Bank Nifty on February 25, 2025: Short-Term Technical Outlook

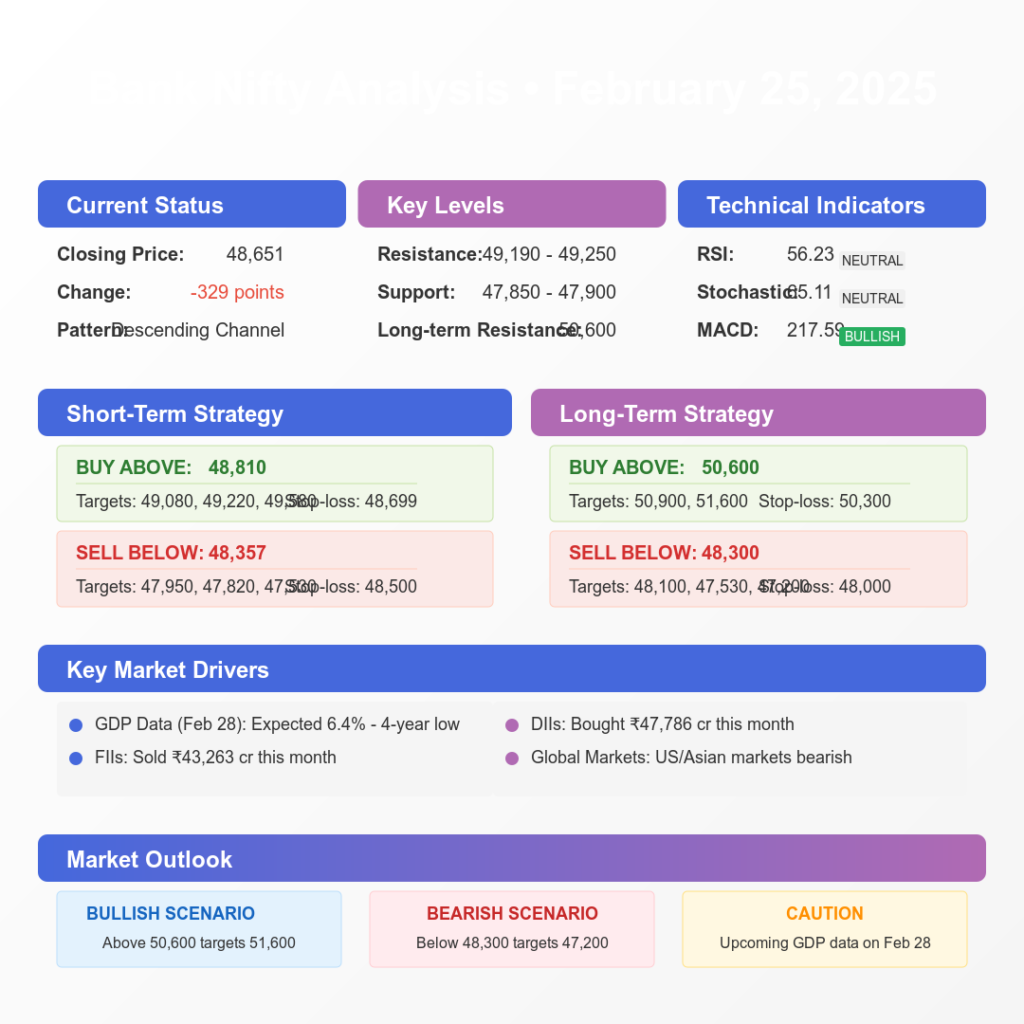

Bank Nifty closed at 48,651, declining by 329 points in the latest trading session. On the 45-minute chart, the index is moving within a descending channel, indicating continued pressure on the banking sector. The immediate resistance is placed at 49,190–49,250, while crucial support lies at 47,850–47,900.

Key Factors Driving Bank Nifty on February 25, 2025

- India’s Q4 GDP Data Impact – The GDP growth rate, scheduled for release on February 28, 2025, could significantly impact market sentiment. Economic projections estimate a slowdown to 6.4%, marking the lowest growth in four years. If GDP figures fall below expectations, further downside pressure is likely.

- Foreign & Domestic Institutional Activity – FIIs continued their selling spree, offloading ₹6,286 crore in the last session, while DIIs provided some support with purchases of ₹5,185.65 crore. FIIs have sold a total of ₹43,263 crore this month, whereas DIIs have accumulated ₹47,786 crore, showcasing strong domestic buying despite foreign outflows.

- Global Market Sentiment – Weakness in Asian markets, triggered by potential U.S. investment restrictions on China, has negatively impacted investor confidence. This bearish sentiment could spill over into Indian equities, including Bank Nifty, contributing to heightened volatility.

Short-Term Trading Levels & Strategy for Bank Nifty on February 25, 2025

- Buy Above: 48,810 | Targets: 49,080, 49,220, 49,580 | Stop-loss: 48,699

- Sell Below: 48,357 | Targets: 47,950, 47,820, 47,530 | Stop-loss: 48,500

Bank Nifty on February 25, 2025: Long-Term Technical Outlook

On a 4-hour chart, Bank Nifty remains in a descending channel but shows signs of an ascending channel in a shorter timeframe. A critical resistance zone exists between 50,600, while strong support is at 48,300. A breakout above the resistance could push Bank Nifty into bullish territory, whereas a drop below 48,300 may accelerate selling pressure.

Long-Term Trading Levels & Strategy

- Buy Above: 50,600 | Targets: 50,900, 51,600 | Stop-loss: 50,300

- Sell Below: 48,300 | Targets: 48,100, 47,530, 47,200 | Stop-loss: 48,000

Key Market Influences

- Macroeconomic Data: The upcoming GDP release and inflation numbers will play a crucial role in Bank Nifty’s long-term direction.

- FII vs. DII Activity: While foreign investors continue to sell, strong domestic institutional support is stabilizing the market.

- Sectoral Performance: The banking sector remains under pressure, with private banks showing resilience while PSU banks exhibit higher volatility.

Global Market Overview on February 25, 2025

The broader market sentiment remains weak, as reflected in major global indices:

| Index | Country | Closing Value | Change (%) |

|---|---|---|---|

| NASDAQ | USA | 19,287.27 | -1.21% |

| Dow Jones | USA | 43,580.94 | +0.28% |

| FTSE | UK | 8,658.98 | 0.00% |

| DAX | Germany | 22,425.93 | +0.62% |

| Nikkei 225 | Japan | 38,311.75 | -1.20% |

| Shanghai | China | 3,368.24 | -0.14% |

Key Takeaways from Global Cues

- U.S. markets are under pressure due to Federal Reserve policy concerns.

- Asian markets are declining due to geopolitical uncertainties and economic slowdown fears.

- European markets show mixed sentiment, with some indices staying in the green amid cautious optimism.

Pivot Levels & Moving Averages for Bank Nifty on February 25, 2025

Advanced Pivot Levels

| Level | Buy Above | Sell Below |

| R1 | 48,738.02 | 48,383.48 |

| R2 | 48,845.32 | 48,276.19 |

| R3 | 49,036.58 | 48,084.92 |

| Pivot | 48,560.75 | 48,514.10 |

Moving Averages & Technical Indicators

| Indicator | Value | Trend |

| 5-Day EMA | 45,519.65 | Bullish |

| 20-Day SMA | 44,335.76 | Bearish |

| 50-Day SMA | 43,451.41 | Bearish |

| 200-Day SMA | 41,389.75 | Neutral |

Momentum Indicators

| Indicator | Value | Trend |

| RSI | 56.23 | Neutral |

| Stochastic RSI | 65.11 | Neutral |

| MACD | 217.59 | Bullish |

| CCI | -114.58 | Bearish |

Final Verdict: What’s Next for Bank Nifty on February 25, 2025?

Bullish Case:

- If Bank Nifty crosses 50,600, expect a breakout rally toward 51,600.

- Positive GDP numbers could drive short-term optimism.

- DIIs continue strong buying, supporting recovery.

Bearish Case:

- A fall below 48,300 could push the index toward 47,200.

- FII selling pressure remains high, weighing on sentiment.

- Weak global markets could drag Bank Nifty further down.

Traders should remain cautious and track key support/resistance levels before making any decisive moves.

You Might Also Like to Read: Nifty 50 on February 25, 2025: Market Trends, Key Levels & Analysis

Visual Recap: Bank Nifty on February 25, 2025: Short & Long-Term Technical Outlook