In the intricate world of finance, the term “market crash” denotes a swift and severe decline in asset prices, often leading to significant economic upheaval. Predicting such events has long been a formidable challenge for economists and investors alike. However, with the advent of advanced technologies, particularly artificial intelligence (AI) and machine learning, sophisticated algorithms have been developed to forecast these turbulent events. This article delves into the mechanisms of these predictive algorithms, their current insights, and their implications for the global economy, with a particular emphasis on India’s key indices: Nifty 50, Bank Nifty, and Sensex.

Understanding Market Crashes

A market crash is characterized by a rapid and often unanticipated drop in asset prices, typically exceeding a 10% decline in a Short Period. Such crashes can be triggered by various factors, including economic imbalances, geopolitical tensions, or widespread investor panic. The aftermath often includes economic recessions, increased unemployment rates, and a loss of investor confidence.

The Role of Algorithms in Predicting Market Crashes

The quest to predict market crashes has led to the development of sophisticated algorithms that analyze vast datasets to identify patterns indicative of impending downturns. These algorithms leverage machine learning techniques to process historical market data, economic indicators, and even sentiment analysis from news sources and social media.

Machine Learning Techniques

Machine learning models, such as Support Vector Machines (SVM), Random Forests, and Neural Networks, are employed to classify and predict market behaviors. These models are trained on historical data to recognize patterns that have historically preceded market crashes. For instance, a study utilizing Random Forest and Extreme Gradient Boosting techniques demonstrated effectiveness in forecasting U.S. stock market crises by analyzing daily financial data and various market indicators.

Data Sources and Processing

The accuracy of these predictive models heavily relies on the quality and diversity of data. Key data sources include:

- Stock Price Trends: Monitoring fluctuations and identifying unusual movements.

- Trading Volume and Liquidity: Analyzing spikes in trading volumes that may signal instability.

- Economic Indicators: Incorporating metrics such as GDP growth rates, unemployment figures, and inflation rates.

- Sentiment Analysis: Assessing public sentiment through news articles, financial reports, and social media platforms.

By processing this multifaceted data, algorithms can detect subtle correlations and anomalies that may escape human analysts.

Current Insights from Predictive Algorithms

As of February 26, 2025, predictive algorithms have been closely monitoring global financial markets, providing insights into potential vulnerabilities.

Global Market Indicators

Recent analyses have highlighted several factors contributing to market volatility:

- Overvaluation Concerns: A significant number of top fund managers, approximately 89%, believe that the market is currently overvalued, reminiscent of the conditions preceding the millennium bubble.

- Economic Policies: Political decisions, such as immigration policies and tariffs on materials, have introduced uncertainties affecting investor confidence and market stability.

The Indian Context

India’s financial markets are not insulated from global trends. Predictive algorithms have identified specific areas of concern:

- Export Dependencies: India’s reliance on global markets for exports makes it susceptible to international economic shifts. A downturn in major economies can lead to reduced demand for Indian goods, impacting domestic industries.

- Foreign Investment Flows: Fluctuations in foreign direct investment (FDI) and foreign institutional investment (FII) can lead to increased volatility in Indian stock markets. Predictive models monitor these flows to assess potential risks.

Current Levels of Key Indian Indices

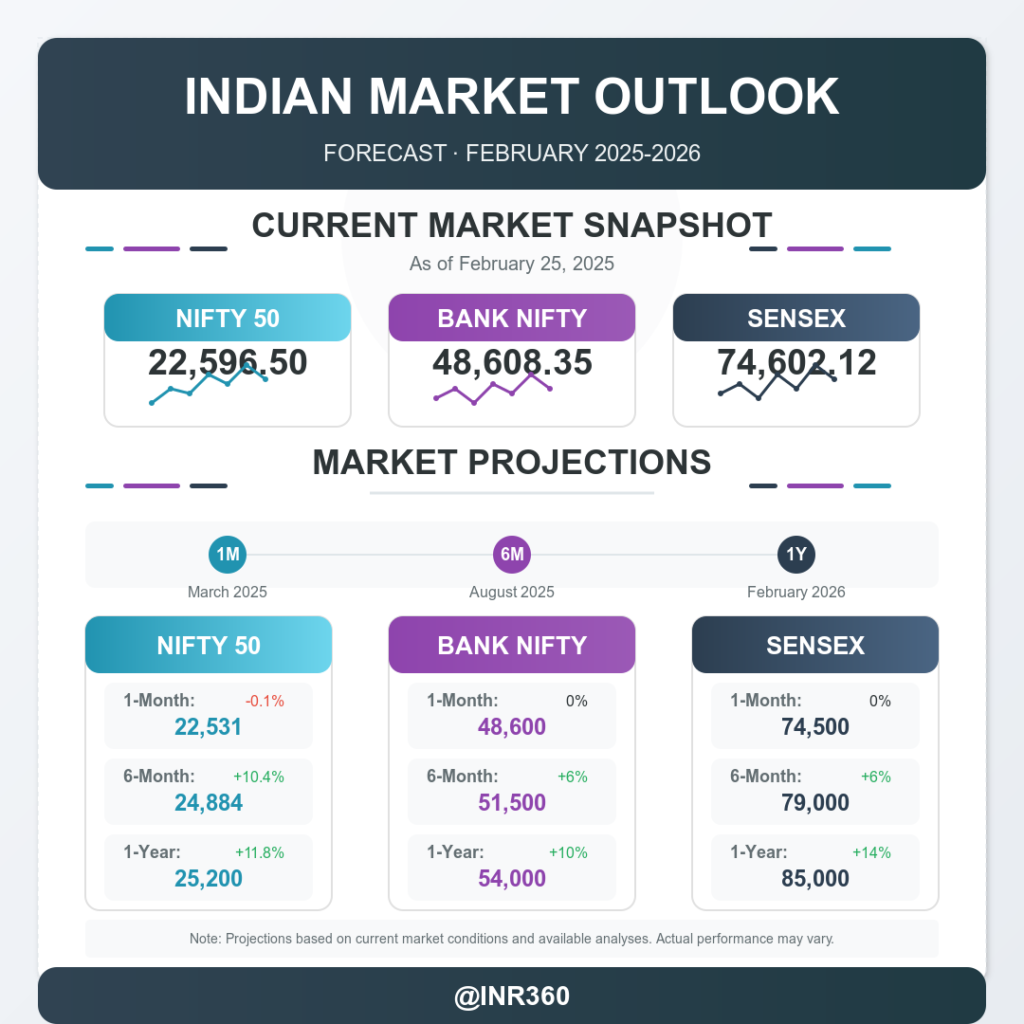

As of the market close on February 25, 2025, the key Indian stock indices stood at the following levels:

- Nifty 50: 22,596.50

- Bank Nifty: 48,608.35

- Sensex: 74,602.12

These figures reflect the market’s performance up to the last trading session before the Mahashivratri holiday on February 26, 2025.

Historical Performance and Recent Trends

Nifty 50

The Nifty 50 index, representing the weighted average of 50 of the largest Indian companies listed on the National Stock Exchange (NSE), has experienced notable fluctuations over the past year. After reaching an all-time high in September 2024, the index has faced a downward trend, influenced by both domestic economic factors and global market sentiments.

Bank Nifty

The Bank Nifty index, comprising the most liquid and large capitalized banking stocks, has mirrored the broader market’s volatility. The banking sector’s performance is closely tied to economic cycles, and recent concerns over non-performing assets (NPAs) and credit growth have contributed to its current levels.

Sensex

The Sensex, or the S&P BSE Sensex, is a benchmark index of the Bombay Stock Exchange (BSE) and includes 30 well-established and financially sound companies. Similar to the Nifty 50, the Sensex reached record highs in late 2024 but has since retracted due to a combination of profit-booking and macroeconomic challenges.

Factors Influencing Recent Market Movements

Several key factors have influenced the recent movements in these indices:

- Economic Slowdown: India’s GDP growth has decelerated, with projections indicating a four-year low of 6.4% for the current fiscal year. This slowdown has dampened investor sentiment and corporate earnings.

- Corporate Earnings: The October-December quarter saw a modest 5% growth in profits among Nifty 50 companies, marking the third consecutive quarter of single-digit increases. This tepid growth reflects challenges across various sectors, including manufacturing and services.

- Foreign Investment Outflows: Since the market peak in September 2024,

Conclusion and Market Predictions

As of February 26, 2025, the Indian stock market indices—Nifty 50, Bank Nifty, and Sensex—stand at 22,547.55, 48,608.35, and 74,602.12, respectively. The market has exhibited resilience amid global economic fluctuations, supported by robust domestic growth and favorable policy measures.

Nifty 50 Projections

- 1-Month Outlook (March 2025): Analysts project that the Nifty 50 will experience modest fluctuations, with forecasts suggesting a closing value around 22,531, indicating a slight decrease of approximately 0.1% from current levels.

- 6-Month Outlook (August 2025): The index is anticipated to reach approximately 24,884, reflecting a potential increase of about 10.4% over the next six months.

- 1-Year Outlook (February 2026): Projections estimate the Nifty 50 could attain a level of around 25,200, representing an approximate 11.8% rise over the current value.

Bank Nifty Projections

- 1-Month Outlook (March 2025): While specific short-term forecasts for Bank Nifty are limited, the banking sector’s performance is closely tied to economic indicators and monetary policies. Assuming stable economic conditions, a marginal increase or stabilization around current levels (48,608.35) is plausible.

- 6-Month Outlook (August 2025): With anticipated economic growth and potential policy support, Bank Nifty may experience growth, potentially reaching levels around 51,000 to 52,000, indicating a 5-7% increase.

- 1-Year Outlook (February 2026): Assuming continued economic expansion and favorable banking sector reforms, Bank Nifty could approach levels between 53,000 and 55,000, reflecting an approximate 9-11% rise over the current value.

Sensex Projections

- 1-Month Outlook (March 2025): Short-term projections suggest that Sensex may experience minor adjustments, potentially closing around 74,000 to 75,000, indicating relative stability.

- 6-Month Outlook (August 2025): Analysts forecast that Sensex could reach approximately 78,000 to 80,000, representing a 5-7% increase from current levels.

- 1-Year Outlook (February 2026): Projections indicate that Sensex may attain levels around 85,000, reflecting a potential rise of about 14% over the current value.

Note: These projections are based on current market conditions and available analyses. Actual market performance can be influenced by a multitude of factors, including economic developments, policy changes, and global events. Investors are advised to conduct thorough research and consult financial advisors before making investment decisions.

You Might Also Like to Read: Bank Nifty on February 25, 2025: Short & Long-Term Technical Outlook

Visual Recap: The Algorithm That Predicts Market Crashes