakh/year)

Goal: Diversification, Passive Income, Growth

Risk Appetite: Moderate to High

✅ 50% in Direct Stocks & Mutual Funds (₹2.5L – ₹25L)

✅ 20% in Real Estate (₹1L – ₹10L)

✅ 10% in Gold ETFs & SGBs (₹50K – ₹5L)

✅ 10% in NRE Fixed Deposits (₹50K – ₹5L)

✅ 10% in PPF/REITs (₹50K – ₹5L)

9. Startup Founder (High-income, irregular cash flow)

✅ 30% in Liquid Funds & FDs – Emergency buffer

✅ 30% in Equity Mutual Funds & Stocks – Growth

✅ 20% in Gold, REITs, & Bonds – Stability

✅ 20% in Angel Investing – High-reward

10. Middle-Class Family (₹50,000 – ₹1.5 Lakh/month)

✅ 30% in Mutual Funds (₹15,000 – ₹45,000)

✅ 20% in FD/PPF (₹10,000 – ₹30,000)

✅ 10% in Stocks (₹5,000 – ₹15,000)

✅ 10% in REITs/Gold (₹5,000 – ₹15,000)

✅ 30% in NPS, SCSS, or Pension Schemes (₹15,000 – ₹45,000)

You Might Also Like to Read: MetaBrawl Airdrop Guide 2025: How to Participate and Maximize Your Rewards

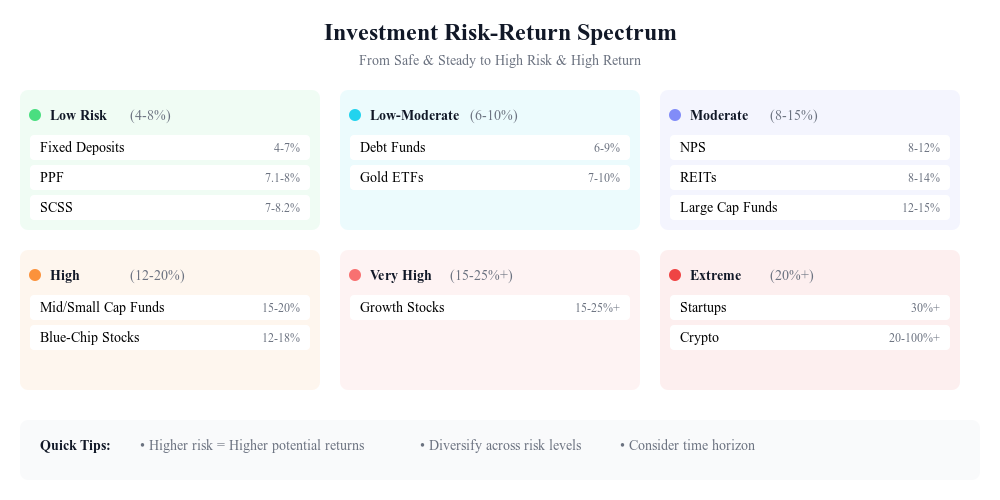

Visual Recap of Investment Options in India: