The Indian stock market is preparing for a potentially volatile session today, and traders are keenly watching the Nifty and Bank Nifty 24th April setup. With both indices coming off significant movements, April 24, 2025, offers crucial cues for intraday and swing traders. This deep-dive explores resistance levels, support zones, technical patterns, and expert strategies to help you navigate the action around Nifty and Bank Nifty on 24th April.

🔍 Overview: Nifty and Bank Nifty 24th April in Focus

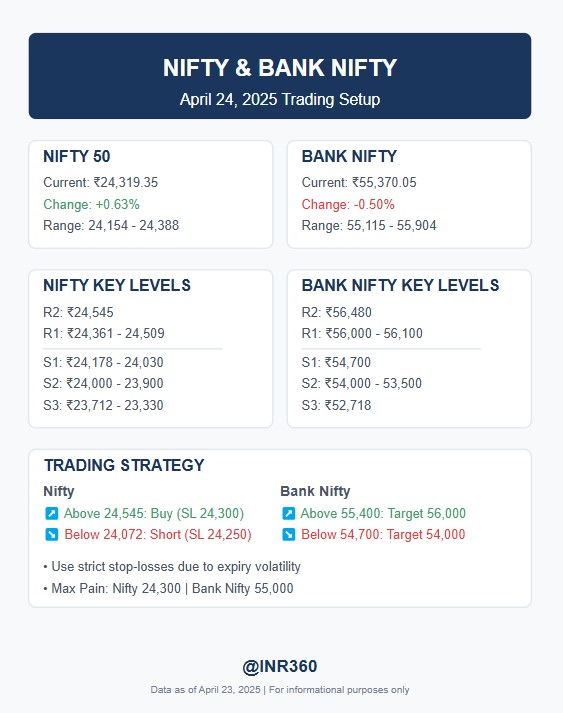

On April 23, Nifty 50 closed at 24,319.35, gaining 0.63%, while Bank Nifty ended at 55,370.05, declining 0.5%. As we look at Nifty and Bank Nifty on 24th April, both indices show divergence—Nifty sustaining momentum while Bank Nifty reflects selling pressure. Understanding these contrasting trends is crucial for effective positioning on expiry day.

📊 Nifty 50 Technicals – Nifty and Bank Nifty 24th April Analysis

🔹 Price Snapshot

- Closing Price (Apr 23): 24,319.35

- Previous Close: 24,167

- Day’s Range: 24,154 – 24,388

🔹 Support & Resistance – Nifty and Bank Nifty 24th April Levels

| Level Type | Price (₹) | Notes |

|---|---|---|

| Resistance 1 | 24,361 – 24,509 | Pivot-based |

| Resistance 2 | 24,545 | Fibonacci 61.8% of 26,277 to 21,743 |

| Support 1 | 24,178 – 24,030 | Pivot |

| Support 2 | 24,000 – 23,900 | Psychological zone |

| Support 3 | 23,712 – 23,330 | Trendline base |

📌 These levels are pivotal to the Nifty and Bank Nifty for 24th April strategy, especially if the Nifty breaks below 24,072.

🔹 Patterns & Indicators

- Chart Pattern: Hanging Man (bearish reversal sign)

- RSI: Above 60 – overbought territory

- MACD: Positive crossover intact

- Volatility: India VIX at 11.95 – low volatility suggests complacency, a risky sign for bulls

🏦 Bank Nifty Technicals – Nifty and Bank Nifty 24th April Angle

🔹 Price Snapshot

- Closing Price (Apr 23): 55,370.05

- Previous Close: 55,652.80

- Day’s Range: 55,115 – 55,904

🔹 Support & Resistance – Bank Nifty 24th April

| Level Type | Price (₹) | Notes |

|---|---|---|

| Resistance 1 | 56,000 – 56,100 | Psychological resistance |

| Resistance 2 | 56,480 | Pivot resistance |

| Support 1 | 54,700 | Strong immediate support |

| Support 2 | 54,000 – 53,500 | Consolidation zone |

| Support 3 | 52,718 | Historical trendline support |

📌 Expect volatility during expiry if the Nifty and Bank Nifty on 24th April setup sees Bank Nifty violating 54,700.

🔹 Patterns & Indicators

- Chart Pattern: Bearish Engulfing

- Candlestick Insight: Outside Bar after 5,000-point rally – trend reversal probable

- Momentum Indicator: RSI near 58, losing steam

🧠 Strategy for Traders – Nifty and Bank Nifty on 24th April

🔸 Nifty Strategy

- If sustains above 24,545: Buy with SL below 24,300, target 24,700/25,000

- If breaks below 24,072: Short with SL above 24,250, target 23,900/23,700

🔸 Bank Nifty Strategy

- If holds above 55,400: Expect retest of 56,000

- If breaks below 54,700: Prepare for correction to 54,000 or even 53,500

The Nifty and Bank Nifty 24th April plan must include strict stop-losses due to expiry day volatility and options gamma risk.

📈 Option Chain Insights – Nifty and Bank Nifty for 24th April

🔹 Nifty Options OI

- Call OI Buildup: 24,500, 25,000

- Put OI Buildup: 24,200, 24,000

- Max Pain: 24,300 – suggests expiry near current levels

🔹 Bank Nifty Options OI

- Call OI: 56,000, 55,500

- Put OI: 54,500, 55,000

- Max Pain: 55,000 – downside pressure evident in Bank Nifty for 24th April

📉 Global Market Influence on Nifty and Bank Nifty 24th April

- US Markets: Tech rally continues; Nasdaq gains 1.3%

- Asia: Mixed bag; Nikkei strong, Hang Seng weak

- SGX Nifty: Flat to slightly negative – cautious start expected

📌 Global cues will influence opening moves for Nifty and Bank Nifty on 24th April.

🧾 Recommended Stocks – Nifty and Bank Nifty 24th April Focus

| Stock Name | Action | Entry (₹) | Target (₹) | Stop Loss (₹) |

|---|---|---|---|---|

| AU Small Finance | Buy | 665 | 710 | 640 |

| Home First Finance | Buy | 1301 | 1375 | 1275 |

| Infosys | Buy | 1490 | 1550 | 1450 |

| IndusInd Bank | Sell | 1465 | 1430 | 1485 |

| Kotak Bank | Sell | 1825 | 1770 | 1850 |

These setups align with the broader Nifty and Bank Nifty 24th April outlook.

🔚 Final Thoughts: Nifty and Bank Nifty 24th April Expiry

The Nifty and Bank Nifty 24th April trade setup demands caution. While Nifty is in bullish control, Bank Nifty signals exhaustion. Traders should watch 24,545 on Nifty and 54,700 on Bank Nifty closely. A breakout or breakdown beyond these levels may define the rest of the week.

You Might Also Like to Read: Best Cities to Live in India (2025): The Ultimate Comparison for Life, Work & Growth

Visual Recap: Nifty and Bank Nifty 24th April