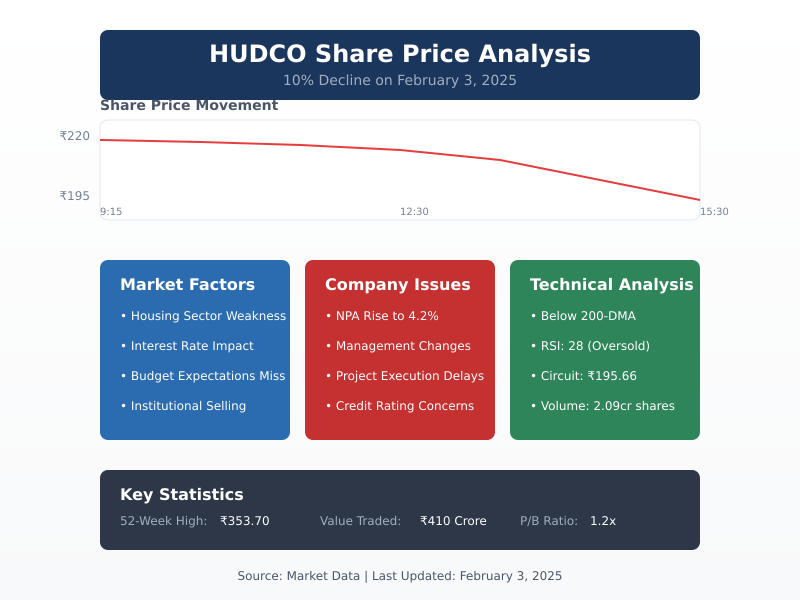

HUDCO Share Price: The Housing and Urban Development Corporation (HUDCO) faced a severe setback on February 3, 2025, with its share price plummeting 10% to hit the lower circuit at ₹195.66. Opening at ₹214.00, slightly below its previous close of ₹217.40, the stock spiraled downward amid aggressive selling pressure. With over 2.09 crore shares traded, valued at ₹410 crore, the crash left investors bewildered. This article delves into the 15 critical reasons behind HUDCO’s share price crash, offering insights into technical, fundamental, and market-driven factors.

1. Ex-Dividend Date Impact

HUDCO recently declared an interim dividend of ₹2.05 per share with a record date of January 30, 2025. Post the ex-dividend date, stocks typically adjust downward by the dividend amount, contributing to price declines.

2. Profit Booking After Dividend Payout

Investors who bought shares to avail the dividend might have sold their holdings post-payout, leading to increased selling pressure and contributing to the crash.

3. Technical Breakdown

HUDCO breached multiple key technical support levels, including its 200-day moving average of ₹208.50. The Relative Strength Index (RSI) dropped to 28, indicating oversold conditions but failing to attract buyers.

4. Weakness in the Housing Finance Sector

Broader weakness in the housing finance sector, driven by regulatory changes and rising interest rates, has negatively impacted HUDCO’s stock performance.

5. Downgrade by Analysts

Several brokerage firms downgraded HUDCO, citing overvaluation concerns with a price-to-book value of 2.6 and a return on equity of 14.4%. This downgrade triggered a wave of institutional sell-offs.

6. Decline in Institutional Investor Participation

A noticeable reduction in institutional investor holdings has led to lower demand and increased downward pressure on the stock price.

7. Sluggish Government Infrastructure Spending

Concerns over delays in government urban development projects and reduced infrastructure spending have dampened investor sentiment, as HUDCO heavily relies on such projects.

8. Rising Non-Performing Assets (NPAs)

HUDCO’s NPAs rose to 4.2% in Q3 FY25, raising alarms about asset quality and financial stability. This increase has spooked investors, prompting a sell-off.

9. Market Anticipation vs. Union Budget Reality

Prior to the Union Budget announcement, expectations of favorable housing policies drove HUDCO’s rally. However, when budget allocations fell short of expectations, it triggered a sharp correction.

10. Broader Market Downturn

The Sensex and Nifty have been volatile due to global economic uncertainties, including geopolitical tensions and fluctuating commodity prices. HUDCO’s decline mirrors this broader market sentiment.

11. Interest Rate Hikes

The RBI’s recent rate hikes have increased borrowing costs, adversely affecting housing finance companies like HUDCO, which rely on affordable lending to drive growth.

12. Regulatory Headwinds

New regulatory measures targeting the housing and urban development sector have introduced compliance burdens and operational inefficiencies, negatively impacting HUDCO’s profitability.

13. Increased Competition in Housing Finance

Rising competition from private housing finance companies and fintech firms has eroded HUDCO’s market share and pressured margins.

14. Credit Rating Downgrade Concerns

Fears of a potential credit rating downgrade have heightened investor anxiety. Such downgrades could increase HUDCO’s cost of capital, affecting future growth prospects.

15. Company-Specific Issues

Recent reports of internal management reshuffles, project delays, and legal disputes have further eroded investor confidence in HUDCO’s governance and strategic direction.

Technical Analysis: Key Support and Resistance Levels

- 52-Week High: ₹353.70 (April 2024)

- Lower Circuit: ₹195.66 (February 3, 2025)

- Next Critical Support: ₹152.55

With the stock now trading 44.6% below its 52-week high, technical indicators suggest continued bearish momentum unless institutional buyers intervene.

Is This a Buying Opportunity?

Opinions remain divided among market experts:

- Rahul Sharma, Equity99 Advisors: “The crash reflects systemic risks beyond HUDCO. Caution is advised until market stability returns.”

- Aparna Mishra, Motilal Oswal: “HUDCO’s fundamentals are intact. This dip could be a contrarian opportunity for long-term investors.”

HUDCO’s price-to-book ratio of 1.2x is near historic lows, hinting at potential undervaluation for risk-tolerant investors.

HUDCO Share Price: FAQs

1. Why did HUDCO share price crash 10% today?

Multiple factors, including the ex-dividend date effect, profit booking, weak sector performance, and rising NPAs, contributed to the sharp decline.

2. What is the lower circuit limit for HUDCO?

As of February 3, 2025, the lower circuit limit was ₹195.66.

3. Is HUDCO a good stock to buy now?

While the fundamentals remain strong, investors should wait for market stabilization and monitor institutional activity before making decisions.

4. How have rising interest rates affected HUDCO?

Higher interest rates have increased borrowing costs, reducing demand for housing loans and impacting HUDCO’s growth.

5. What role did the Union Budget play in HUDCO’s decline?

Unmet expectations regarding budget allocations for urban development projects led to a post-budget sell-off.

6. How does HUDCO’s NPA situation affect its share price?

Rising NPAs indicate potential financial stress, affecting investor confidence and triggering stock price declines.

7. What are the technical indicators suggesting for HUDCO?

HUDCO has breached key support levels, with RSI indicating oversold conditions. However, sustained selling pressure suggests caution.

8. What is HUDCO’s exposure to government projects?

A significant portion of HUDCO’s revenue comes from government infrastructure projects, making it vulnerable to policy shifts and project delays.

9. Are institutional investors buying or selling HUDCO shares?

Recent data shows reduced institutional participation, contributing to downward pressure on the stock.

10. What should existing HUDCO shareholders do?

Consider diversifying holdings, monitor Q4 results closely, and consult financial advisors for tailored strategies.

Investor Strategies Amid Uncertainty

- Monitor Institutional Activity: Keep an eye on mutual fund and FII holdings.

- Evaluate Q4 FY25 Results: Focus on asset quality, project updates, and NPA trends.

- Diversify Portfolios: Reduce concentrated exposure to HUDCO by balancing with defensive stocks.

The Road Ahead

- Union Budget Allocations: Higher spending on urban infrastructure could revive interest.

- Renewable Energy Diversification: HUDCO’s plans to enter the renewable sector could offset traditional risks.

- Policy Announcements: Government reforms aimed at boosting affordable housing may offer relief.

Conclusion

The 10% crash in HUDCO’s share price reflects a confluence of macroeconomic pressures, sector-specific challenges, and company-related issues. While some view this as a buying opportunity, caution is warranted. Investors should adopt a balanced approach, focusing on long-term fundamentals while staying vigilant about market developments.

You Might Also Be Interested in: Sensex Crashes: The Ripple Effect of Trump Tariffs on Indian Markets

HUDCO Share Price Crash: Visual Recap