The stock market today is witnessing cautious trading as Indian equities face profit-booking after a strong rally. The GIFT Nifty is down by 35 points, signaling a subdued start for the session. The Nifty 50 fell 182 points in the previous session due to uncertainty over US-India trade relations and pre-expiry volatility.

In this article, we’ll analyze:

✔ Key support and resistance levels for Nifty 50 & Bank Nifty

✔ Options data trends (Call & Put OI)

✔ F&O ban list and high-delivery stocks

✔ Market sentiment indicators (VIX, PCR)

✔ Long & short buildup stocks

Market Overview: Nifty 50 & Bank Nifty

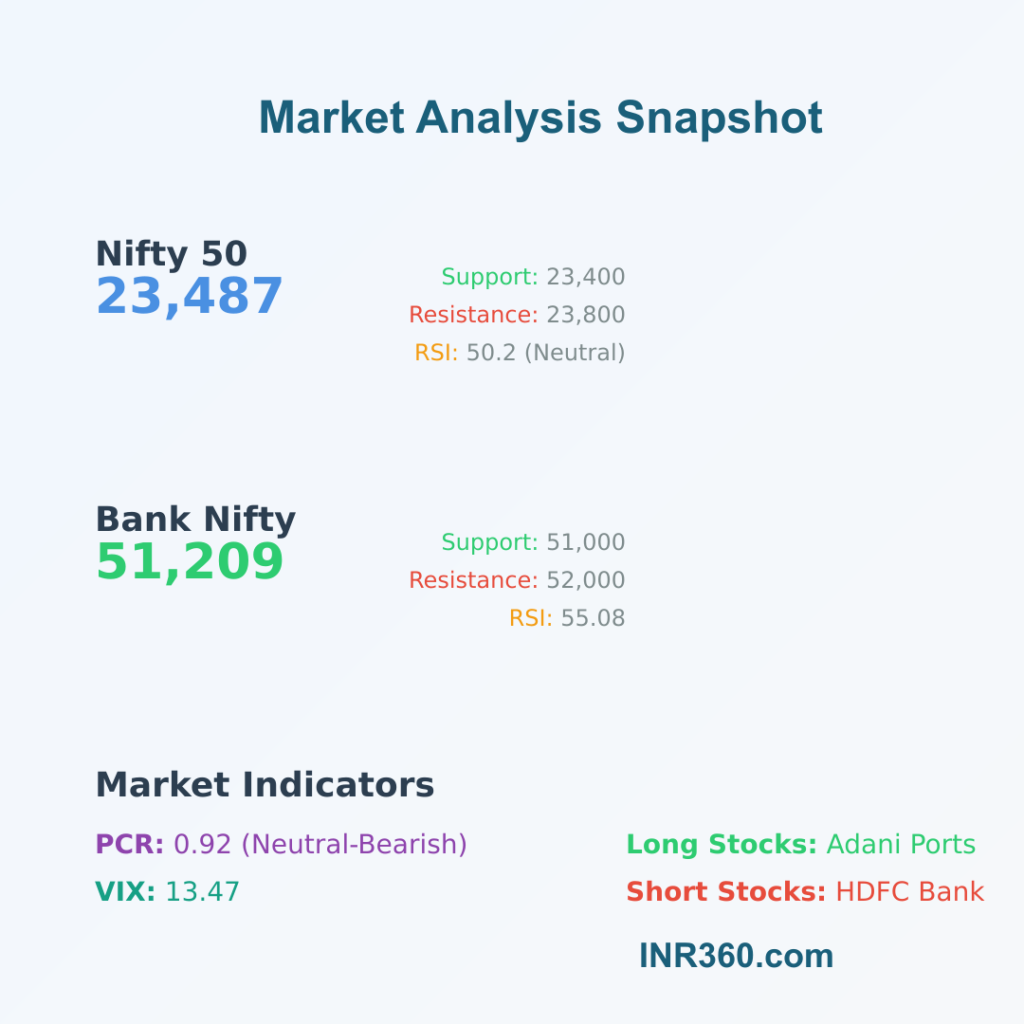

1. Nifty 50 Technical Analysis (Spot: 23,487)

The Nifty 50 formed a bearish candlestick but remains above key moving averages.

| Levels | Value | Significance |

|---|---|---|

| Resistance | 23,667 | Pivot Point R1 |

| Resistance | 23,734 | Pivot Point R2 |

| Resistance | 23,843 | Pivot Point R3 |

| Support | 23,450 | Pivot Point S1 |

| Support | 23,382 | Pivot Point S2 |

| Support | 23,274 | Pivot Point S3 |

| 200-EMA | 23,400 | Critical support |

| RSI (Daily) | 50.2 | Neutral zone |

Key Observations:

- A break below 23,400 (200-EMA) could lead to 23,200.

- Upside resistance at 23,800.

- Bollinger Bands are expanding, indicating volatility.

2. Bank Nifty Technical Analysis (Spot: 51,209)

Bank Nifty also saw profit-booking but remains in an uptrend.

| Levels | Value | Significance |

|---|---|---|

| Resistance | 51,693 | Pivot Point R1 |

| Resistance | 51,883 | Pivot Point R2 |

| Resistance | 52,191 | Pivot Point R3 |

| Support | 51,076 | Pivot Point S1 |

| Support | 50,886 | Pivot Point S2 |

| Support | 50,578 | Pivot Point S3 |

| RSI (Weekly) | 55.08 | Bullish momentum |

Key Observations:

- Immediate support at 51,000, resistance at 52,000.

- MACD shows a positive crossover but remains below zero.

Options Data: Nifty & Bank Nifty

3. Nifty Call & Put OI Analysis

Call Options Data (Maximum Open Interest)

| Strike | OI (Contracts) | Significance |

|---|---|---|

| 24,000 | 1.56 Crore | Strong resistance |

| 24,100 | 1.21 Crore | Next resistance |

| 24,500 | 1.11 Crore | Far resistance |

Put Options Data (Maximum Open Interest)

| Strike | OI (Contracts) | Significance |

|---|---|---|

| 23,000 | 1.17 Crore | Major support |

| 22,500 | 1.06 Crore | Strong support |

| 23,300 | 79.08 Lakh | Near-term support |

Key Takeaway:

- 24,000 is a major resistance, while 23,000 is strong support.

4. Bank Nifty Call & Put OI Analysis

Call Options Data (Maximum Open Interest)

| Strike | OI (Contracts) | Significance |

|---|---|---|

| 53,000 | 26.62 Lakh | Key resistance |

| 52,000 | 19.86 Lakh | Immediate hurdle |

| 52,500 | 18.21 Lakh | Secondary resistance |

Put Options Data (Maximum Open Interest)

| Strike | OI (Contracts) | Significance |

|---|---|---|

| 50,000 | 17.42 Lakh | Strong support |

| 49,500 | 13.53 Lakh | Major support |

| 51,000 | 11.69 Lakh | Near-term support |

Key Takeaway:

- 53,000 is a key resistance, while 50,000 is a major support.

Market Sentiment Indicators

5. Put-Call Ratio (PCR)

- Nifty PCR fell to 0.92 (from 1.04), indicating neutral-to-bearish sentiment.

- A PCR above 1 is bullish, below 0.7 is bearish.

6. India VIX (Fear Index)

- VIX down 1.21% to 13.47

- Needs to stay below 13 for bullish stability.

F&O Stock Activity

7. Long & Short Build-Up Stocks

Long Build-Up (35 Stocks)

- OI ↑ & Price ↑ → Bullish momentum.

- Stocks include Adani Ports, Tata Motors, SBI.

Short Build-Up (89 Stocks)

- OI ↑ & Price ↓ → Bearish pressure.

- Stocks include HDFC Bank, Reliance, ICICI Bank.

Short-Covering (31 Stocks)

- OI ↓ & Price ↑ → Squeeze in bearish bets.

8. Stocks Under F&O Ban

| Status | Stocks |

|---|---|

| Added | Hindustan Copper |

| Retained | None |

| Removed | IndusInd Bank |

Conclusion: Stock Market Today Outlook

The stock market today is in a consolidation phase after a sharp rally. Key levels to watch:

- Nifty 50: Support at 23,400, resistance at 23,800.

- Bank Nifty: Support at 51,000, resistance at 52,000.

- VIX below 13 and PCR stability will dictate trend strength.

FAQs: Stock Market Today

Q1. Why is the stock market down today?

Profit-booking after a 1,500-point Nifty rally and US-India trade tensions led to the decline.

Q2. What is the support for Nifty today?

Immediate support at 23,400 (200-EMA), followed by 23,200.

Q3. Which stocks are in the F&O ban list today?

Only Hindustan Copper is under the F&O ban.

Q4. What does PCR 0.92 indicate?

A neutral-to-bearish sentiment as traders sold more Calls than Puts.

Q5. Is Bank Nifty bullish or bearish?

The trend is bullish as it trades above key moving averages, but resistance at 52,000 is crucial.

This stock market today analysis provides a data-driven trading strategy for investors. Stay tuned to INR360.com for real-time updates! 🚀

You might also like to read: Nifty and Bank Nifty Trade Setup for 26 March: Comprehensive Analysis, Levels & Trading Strategies

Visual Recap: Stock Market Today: Nifty, Bank Nifty Trading Setup & Key Levels to Watch