The trade setup for 9th April suggests a potential bullish continuation after a sharp recovery on April 8. The Nifty 50 surged 1.7%, driven by global market strength and optimism ahead of the RBI policy meeting. However, the index remains below key moving averages, signaling caution. If the Nifty sustains above 22,850, it could target 23,000-23,200, while support lies at 22,270.

Below is a detailed breakdown of the trade setup for 9th April, including key levels, options data, FII/DII activity, and stock-specific trends.

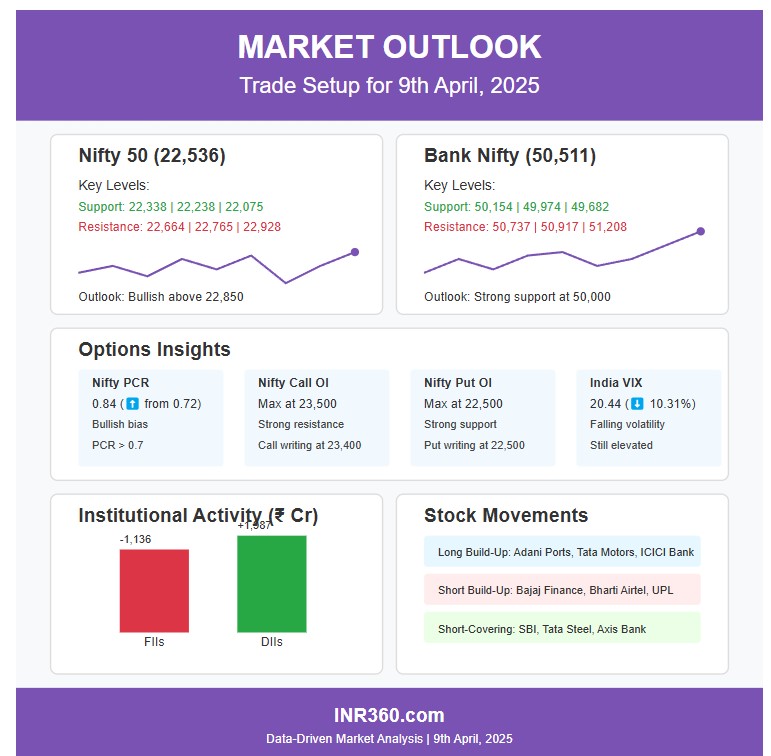

1. Nifty 50 Key Levels (22,536)

| Level Type | Value |

|---|---|

| Resistance 1 | 22,664 |

| Resistance 2 | 22,765 |

| Resistance 3 | 22,928 |

| Support 1 | 22,338 |

| Support 2 | 22,238 |

| Support 3 | 22,075 |

Technical Observations:

- Candlestick Pattern: High Wave-like formation (indicates volatility).

- Moving Averages: Trading below 5, 10, 20, 50, 100, and 200-day EMAs.

- RSI: At 42.07 (below 50 but rising).

- MACD: Below zero line but shows a bullish divergence.

2. Bank Nifty Key Levels (50,511)

| Level Type | Value |

|---|---|

| Resistance 1 | 50,737 |

| Resistance 2 | 50,917 |

| Resistance 3 | 51,208 |

| Support 1 | 50,154 |

| Support 2 | 49,974 |

| Support 3 | 49,682 |

Technical Observations:

- Candlestick Pattern: High Wave formation (bullish momentum).

- Moving Averages: Above 20, 50, 100, and 200-day EMAs.

- RSI: Above 50 (bullish momentum).

- MACD: Positive crossover but below zero on weekly charts.

3. Nifty Call Options Data (Weekly Expiry)

| Strike Price | OI (Lakh Contracts) | Call Writing (Lakh Contracts) | Call Unwinding (Lakh Contracts) |

|---|---|---|---|

| 23,500 | 122 | 18.12 | – |

| 23,000 | 99.32 | 20.27 | – |

| 23,300 | 88.85 | 24.26 | – |

| 22,000 | – | – | 31.10 |

Key Takeaway:

- Max Call OI at 23,500 (strong resistance).

- Max Call Writing at 23,400 (bulls cautious).

4. Nifty Put Options Data (Weekly Expiry)

| Strike Price | OI (Lakh Contracts) | Put Writing (Lakh Contracts) | Put Unwinding (Lakh Contracts) |

|---|---|---|---|

| 22,500 | 66.02 | 44.13 | – |

| 22,000 | 57.78 | – | 19.43 |

| 22,400 | 32.02 | 21.92 | – |

Key Takeaway:

- Max Put OI at 22,500 (strong support).

- Put Writing highest at 22,500 (bulls defending support).

5. Bank Nifty Call Options Data (Monthly Expiry)

| Strike Price | OI (Lakh Contracts) | Call Writing (Lakh Contracts) | Call Unwinding (Lakh Contracts) |

|---|---|---|---|

| 52,000 | 13.52 | – | – |

| 51,000 | 9.25 | 77.10 | – |

| 50,700 | – | 86.85 | – |

Key Takeaway:

- Max Call OI at 52,000 (resistance).

- Call Writing at 50,700 (immediate hurdle).

6. Bank Nifty Put Options Data (Monthly Expiry)

| Strike Price | OI (Lakh Contracts) | Put Writing (Lakh Contracts) | Put Unwinding (Lakh Contracts) |

|---|---|---|---|

| 50,000 | 10.03 | – | 80.88 |

| 50,500 | – | 2.97 | – |

| 50,700 | – | 1.05 | – |

Key Takeaway:

- Max Put OI at 50,000 (key support).

- Put Writing at 50,500 (bulls active).

7. FII/DII Activity (April 8)

| Category | Net Buying (₹ Cr) |

|---|---|

| FIIs | -1,136 |

| DIIs | +1,987 |

Key Takeaway:

- FIIs sold, while DIIs bought aggressively, supporting the market.

8. Put-Call Ratio (PCR)

- Nifty PCR rose to 0.84 (from 0.72), indicating bullish sentiment.

- PCR > 0.7 suggests bullish bias.

9. India VIX (Volatility Index)

- Fell 10.31% to 20.44, but remains elevated.

- High VIX suggests caution despite bullish momentum.

10. Long Build-Up (110 Stocks)

Stocks seeing fresh long positions:

- Adani Ports, Tata Motors, ICICI Bank

11. Long Unwinding (3 Stocks)

Stocks seeing profit booking:

- HDFC Bank, Reliance, ITC

12. Short Build-Up (8 Stocks)

Stocks seeing fresh shorting:

- Bajaj Finance, Bharti Airtel, UPL

13. Short-Covering (101 Stocks)

Stocks seeing short-covering rallies:

- SBI, Tata Steel, Axis Bank

14. High Delivery Percentage Stocks

Stocks with strong delivery-based buying:

- Infosys, HUL, Asian Paints

15. F&O Ban List

- Retained: Birlasoft, Hindustan Copper, Manappuram Finance

- No additions/removals.

Final Verdict on Trade Setup for 9th April

- Nifty Outlook: Bullish above 22,850, bearish below 22,270.

- Bank Nifty Outlook: Strong support at 50,000, resistance at 51,000.

- Key Triggers: RBI policy, global cues, FII flows.

Traders should watch 22,850 (Nifty) and 50,700 (Bank Nifty) for breakout confirmation.

You might also Like to Read: Trade Setup for 8th April 2025: Nifty 50, Global Markets, and Nine Stocks to Buy or Sell

Visual Recap: Trade Setup for 9th April