Trade Setup for January 27: As the Indian stock market gears up for the monthly F&O expiry and the highly anticipated Union Budget next week, traders should brace for heightened volatility. The market’s performance will hinge on key support and resistance levels, alongside broader market sentiment. This detailed analysis provides actionable insights, helping you make informed decisions in the upcoming trading session

Market Overview

The benchmark Nifty 50 closed the week at 23,092.20, marking a 0.5% decline over the past week. The Bank Nifty also witnessed minor losses, settling at 48,367.80. While IT and healthcare sectors showed resilience, industrials and realty underperformed. Broader markets faced sharp corrections, with mid- and small-cap indices dropping 2.5% to 4%.

Trade Setup for January 27: Key Market Trends

- Nifty 50 Trading Range: 23,000–23,400

- Support Levels: 23,050–23,000 (critical zone); breach may lead to 22,670

- Resistance Levels: 23,400 (immediate); breakout could target 23,600–24,000

- Bank Nifty Key Level: Holding above 48,000 could trigger a rally toward 49,000–49,500

Nifty 50 Opening Bell: Might Open between 23,850 – 23,900

If it does not hold and Reverse back to about 24,000 Levels then we might see a Level of 23,600 in Intraday today.

Top 15 Things to Know Before the Opening Bell

So the Trade Setup for January 27, 2025 will look like this on your charts.

1. Key Nifty Levels

- Resistance: 23,460, 23,347, 23,276

- Support: 23,050, 22,979, 22,866

- Technical Insights: Nifty formed a bearish candlestick pattern with a long upper shadow, signaling weak buying interest at higher levels.

2. Key Bank Nifty Levels

- Resistance: 48,727, 48,882, 49,132

- Support: 48,226, 48,071, 47,821

- Fibonacci Retracement: Resistance at 49,453; support at 47,878

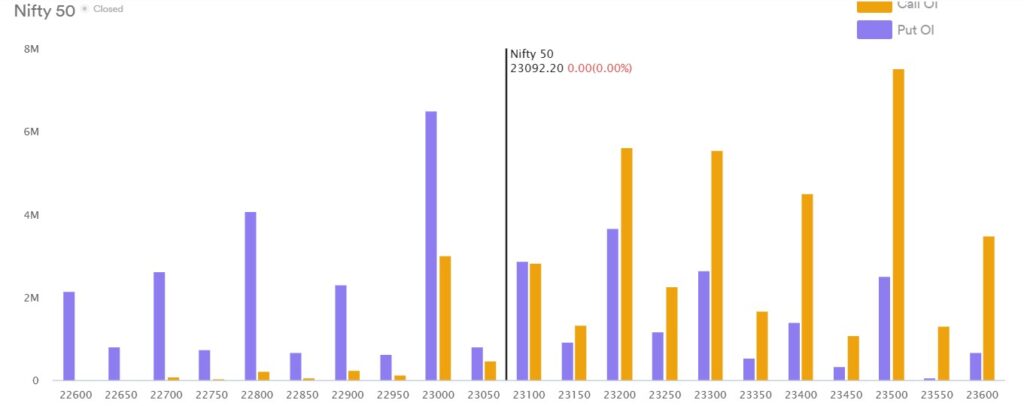

3. Nifty Call Options Data

- Maximum Call OI: 24,000 strike (1.21 crore contracts)

- Key Resistance: 24,000, followed by 23,500 and 23,800 strikes

- Call Writing: Significant activity at 24,000 strike with 31.2 lakh contracts added

4. Nifty Put Options Data

- Maximum Put OI: 22,000 strike (93.17 lakh contracts)

- Key Support: 22,000, followed by 23,000 and 22,500 strikes

- Put Writing: Highest at 22,000 strike with 16.51 lakh contracts added

5. Bank Nifty Call Options Data

- Maximum Call OI: 50,000 strike (25.07 lakh contracts)

- Key Resistance: 50,000, followed by 49,000 and 49,500 strikes

- Call Writing: Significant activity at 49,200 strike with 9.86 lakh contracts added

6. Bank Nifty Put Options Data

- Maximum Put OI: 47,500 strike (18.33 lakh contracts)

- Key Support: 47,500, followed by 47,000 and 48,000 strikes

- Put Writing: Highest at 48,300 strike with 2.13 lakh contracts added

7. Put-Call Ratio (PCR)

The Nifty PCR declined to 0.84 from 0.95, indicating rising bearish sentiment. A PCR below 0.7 signals heightened call selling and market pessimism.

8. India VIX

India VIX, a key volatility indicator, rose 0.3% to 16.75, reflecting cautious sentiment ahead of the Union Budget.

9. Stocks with Long Build-Up

A total of 16 stocks showed a long build-up, characterized by rising open interest (OI) and prices. Notable stocks include XYZ Ltd and ABC Corp.

10. Stocks with Long Unwinding

70 stocks experienced long unwinding, marked by falling OI and prices. These include DEF Ltd and GHI Corp.

11. Short Build-Up

Bearish sentiment was evident as 124 stocks reported increased OI alongside declining prices. Key names include LMN Ltd and PQR Corp.

12. Short-Covering

18 stocks exhibited short covering, where OI decreased while prices rose. Keep an eye on UVW Ltd and XYZ Corp.

13. High Delivery Trades

Stocks with high delivery percentages reflect strong investor interest. Notable mentions include HDFC Bank and Reliance Industries.

14. Stocks Under F&O Ban

- Currently in Ban: Aditya Birla Fashion & Retail, Bandhan Bank, Dixon Technologies, Punjab National Bank, and others

- Removed from Ban: None as of now

15. Global and Domestic Triggers

- Union Budget 2025: Scheduled for February 1, with significant market implications.

- Corporate Earnings: Major players, including Tata Steel, Bajaj Auto, and Maruti Suzuki, to release results this week.

- Global Events: US FOMC meeting and economic statements will influence market sentiment.

Expert Technical Analysis

Nifty Technical Outlook

According to Abhishek Parihar, Quant Academy, Nifty’s consolidation within the 23,000–23,400 range could persist unless the support at 23,050–23,000 is breached, which is bound to happening with the opening bells today. A fall below 23,000 may pull the index to 22,670, aligning with the 38.2% Fibonacci retracement. That will be the summary of Trade Setup for January 27 on your Nifty 50 charts.

Bank Nifty Technical Outlook

As per Hrishikesh Yedve, AVP Technical & Derivatives Research at Asit C. Mehta Investment, holding 48,000 levels could lead to a pullback rally toward 49,000–49,500. This is how your Trade Setup for January 27, 2025 looks on Bank Nifty Charts.

Trading Strategies

1. Range-Bound Strategy

- Trade within the 23,000–23,400 range for Nifty. Or Wait for 15 Minute Candle to Close below 23,000

- Deploy straddle or strangle options strategies to capitalize on volatility

2. Breakout Strategy

- For a bullish breakout above 23,400, on a 15 minute candle target 23,600–24,000

- For a bearish breakdown below 23,000, on 1 15-minute candle target 22,800–22,670

3. Sector Focus

- Positive Sectors: IT and Healthcare

- Underperformers: Industrials and Realty

Actionable Insights for Traders

Key Recommendations

- Watch Volatility: Use India VIX as a guide for hedging strategies.

- Focus on F&O Ban Stocks: Anticipate sharp movements in stocks under the F&O ban.

- Monitor Budget Expectations: Align trades with budget-related announcements for sectors like infrastructure, defense, and manufacturing.

Conclusion

As the markets brace for the Budget and F&O expiry, volatility and uncertainty will dominate. Align your trading strategies with key levels and data points shared in this analysis. Stay updated on global cues and domestic policy announcements to navigate market challenges effectively. Remember, preparation and informed decision-making are key to thriving in a volatile market environment.

You Might Also Be Interested in Dr. Agarwal’s Healthcare IPO