Nifty & Bank Nifty Prediction for March 4: The Indian stock market has faced relentless selling pressure, with Nifty 50 and Bank Nifty declining sharply over the past month. February turned out to be one of the worst months in recent years, as both indices struggled to find a bottom. As we move into the first full week of March, traders and investors are eagerly watching for signs of stability or further downside.

This in-depth analysis covers technical indicators, global market influences, institutional activity, and key support & resistance levels to predict the possible movement of Nifty and Bank Nifty on March 4, 2024.

Market Recap: February Ends with a Bearish Trend

The last few weeks have been brutal for the Indian equity market, with the indices showing significant declines:

- Nifty 50: Down 16% from its September 2023 peak.

- Nifty Midcap 100: Down 22% from its all-time high.

- Nifty Smallcap 100: Down 25%, entering a technical bear market.

- FII (Foreign Institutional Investors) Outflows: A major concern, continuing their selling spree.

- Sensex & Nifty: Both fell nearly 3% last week, showing persistent weakness.

Even with MSCI rebalancing flows providing some support on Friday, the market struggled to hold its ground. The fresh March F&O (Futures & Options) series began on a weak note, with short positions dominating.

Key question: Has the market bottomed out, or is there more downside ahead?

Global Market Influence: Impact on Nifty & Bank Nifty

1. US Market Trends & Trump’s Policy Uncertainty

- The Dow Jones and S&P 500 ended on a mixed note, with uncertainty surrounding Donald Trump’s tariff policies.

- Any potential trade restrictions under Trump could negatively impact Indian IT and export-driven sectors.

2. Currency & Crude Oil Impact

- The Indian Rupee (INR) depreciated 19 paise, closing at 87.37 against the US dollar, increasing import costs.

- Brent Crude Oil remains elevated, which could add inflationary pressure and hurt corporate profit margins.

3. FII & DII Institutional Activity

- FIIs (Foreign Institutional Investors): Continued their aggressive selling streak, dragging down market sentiment.

- DIIs (Domestic Institutional Investors): Providing some buying support, but not enough to offset FII outflows.

These global factors indicate persistent downside risk for Nifty and Bank Nifty in the near term.

Technical Analysis: Key Levels for Nifty & Bank Nifty

Nifty 50: Key Support & Resistance Levels

| Zone | Level | Implication |

|---|---|---|

| Immediate Support | 22,000 | Holding above this can prevent further downside |

| Crucial Support | 21,800 | If breached, a bear market could deepen |

| Next Major Support | 21,200 | A breakdown could trigger panic selling |

| Immediate Resistance | 22,500 | Bulls need to reclaim this for a rebound |

| Major Resistance | 22,750 | Strong supply zone; breakout needed for reversal |

Indicators Suggesting Weakness

- RSI (Relative Strength Index): Near 30, indicating oversold conditions.

- MACD (Moving Average Convergence Divergence): Bearish crossover suggests continued weakness.

- Volume Profile: Heavy selling volume, indicating that bears are still in control.

Nifty & Bank Nifty Prediction for March 4: If Nifty fails to hold above 22,000, it could head towards 21,800. A close above 22,500 is necessary for a potential trend reversal.

Bank Nifty: Key Support & Resistance Levels

| Zone | Level | Implication |

| Immediate Support | 47,500 | Must hold to prevent more downside |

| Major Support | 46,200 | Breakdown here could trigger further selling |

| Immediate Resistance | 49,000 | Needs to be reclaimed for bullish momentum |

| Crucial Resistance | 50,500 | Breakout required for trend reversal |

Indicators Suggesting Weakness

- Banking stocks under pressure, especially PSU Banks.

- HDFC Bank & ICICI Bank leading the downside.

- FII selling in financials remains aggressive.

Prediction: If Bank Nifty breaks below 47,500, expect a drop to 46,200. Upside potential is limited unless it crosses 49,000.

Nifty & Bank Nifty Prediction for March 4, 2024

For Nifty

- Bearish Scenario: Sell below 22,000 for 21,800 and 21,500 targets.

- Bullish Scenario: Buy only above 22,500 for 22,750 and 23,000 targets.

For Bank Nifty

- Bearish Scenario: Sell below 47,500 for 46,200 and 45,500 targets.

- Bullish Scenario: Buy only above 49,000 for 50,500 targets.

Intraday Trading Tips

- Avoid bottom fishing in small and mid-caps.

- Focus on large-cap stocks for stability.

- Use a tight stop-loss to manage risk effectively.

Expert Opinions on Nifty & Bank Nifty Prediction for March 4

Ajit Mishra (Religare Broking):

- Market remains weak; traders should avoid averaging down losing positions.

- Midcap & smallcap stocks remain highly vulnerable.

Puneet Singhania (Independent Analyst):

- Adopting a “Sell on Rise” approach is ideal.

- Bank Nifty’s weakness remains a major concern.

Frequently Asked Questions (FAQs) about Nifty & Bank Nifty Prediction for March 4

1. Will Nifty and Bank Nifty recover tomorrow?

It depends on whether Nifty holds 22,000 and Bank Nifty 47,500. A break below these levels signals more downside.

2. What are the key resistance levels for Nifty?

Immediate resistance is at 22,500, and strong resistance is at 22,750.

3. Should I buy stocks now or wait?

Wait for clear reversal signals before entering long positions.

4. Is this a good time to invest in midcaps and smallcaps?

No, midcaps and smallcaps are still in a downtrend. Wait for stability before entering.

5. How is FII selling affecting markets?

FII outflows are one of the main reasons behind the market fall. Until they stop selling, pressure will continue.

Final Thoughts on Nifty & Bank Nifty Prediction for March 4

- Bearish bias continues unless a strong bounce occurs.

- Nifty must hold 22,000 to prevent further decline.

- Bank Nifty below 47,500 could lead to more downside.

- Traders should remain cautious and follow strict risk management.

The upcoming trading session will depend on global market trends and institutional activity. Until then, a sell-on-rise strategy remains the best approach.

You Might Also Like to Read: The ₹1.81 Lakh Crore Nightmare: Why 93% of Option Buyers Are Losing Money

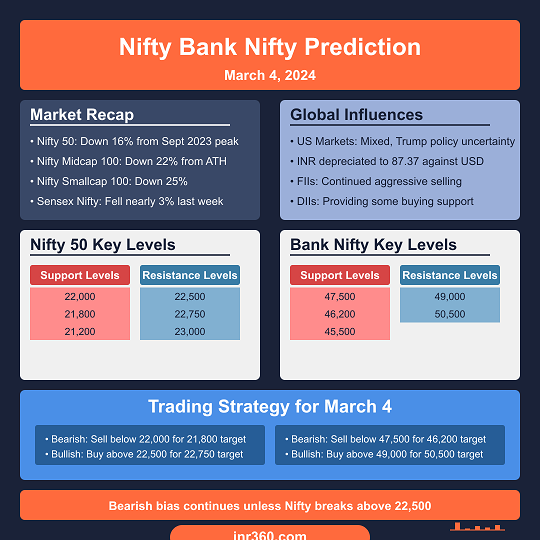

Visual Recap: Nifty & Bank Nifty Prediction for March 4