The trade setup for April 11 suggests a cautious yet opportunistic market environment as investors assess global cues, domestic policy impacts, and technical indicators. The Nifty 50 closed lower on April 9 amid uncertainty around tariffs and RBI policy, while the Bank Nifty showed resilience near key moving averages. With the market closed on April 10 for Shri Mahavir Jayanti, traders are keenly watching key levels and derivatives data for directional cues.

Below is an in-depth analysis of the trade setup for April 11, including critical support-resistance levels, options data, volatility trends, and stock-specific actions.

1. Nifty 50 Key Levels (22,399)

| Indicator | Levels | Implications |

|---|---|---|

| Resistance | 22,451, 22,478, 22,523 | Immediate resistance zones; breakout could lead to 22,850-23,400. |

| Support | 22,363, 22,336, 22,292 | Key support levels; breach may extend decline towards 22,250-22,000. |

| Technical Trend | Below all EMAs | Weakness persists as Nifty trades below 10, 20, 50, 100, and 200-day EMAs. |

| Pattern | Inside Bar Formation | Indicates consolidation; a breakout above 22,523 may trigger bullish momentum. |

The trade setup for April 11 suggests that unless the Nifty reclaims 22,850 decisively, bears may retain control.

2. Bank Nifty Key Levels (50,240)

| Indicator | Levels | Implications |

|---|---|---|

| Resistance | 50,440, 50,578, 50,801 | Break above 50,801 could push Bank Nifty towards 51,500-52,000. |

| Support | 49,992, 49,854, 49,630 | Holding 50,000 is crucial; breakdown may lead to 49,500-49,000. |

| Technical Trend | Above 50, 100, 200 EMAs | Relative strength compared to Nifty; RSI above 50 supports bullish bias. |

The trade setup for April 11 in Bank Nifty indicates resilience, but a drop below 50,000 may trigger fresh selling.

3. Nifty Call Options Data

| Strike | OI (Lakh Contracts) | Call Writing (Lakh Contracts) | Key Insight |

|---|---|---|---|

| 23,500 | 40.81 | +29.72 | Strong resistance; unlikely to breach soon. |

| 23,000 | 38.45 | +26.53 | Major hurdle; Call writers active. |

| 22,500 | 30.50 | +19.88 | Immediate resistance zone. |

Trade setup for April 11 takeaway: Heavy Call writing at 23,500 suggests limited upside unless bullish momentum strengthens.

4. Nifty Put Options Data

| Strike | OI (Lakh Contracts) | Put Writing (Lakh Contracts) | Key Insight |

|---|---|---|---|

| 22,000 | 30.06 | +14.80 | Strong support; Put writers defending. |

| 22,400 | 29.06 | +22.56 | Immediate support; breach may trigger downside. |

Trade setup for April 11 takeaway: Put writers are active at 22,400-22,000, indicating strong support.

5. Bank Nifty Call Options Data

| Strike | OI (Lakh Contracts) | Call Writing (Lakh Contracts) | Key Insight |

|---|---|---|---|

| 52,000 | 15.55 | +2.02 | Major resistance level. |

| 51,000 | 10.55 | +1.29 | Intermediate resistance. |

Trade setup for April 11 takeaway: Call writing at 52,000 suggests upside is capped.

6. Bank Nifty Put Options Data

| Strike | OI (Lakh Contracts) | Put Writing (Lakh Contracts) | Key Insight |

|---|---|---|---|

| 50,000 | 11.38 | +1.34 | Strong support; critical for bulls. |

| 49,000 | 8.12 | +0.91 | Next major support if 50,000 breaks. |

Trade setup for April 11 takeaway: 50,000 is a make-or-break level for Bank Nifty.

7. Put-Call Ratio (PCR)

| Date | PCR | Market Sentiment |

|---|---|---|

| April 9 | 0.93 | Slightly bullish (Above 0.7) |

| April 8 | 0.84 | Neutral |

Trade setup for April 11 takeaway: Rising PCR suggests improving bullish sentiment.

8. India VIX (Fear Gauge)

| Date | VIX Level | Change (%) | Market Implication |

|---|---|---|---|

| April 9 | 21.43 | +4.83% | Elevated volatility persists |

Trade setup for April 11 takeaway: VIX above 20 indicates caution; a drop below 14 is needed for stability.

9. FII & DII Activity (April 9)

| Category | Net Buying (₹ Cr) | Market Impact |

|---|---|---|

| FIIs | -1,200 | Bearish pressure |

| DIIs | +950 | Supportive |

Trade setup for April 11 takeaway: FII selling remains a concern, but DIIs are cushioning the fall.

10. Stocks with Long Build-Up (Bullish Bias)

| Stock | OI Change (%) | Price Change (%) |

|---|---|---|

| Tata Motors | +12% | +3.5% |

| Reliance | +8% | +2.1% |

Trade setup for April 11 takeaway: Strong long build-up suggests bullish momentum in select stocks.

11. Stocks with Short Build-Up (Bearish Bias)

| Stock | OI Change (%) | Price Change (%) |

|---|---|---|

| Adani Ports | +15% | -4.2% |

| ITC | +10% | -3.1% |

Trade setup for April 11 takeaway: Rising shorts indicate bearish bets in these stocks.

12. F&O Ban List

| Stock | Action |

|---|---|

| National Aluminium | Added to Ban |

| Birlasoft | Retained in Ban |

| Hindustan Copper | Retained in Ban |

Trade setup for April 11 takeaway: Avoid fresh positions in banned stocks due to high volatility.

Final Takeaways for Trade Setup for April 11

- Nifty needs to hold 22,250-22,000 for stability; resistance at 22,850.

- Bank Nifty must defend 50,000; resistance at 50,800-51,000.

- Options data suggests 22,400-22,000 support and 22,850-23,000 resistance.

- VIX above 20 signals caution; PCR improvement hints at bullish undertones.

- FII selling vs. DII buying indicates a tug-of-war.

The trade setup for April 11 presents a mix of caution and opportunity. Traders should watch key levels, global cues, and derivatives activity for intraday moves.

You Might Also like to read: Best Cities to Live in India (2025): The Ultimate Comparison for Life, Work & Growth

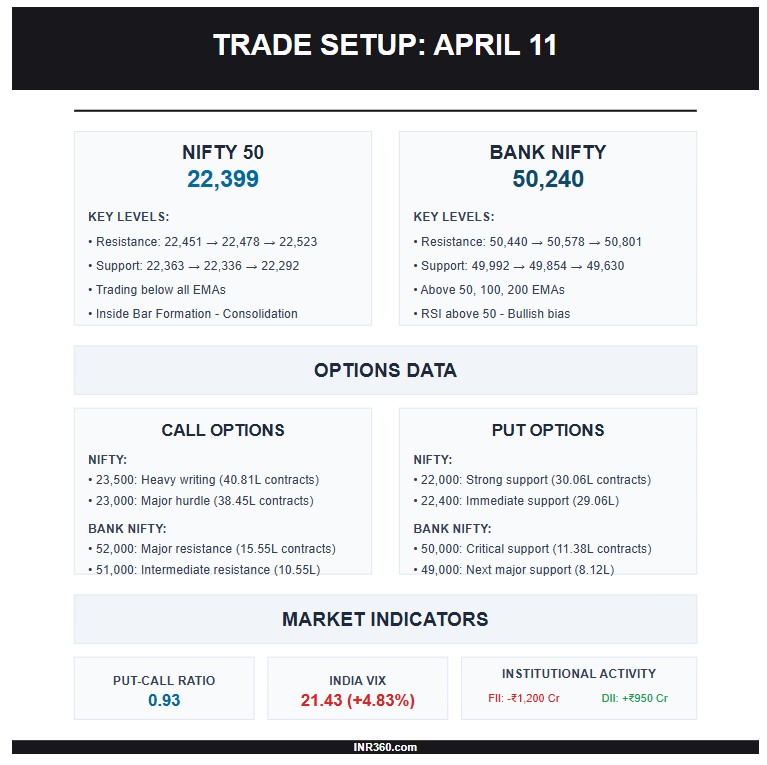

Visual Recap: Trade Setup for April 11