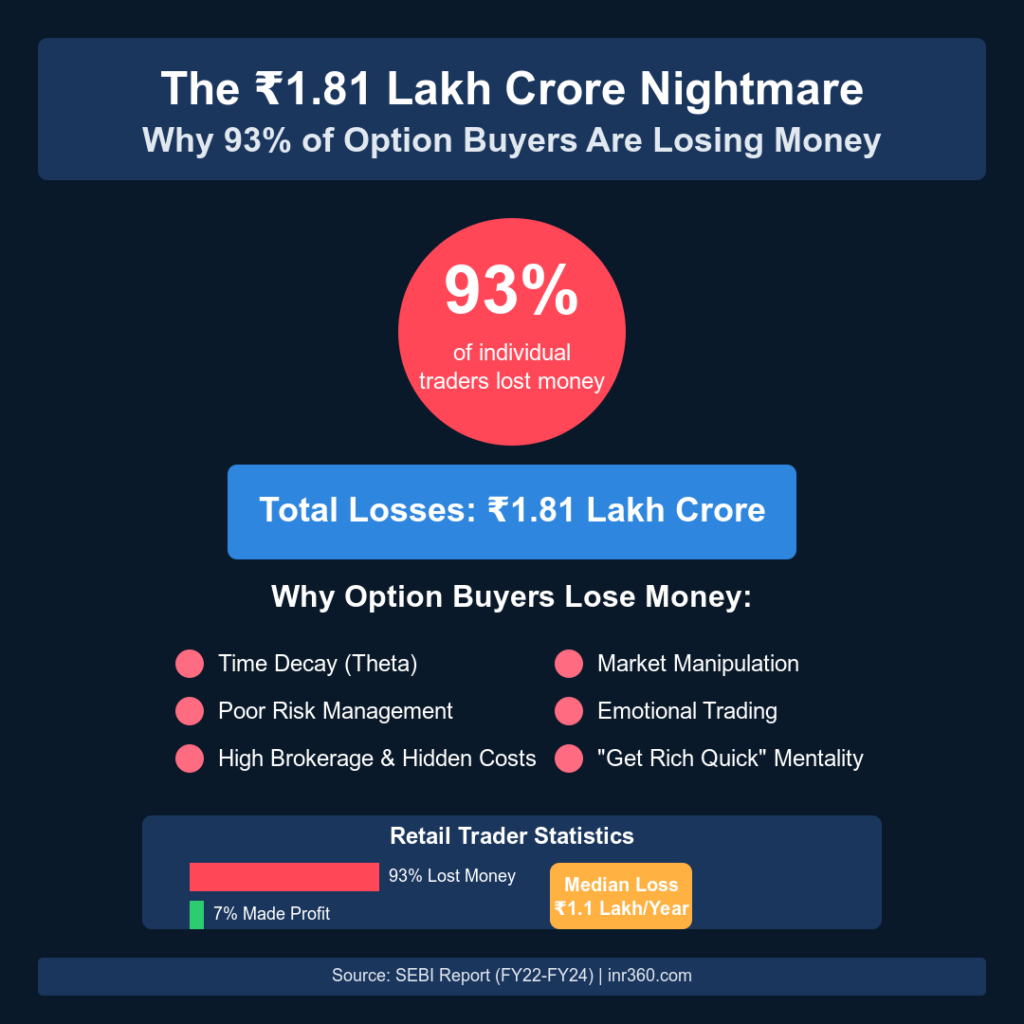

Option Buyers in India are facing a financial catastrophe, with a staggering 93% of them incurring losses, according to a recent SEBI report. The Indian derivatives market, once considered an opportunity for small traders to multiply their wealth, has instead turned into a pitfall for most. SEBI’s shocking findings reveal that between FY22 and FY24, retail traders lost a whopping ₹1.81 lakh crore in the equity derivatives segment, with option buyers suffering the most. This article delves into the reasons behind these losses, the psychological traps that lure traders into reckless option buying, and real-life stories of individuals who wiped out their life savings in the market.

The Harsh Reality: SEBI’s Shocking Report on Option Buyers

SEBI’s Report: The Numbers Don’t Lie

SEBI’s study on retail traders in the equity derivatives market has unveiled alarming statistics:

- 93% of individual traders lost money in the F&O segment.

- The cumulative losses stood at ₹1.81 lakh crore, a figure that exposes the brutal nature of options trading.

- Retail traders had a median loss of ₹1.1 lakh per year.

- Only 7% of traders made profits, but their gains were overshadowed by the enormous losses suffered by the majority.

Why Are Option Buyers Losing Money?

While options trading offers high leverage and the promise of significant returns, it is a double-edged sword. The following are key reasons why option buyers face extreme losses:

- Time Decay (Theta) Works Against Them

- Unlike stock investments, options have an expiry date. As time passes, the value of options erodes, often leading to losses even if the underlying asset moves in the expected direction.

- Lack of Proper Risk Management

- Most option buyers fail to set stop-loss limits, leading to complete capital erosion.

- High Brokerage and Hidden Costs

- Even before making a profit, traders pay brokerage fees, transaction charges, and GST. This eats into their capital significantly.

- Market Manipulation and Institutional Control

- Large institutional traders and market makers have access to high-frequency trading (HFT) strategies, making it difficult for retail traders to win.

- Emotional Trading and Lack of Strategy

- Fear of missing out (FOMO) and greed drive traders to make impulsive trades, often leading to heavy losses.

Psychological Traps That Lure Option Buyers into Financial Ruin

The Mindset of a Losing Trader

Most retail traders approach options trading with unrealistic expectations. They are lured by success stories on social media, aggressive marketing by brokers, and the thrill of quick profits. However, they fall into psychological traps such as:

The “Get Rich Quick” Mentality

- Many traders believe options trading is a shortcut to financial freedom. This mindset leads them to take high-risk trades without a solid strategy.

Overconfidence and Revenge Trading

- After making a few initial wins, traders tend to become overconfident, increasing their trade sizes recklessly.

- When they face losses, they try to recover quickly by taking even bigger trades, leading to a vicious cycle of losses.

Gambling Mindset vs. Strategic Trading

- Most option buyers fail to differentiate between gambling and trading. Instead of following data-driven strategies, they bet based on instincts or tips from unreliable sources.

The Social Media Illusion

- Traders are often influenced by YouTubers and Telegram groups that showcase large profits but hide their losses. This creates false confidence and encourages reckless trading.

Real-Life Stories: Traders Who Lost Everything

How Option Buying Destroyed Savings, Families, and Lives

Here are some heart-wrenching stories of real traders who faced financial devastation:

Case 1: The IT Employee Who Lost His Home

- A 35-year-old IT professional from Bangalore started trading options in 2022, lured by a friend’s success. Within six months, he lost ₹8 lakh of his savings and took a personal loan to recover. By mid-2023, his total losses reached ₹20 lakh. Unable to pay his EMI, he had to sell his apartment.

Case 2: The Student Who Burned His Father’s Retirement Fund

- A 23-year-old engineering student in Pune used his father’s ₹5 lakh retirement savings to trade options. Following social media tips, he made some initial gains but eventually lost everything within three months. His father had to return to work at the age of 60.

The Businessman Who Went Bankrupt

- A textile businessman from Surat turned to options trading after suffering business losses during COVID-19. He invested ₹30 lakh, believing he could recover his business losses. Instead, he lost everything and is now drowning in debt.

How to Reset Your Psychology and Trade the Right Way

A Step-by-Step Guide to Changing Your Trading Mindset

If you are an option buyer who has faced significant losses, it is not too late to reset your approach. Here’s how you can recover mentally and financially:

1. Accept the Reality and Stop Blaming the Market

- The market is not against you. The problem lies in your strategy and mindset. Accept responsibility for your losses and learn from them.

2. Take a Break and Avoid Impulsive Trades

- If you have been on a losing streak, stop trading immediately. Give yourself time to reset your emotions and analyze your mistakes.

3. Learn the Fundamentals Before Trading Again

- Study risk management, probability, and market structure before re-entering options trading. Books like Options as a Strategic Investment by Lawrence McMillan can help.

4. Avoid Weekly Expiry Gambling and Focus on Longer-Term Trades

- Weekly expiries are designed to favor option sellers. Consider monthly or LEAPS options to reduce time decay risks.

5. Implement a Strict Risk Management System

- Never risk more than 2% of your capital on a single trade.

- Always set stop-loss and exit strategies before entering a position.

6. Switch to Option Selling (With Proper Hedging)

- Instead of buying options, consider selling options with hedging strategies like Iron Condors or Credit Spreads, which statistically have a higher probability of success.

7. Stop Relying on Social Media and Develop Your Own Strategy

- Unfollow trading influencers who showcase unrealistic profits.

- Backtest your strategies and rely on data, not hype.

8. Build a Sustainable Trading Career Instead of a Lottery Mindset

- Treat trading like a business, not a get-rich-quick scheme.

- Have realistic profit expectations (consistent 10-20% annual returns are better than high-risk bets).

Conclusion: Option Buyers Must Evolve or Perish

The ₹1.81 lakh crore lost by option buyers is a wake-up call. Trading options is not a shortcut to wealth—it is a skill that requires knowledge, discipline, and patience. By resetting your psychology, implementing proper risk management, and changing your approach, you can turn from a losing trader into a consistently profitable one. If you continue to chase easy money, the market will always find a way to take it from you. The choice is yours.

By adopting the right strategies and mindset, you can be among the 7% of traders who consistently make profits instead of contributing to the massive losses that plague retail traders today.

You might also like to read: Nifty Records Longest Losing Streak Since 1996 – Is This the Bloodiest Crash in History?

Ready to Master the Stock Market?

If you’re serious about transforming your trading journey and learning the right strategies, check out our Stock Market Course. Designed by experts, this course will teach you how to navigate the market with confidence, manage risks effectively, and develop winning strategies. Don’t gamble—trade smart. Join today and take control of your financial future!

Visual Recap: Why 93% of Option Buyers Are Losing Money