Nifty 50 on February 25, 2025: Live Updates & Market Overview

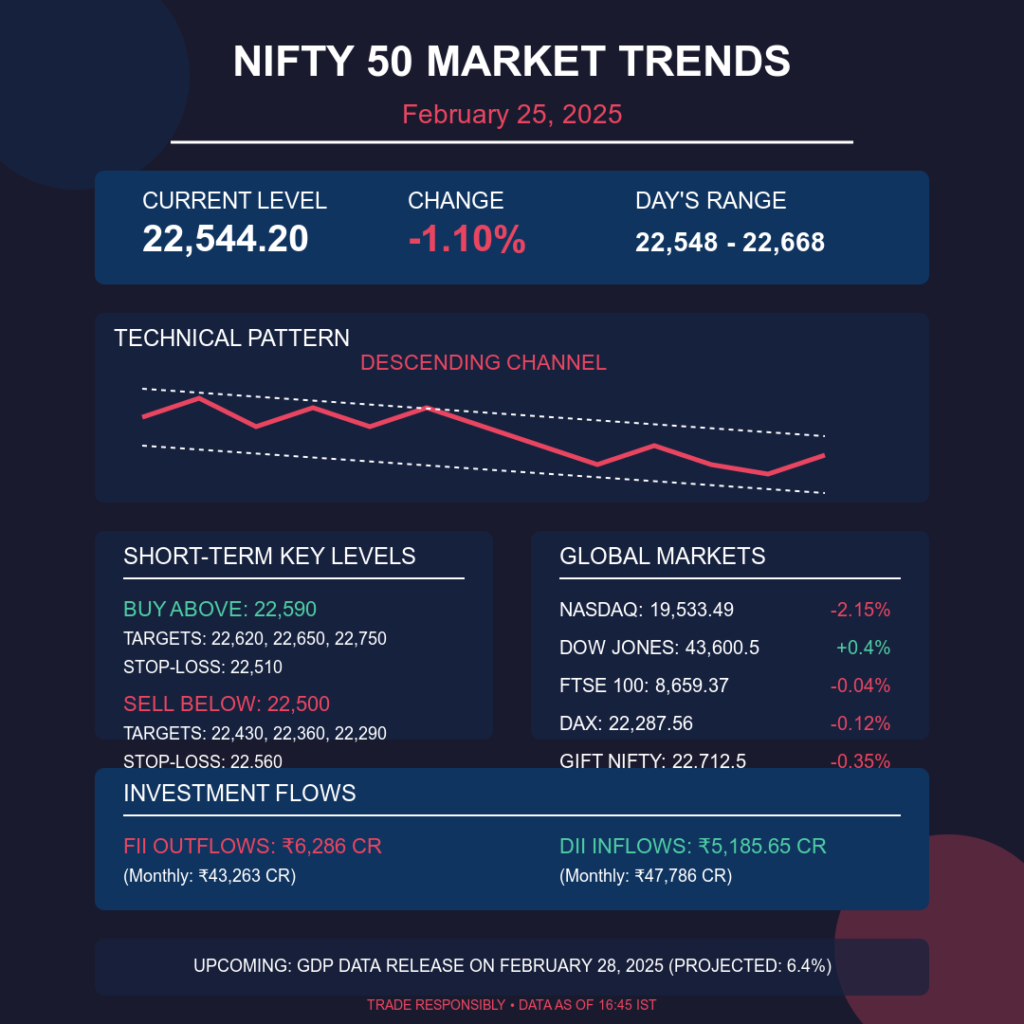

Nifty 50 on February 25, 2025, is witnessing significant market movements as traders and investors analyze global and domestic cues. At 16:45 IST, Nifty 50 was trading at 22,544.20, marking a decline of 1.10%. The index has been fluctuating between 22,668.05 and 22,548.35 throughout the day, indicating a tight trading range.

Nifty 50 on February 25, 2025 – Key Market Insights

The Indian stock market opened flat to negative, influenced by global trends and foreign institutional investor (FII) outflows. Gift Nifty is trading at 22,591.50, up by 5.50 points, suggesting a subdued start for the domestic market. Additionally, USD/INR is hovering around 86.82, reflecting currency market volatility.

Technical Analysis & Key Levels for Nifty 50

Short-Term Technical Outlook

- Nifty is trading in a descending channel on the 15-minute chart, indicating a bearish trend.

- The previous session saw a gap-down opening, with Nifty closing lower by 242 points at 22,553.

- If Nifty sustains above 22,590, an upward move towards 22,620-22,750 is possible.

- Conversely, a break below 22,520 could lead to further downside, testing levels like 22,430-22,290.

Short-Term Key Levels

- Buy Above: 22,590 | Targets: 22,620, 22,650, 22,750 | Stop-loss: 22,510

- Sell Below: 22,500 | Targets: 22,430, 22,360, 22,290 | Stop-loss: 22,560

Long-Term Technical Outlook

- On the 4-hour chart, Nifty is trading in a falling wedge pattern, nearing a potential breakdown below 22,550.

- A close below 22,500 may intensify selling pressure, while a move above 23,100 could trigger bullish momentum.

Long-Term Key Levels

- Buy Above: 23,100 | Targets: 23,550, 23,750, 24,000 | Stop-loss: 22,900

- Sell Below: 22,500 | Targets: 22,400, 22,200, 22,000 | Stop-loss: 22,700

Global Market Impact on Nifty 50

The global markets are experiencing volatility due to trade tensions and economic uncertainties:

- NASDAQ: 19,533.49 (-2.15%)

- Dow Jones: 43,600.5 (+0.4%)

- FTSE 100: 8,659.37 (-0.04%)

- DAX: 22,287.56 (-0.12%)

- Gift Nifty: 22,712.5 (-0.35%)

With U.S. markets undergoing a retesting phase, similar trends may impact Nifty’s movement in the coming sessions.

Economic Indicators & FII/DII Activity

GDP & Economic Growth

India’s Q4 GDP data, scheduled for release on February 28, is projected at 6.4%, marking the slowest growth in four years. A weaker-than-expected figure could exert further pressure on equities.

FII & DII Flows

- FII outflows: 6,286 crore in the last session, totaling 43,263 crore for the month.

- DII inflows: 5,185.65 crore in the last session, totaling 47,786 crore for the month.

FII selling pressure continues to weigh on the markets, but strong DII buying is providing some cushion.

Pivot Levels for Nifty 50 on February 25, 2025

| Pivot Method | R4 | R3 | R2 | R1 | Pivot | S1 | S2 | S3 | S4 |

|---|---|---|---|---|---|---|---|---|---|

| Classic | 22,851 | 22,790 | 22,729 | 22,641 | 22,580 | 22,492 | 22,430 | 22,342 | 22,254 |

| Woodie | 23,021 | 22,777 | 22,722 | 22,627 | 22,573 | 22,478 | 22,424 | 22,329 | 22,125 |

| Camarilla | 22,635 | 22,594 | 22,580 | 22,567 | 22,580 | 22,539 | 22,525 | 22,512 | 22,471 |

Frequently Asked Questions (FAQs): Nifty 50 on February 25, 2025

1. What is the Nifty 50 level on February 25, 2025?

As of 16:45 IST, Nifty 50 is trading at 22,544.20, down 1.10%.

2. What are the key support and resistance levels for Nifty 50?

Support Levels: 22,500, 22,430, 22,290

Resistance Levels: 22,590, 22,620, 22,750

3. What factors are influencing Nifty 50 today?

Global trade tensions and U.S. market corrections

Q4 GDP data release on February 28, 2025

FII outflows of 6,286 crore, causing selling pressure

DII buying of 5,185.65 crore, providing some stability

4. How is the global market impacting Nifty 50?

The NASDAQ fell 2.15%, indicating weakness in tech stocks.

Dow Jones gained 0.4%, but Asian markets remain under pressure.

Gift Nifty suggests a flat to negative opening for the next session.

5. What is the short-term outlook for Nifty 50?

Nifty 50 is in a descending channel and needs to break 22,590 for an upward move. A drop below 22,520 could accelerate selling pressure.

6. What is the long-term outlook for Nifty 50?

Nifty is trading in a falling wedge pattern and could see a strong move above 23,100. However, a break below 22,500 may lead to further downside.

Conclusion

Nifty 50 on February 25, 2025, remains volatile due to global uncertainties and FII outflows. While short-term traders should monitor 22,590 and 22,500 as key levels, long-term investors can look for opportunities above 23,100. With upcoming GDP data, traders should stay cautious as market sentiment could shift rapidly.

Analysis of Nifty 50 on February 25, 2025

The performance of Nifty 50 on February 25, 2025, reflects a highly volatile market scenario influenced by domestic and global economic factors. The index traded in a tight range, experiencing selling pressure due to heavy Foreign Institutional Investor (FII) outflows and weak global cues. The Gift Nifty suggested a flat to negative opening, aligning with market expectations.

Key Takeaways from Nifty 50’s Movement on February 25, 2025

- Market Sentiment & Technical Trends

- Nifty 50 on February 25, 2025, showed a continuation of the downtrend, failing to break key resistance levels.

- The index faced resistance near 22,600-22,550, a critical zone that was breached, confirming bearish momentum.

- A descending channel pattern on the 15-minute chart indicated a sustained weakness in the short term.

- For an upward reversal, Nifty needed to cross 22,590, but it struggled to hold above this level.

- Impact of Economic & Global Factors

- The upcoming Q4 GDP growth rate announcement on February 28 was a major concern, as projections suggested a slowdown to 6.4%, the lowest in four years.

- Global market uncertainty, especially the trade war tensions and U.S. investment restrictions on China, added to bearish sentiment.

- U.S. markets showed mixed performance, with the Nasdaq seeing significant losses, reinforcing weak investor sentiment.

- The Rupee trading at 86.82 indicated a range-bound currency market, offering some stability to domestic equities.

- FIIs & DIIs Activity

- Heavy FII selling continued, with ₹6,286 crore offloaded in a single session, pushing the markets lower.

- Domestic Institutional Investors (DIIs) provided some support, purchasing ₹5,185.65 crore, but not enough to offset FII outflows.

- Month-to-date, FIIs have sold over ₹43,263 crore, while DIIs have been net buyers at ₹47,786 crore, highlighting the divergence in market participation.

- Pivot & Support Levels

- The pivot level for Nifty 50 on February 25, 2025, stood at 22,580, serving as a crucial support zone.

- A break below 22,500 confirmed further downside, with targets at 22,400, 22,290, and 22,000.

- On the upside, resistance levels were identified at 22,590, 22,620, and 22,750, indicating potential recovery zones if buyers stepped in.

- Future Outlook & Strategy

- Short-term traders should watch for a break above 22,590 for an upward move, while cautious investors should monitor support at 22,500 for further weakness.

- Long-term investors might find opportunities to accumulate quality stocks at lower levels if the market remains under pressure.

- A strong reversal above 23,100 could indicate renewed bullish momentum, while failure to hold 22,500 could push the index towards 22,200-22,000 levels.

Conclusion

The performance of Nifty 50 on February 25, 2025, reflects a highly uncertain market grappling with global headwinds and weak domestic sentiment. Heavy FII selling, concerns over economic growth, and technical weakness kept the index under pressure. While short-term volatility remains high, long-term investors can watch for opportunities to enter at key support levels. The coming days, especially around the GDP data release, will be crucial in determining Nifty’s next move.

You might also like to read: Nifty 50 Trade Setup for February 21st: Key Support and Resistance Levels

Visual Recap: Nifty 50 on February 25, 2025