Introduction: The Unprecedented Market Meltdown

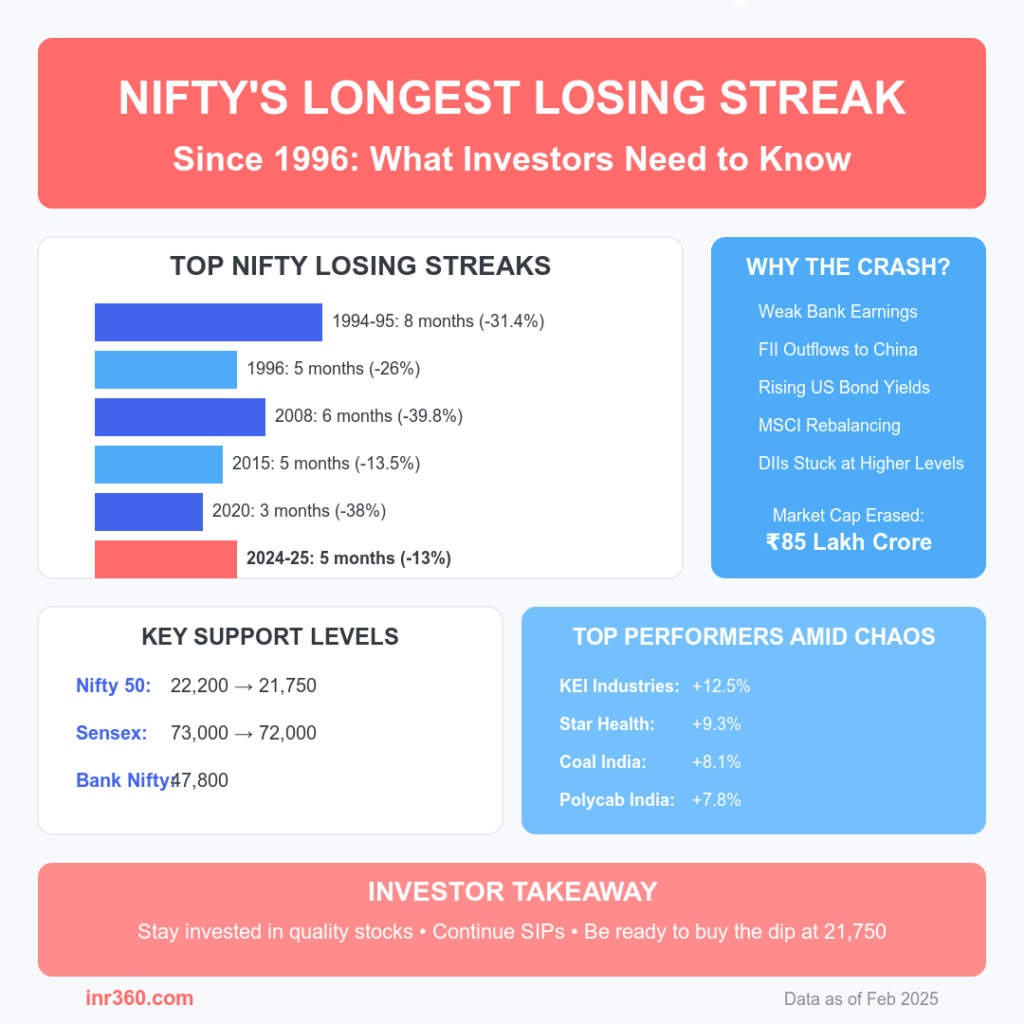

The Indian stock market is witnessing a historic downturn as the Nifty 50 index is set to conclude February 2025 with its fifth consecutive monthly decline, marking its longest losing streak since its inception in 1996.

Investor sentiment has been battered, with ₹85 lakh crore ($1 trillion+) in market capitalization erased since the index peaked in September 2024. As traders grapple with the bloodbath, the question looms—is this the worst stock market crash in Nifty’s history?

Nifty’s Worst Losing Streaks: How Does This Compare?

Historically, Nifty has seen prolonged sell-offs before, but the current downturn stands out due to its magnitude and persistence.

Top 6 Longest Nifty Losing Streaks

| Period | Duration (Months) | Total Decline |

|---|---|---|

| Sep 1994 – Apr 1995 | 8 months | -31.4% |

| Jul 1996 – Nov 1996 | 5 months | -26% |

| Jan 2008 – June 2008 | 6 months | -39.8% (Global Financial Crisis) |

| Feb 2015 – Jun 2015 | 5 months | -13.5% |

| Jan 2020 – Mar 2020 | 3 months | -38% (COVID-19 Crash) |

| Oct 2024 – Feb 2025 | 5 months | -13% (Ongoing) |

While the 2008 crash remains the worst in terms of percentage loss, this ongoing decline is the longest in recent history.

Why Is the Indian Stock Market Crashing?

Market experts cite five key reasons behind the relentless selling pressure:

1. Weak Earnings from Indian Banks

Banking stocks contribute 30% of the Nifty 50 index, and with reports suggesting weaker-than-expected Q4 earnings, investors have hit the sell button. The market is worried that even RBI rate cuts may not inject enough liquidity to revive banking stocks.

2. Foreign Investors (FIIs) Are Dumping Indian Stocks

Foreign Institutional Investors (FIIs) have been heavy sellers in the Indian market, moving their capital towards other emerging markets, particularly China.

“China’s valuations are more attractive, and their recent economic stimulus has made their markets appealing for global investors,” said VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

3. Rising US Bond Yields

A surge in US Treasury yields has made American bonds a safer bet compared to volatile emerging markets. This has accelerated FII outflows, with Indian equities taking a hit.

4. MSCI Index Rebalancing

The MSCI Emerging Markets Index is undergoing a rebalancing, leading to changes in fund allocations. This has triggered volatility as institutional investors adjust their portfolios.

5. Domestic Institutional Investors (DIIs) Stuck at Higher Levels

DIIs have remained cautious, as many are already invested at higher levels, preventing them from stepping in aggressively to absorb the FII selloff.

How Low Can Nifty Go? Key Support Levels to Watch

Technical analysts are keeping a close watch on crucial support levels:

- Nifty 50: Immediate support at 22,200. If breached, next support is at 21,750-21,800.

- Sensex: Key level to watch is 73,000, with major support at 72,000.

- Bank Nifty: Holding above 47,800 is crucial to prevent further downside.

Should Investors Panic or Buy the Dip?

Historically, prolonged market corrections have provided excellent buying opportunities for long-term investors.

What History Tells Us About Market Recoveries

| Crash Year | Decline | Time Taken to Recover |

| 2008 (GFC) | -59% | 18 months |

| 2015 (China Slowdown) | -13.5% | 8 months |

| 2020 (COVID-19) | -38% | 6 months |

| 2022 (Russia-Ukraine War) | -15% | 5 months |

Most past bear markets were followed by strong recoveries, suggesting patient investors who hold quality stocks will benefit in the long run.

Which Stocks Are Still Performing Well?

Despite the bloodbath, some stocks have shown resilience:

Top Gainers Amid the Market Crash

| Stock | Sector | YTD Performance |

| KEI Industries | Power & Electricals | +12.5% |

| Star Health Insurance | Insurance | +9.3% |

| Coal India | Mining & Energy | +8.1% |

| Polycab India | Electrical Equipment | +7.8% |

| IEX | Energy Exchange | +6.4% |

What Should Investors Do Now?

1. Stay Invested in Quality Stocks

Long-term investors should focus on companies with strong balance sheets and growth potential rather than panic selling.

2. Avoid Highly Leveraged Stocks

Highly indebted companies tend to underperform in bearish markets. Stick to fundamentally sound businesses.

3. Use Systematic Investment Plans (SIPs)

For mutual fund investors, continuing SIPs in blue-chip funds can help average out costs during market downturns.

4. Monitor US Bond Yields and FII Trends

A reversal in US Treasury yields or renewed FII interest in Indian markets could signal the beginning of a recovery.

5. Be Ready to Deploy Cash at Lower Levels

If Nifty breaches 21,750, investors can look at gradual accumulation in key sectors like IT, banking, and energy.

Conclusion: Is This the Bloodiest Crash Ever?

While the ongoing five-month losing streak is the longest in Nifty’s history, it is not the deepest in terms of percentage decline. The 2008 Global Financial Crisis and 2020 COVID crash remain more severe in absolute losses.

However, macro headwinds, persistent FII outflows, and global economic uncertainty make this one of the most challenging corrections in recent memory.

The biggest takeaway for investors? Markets are cyclical—bear phases are always followed by bull runs. Those who can weather the storm and invest strategically will likely emerge as winners in the next upcycle.

You might also like to read: The Pi Network Mainnet: A Revolutionary Milestone & What’s Next

Visual Recap: Nifty Records Longest Losing Streak Since 1996