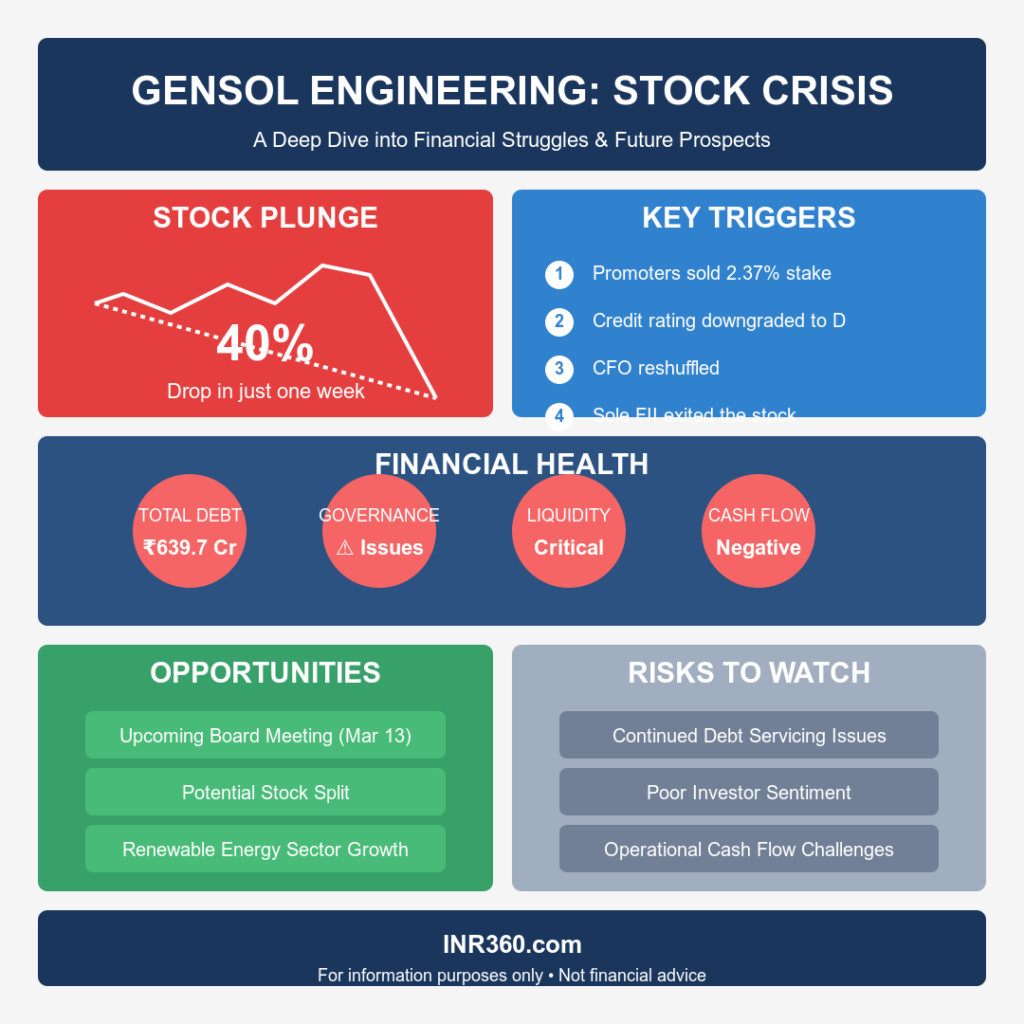

Gensol Engineering Limited, a prominent player in India’s renewable energy and electric mobility sector, is facing a turbulent period. The company, known for its solar EPC (Engineering, Procurement, and Construction) projects, has recently been hit by a series of financial and corporate governance challenges. Its stock has seen a sharp decline, with a 40% drop in just one week, triggered by credit rating downgrades, a liquidity crisis, and the unexpected exit of its only Foreign Institutional Investor (FII). This article explores the root causes of the crisis, the impact of the FII pullout, and the future trajectory of Gensol Engineering.

1. Understanding Gensol Engineering’s Business Model

Founded in 2012, Gensol Engineering specializes in solar power solutions and electric mobility. The company operates in two major verticals:

- Solar EPC Services: Gensol provides turnkey solutions for solar power projects, including design, engineering, procurement, and installation.

- Electric Mobility Solutions: The company manufactures electric vehicles and offers fleet electrification services.

Gensol was viewed as a high-growth clean energy player, benefitting from the global push towards sustainability. However, the company’s recent troubles have raised serious concerns about its financial health and corporate governance.

2. The Crisis: Why is Gensol Engineering Facing a Major Setback?

The company’s stock has fallen dramatically, and this decline can be attributed to a series of alarming events:

A. Credit Rating Downgrades

Two major credit rating agencies, CARE and ICRA, downgraded Gensol Engineering’s credit ratings due to liquidity issues and alleged misreporting. The downgrades were as follows:

- CARE downgraded Gensol’s long-term bank facilities from BB+ (Stable) to CARE D, indicating default.

- ICRA followed suit, lowering the company’s rating to ICRA D, citing delays in debt servicing.

B. Liquidity Crisis & Debt Issues

- Gensol admitted to facing a short-term liquidity mismatch, primarily due to delayed customer payments.

- The company had significant bank loan exposure of ₹639.7 crore.

- To combat liquidity stress, the company announced a series of asset divestments to reduce debt.

C. Allegations of Falsified Financial Disclosures

ICRA stated that some of the financial documents submitted by Gensol were falsified. This raises red flags about corporate governance and transparency, further eroding investor confidence.

D. Promoter Stake Sale & Fundraising Plans

To manage liquidity, Gensol’s promoters recently sold 9,00,000 shares (2.37% of total equity). The promoters have assured reinvestment of the funds, but the sale has led to speculation about financial distress.

3. FII Exit: Why Did Foreign Investors Pull Out?

The exit of Gensol Engineering’s only FII investor is a major setback, signaling a lack of institutional confidence. Several factors likely contributed to this decision:

- Financial Uncertainty: FIIs generally prefer companies with strong balance sheets and cash flows. Gensol’s credit downgrades and liquidity issues made it an unattractive investment.

- Corporate Governance Concerns: Allegations of falsified financial reporting severely damaged investor trust.

- Stock Liquidity Risks: The 40% weekly share price decline likely triggered stop-loss exits by institutional investors.

- Better Alternatives in the Renewable Energy Sector: Competing firms like Adani Green, Tata Power, and ReNew Power provide safer investment options.

The FII exit further accelerated the stock’s decline and intensified selling pressure.

4. Financial Health & Performance Analysis

Key Financial Metrics (as per latest available data):

- Revenue Growth: ₹1,200 crore (YoY growth of 32%)

- Net Profit: ₹48 crore (declining trend)

- EBITDA Margin: 12.4%

- Debt-to-Equity Ratio: 1.8x (high leverage)

- Return on Equity (ROE): 6.5% (below industry standards)

Concerns:

- High debt burden: Servicing obligations are straining cash flows.

- Declining profit margins: Rising operational costs and interest expenses are eroding earnings.

- Negative sentiment impacting stock liquidity.

5. Future Outlook: Can Gensol Engineering Recover?

Despite the challenges, Gensol is not beyond redemption. The company’s recovery will depend on several key factors:

A. Fundraising & Debt Reduction

The company plans to raise capital through equity issuance and asset divestments. If successful, this could reduce debt stress and restore market confidence.

B. Regulatory & Governance Reforms

To regain investor trust, Gensol must strengthen corporate governance and provide clear disclosures about its financial health.

C. Business Diversification & Growth

- Expansion of electric mobility segment to capitalize on India’s growing EV market.

- Strategic partnerships to reduce dependency on bank debt.

D. Market Sentiment & Investor Confidence

A key driver of recovery will be whether institutional investors (DIIs, FIIs) re-enter after seeing improved fundamentals.

6. Stock Price Outlook: Should Investors Buy, Hold, or Sell?

Bullish Scenario (Recovery Possible)

- Successful capital raise and debt restructuring.

- Reassurance from promoters and strong governance reforms.

- Market rebound in renewable energy stocks.

Bearish Scenario (Further Decline)

- Continued liquidity stress and rating downgrades.

- Further stake sales by promoters.

- Regulatory scrutiny over financial disclosures.

Investor Verdict: High-Risk, High-Reward Play

- Short-term traders should avoid the stock due to volatility.

- Long-term investors may consider an entry only if liquidity issues are resolved and the company shows signs of turnaround.

Conclusion: The Road Ahead for Gensol Engineering

Gensol Engineering is at a critical crossroads. The company’s credit downgrades, liquidity crisis, and corporate governance concerns have triggered massive stock losses. However, with promoter backing, planned fundraising, and strategic restructuring, Gensol has a chance to recover if it can restore investor confidence.

For now, the stock remains a high-risk bet, and investors should closely monitor fundraising developments, debt reduction efforts, and FII interest before making any decisions.

You Might Also Like to Read: Resilience of Indian Automakers Against Global EV Giants: A Report

Visual Recap: Gensol Engineering