Introduction

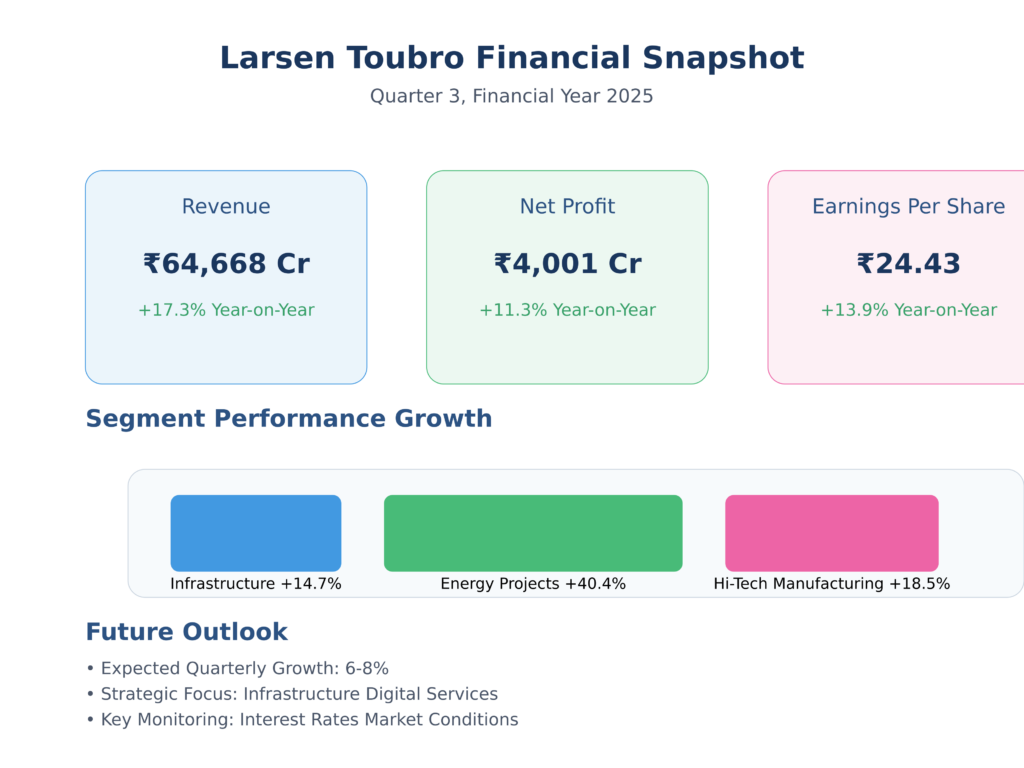

L&T Q3 FY25 Results: Larsen & Toubro Limited (L&T), a leading engineering, construction, and technology conglomerate, has reported its financial performance for Q3 FY25. The company delivered strong revenue growth and steady profitability, reflecting its resilience in a challenging macroeconomic environment. This report provides an in-depth analysis of L&T’s latest financial results, evaluates its segment performance, and presents a future outlook for the next quarter and year-end.

L&T Q3 FY25 Results Financial Highlights

| Particulars | Q3 FY25 (₹ Crore) | Q2 FY25 (₹ Crore) | Q3 FY24 (₹ Crore) | YoY Growth (%) | QoQ Growth (%) |

|---|---|---|---|---|---|

| Revenue from operations | 64,667.78 | 61,554.58 | 55,127.82 | 17.3% | 5.1% |

| Other income | 967.87 | 1,101.27 | 837.75 | 15.5% | -12.1% |

| Total income | 65,635.65 | 62,655.85 | 55,965.57 | 17.2% | 4.8% |

| Total expenses | 60,302.62 | 57,100.76 | 51,193.74 | 17.8% | 5.6% |

| Profit before tax | 5,333.03 | 5,555.09 | 4,771.83 | 11.8% | -4.0% |

| Net profit after tax | 4,001.03 | 4,112.81 | 3,594.51 | 11.3% | -2.7% |

| Basic EPS (₹) | 24.43 | 24.69 | 21.44 | 13.9% | -1.1% |

| Diluted EPS (₹) | 24.41 | 24.68 | 21.42 | 14.0% | -1.1% |

Key Takeaways from L&T Q3 FY25 Results

- Revenue Growth: The company recorded a strong 17.3% YoY revenue increase, driven by sustained execution in infrastructure and engineering projects.

- Profitability Stability: Despite higher input costs, net profit grew by 11.3% YoY, showcasing strong operational efficiency.

- Expense Surge: A 17.8% rise in total expenses reflects increased raw material costs and subcontracting expenses.

- Order Book Strength: The company secured new orders across its infrastructure, energy, and technology divisions, reinforcing future revenue visibility.

L&T Q3 FY25 Results: Segment-Wise Performance

| Segment | Q3 FY25 Revenue (₹ Crore) | Q3 FY24 Revenue (₹ Crore) | YoY Growth (%) |

| Infrastructure Projects | 32,407.98 | 28,266.43 | 14.7% |

| Energy Projects | 11,055.35 | 7,870.30 | 40.4% |

| Hi-Tech Manufacturing | 2,589.08 | 2,184.70 | 18.5% |

| IT & Technology Services | 12,218.92 | 11,325.97 | 7.9% |

| Financial Services | 3,881.26 | 3,406.66 | 13.9% |

| Development Projects | 1,434.56 | 1,219.87 | 17.6% |

| Others | 1,887.41 | 1,741.80 | 8.4% |

L&T Q3 FY25 Results: Performance Analysis

- Infrastructure Projects (14.7% YoY growth): The largest revenue-contributing segment, benefiting from increased government spending on roads, bridges, and metro projects.

- Energy Projects (40.4% YoY growth): Exceptional growth due to new hydrocarbon and renewable energy projects.

- IT & Technology Services (7.9% YoY growth): Driven by higher global IT demand but growth rate slower than other segments.

- Hi-Tech Manufacturing (18.5% YoY growth): Gained traction from defense and aerospace orders.

- Financial Services (13.9% YoY growth): Strong loan book growth, but facing headwinds from rising interest rates.

L&T Q3 FY25 Results: Future Outlook

Short-Term (Next Quarter – Q4 FY25)

- Revenue Growth Expectations: Expected to rise 6-8% QoQ, driven by robust infrastructure project execution and seasonal construction demand.

- Profitability Trends: Margins may remain under pressure due to raw material price fluctuations, but cost optimizations will help maintain net profits.

- Order Inflows: New project awards in power transmission, smart cities, and industrial automation expected to add to L&T’s strong order book.

- Potential Risks:

- Rising interest rates affecting capital-intensive projects.

- Geopolitical tensions impacting commodity prices.

- Delayed project execution due to supply chain disruptions.

Long-Term (Year-End FY25 & Beyond)

- Infrastructure Growth: Government’s capital expenditure push in railways, highways, and urban development will drive sustainable growth.

- Technology & Digital Services Expansion: L&T’s IT services segment to benefit from global demand for AI, cloud computing, and cybersecurity.

- Green Energy Investments: Expansion in renewable energy and electric mobility sectors will provide future revenue streams.

- Debt Management: Focus on reducing debt levels while maintaining strong cash flows to support capital investments.

Frequently Asked Questions (FAQs)

1. What were L&T’s key financial highlights for Q3 FY25?

- Revenue: ₹64,667.78 crore, up 17.3% YoY.

- Net profit: ₹4,001.03 crore, up 11.3% YoY.

- EPS: ₹24.43, up 13.9% YoY.

- Strong order book, particularly in infrastructure and energy projects.

2. What drove L&T’s revenue growth this quarter?

- Increased execution of infrastructure projects.

- Strong expansion in energy projects (40.4% YoY growth).

- Higher demand in hi-tech manufacturing and IT services.

3. What challenges does L&T face in the upcoming quarters?

- Rising raw material costs, which could squeeze margins.

- Interest rate hikes affecting capital-intensive projects.

- Supply chain disruptions impacting construction timelines.

4. What is the future outlook for L&T’s stock?

- Short-term (Q4 FY25): Moderate growth of 6-8% QoQ, driven by execution of existing projects.

- Long-term (FY25 year-end and beyond): Positive growth driven by government infrastructure spending, technology expansion, and sustainability projects.

5. Is L&T a good investment for 2025?

Yes, considering:

- Strong fundamentals and order book growth.

- Expanding digital & green energy portfolio.

- Consistent profitability and dividends.

- Long-term government infrastructure projects pipeline.

Conclusion

L&T has once again demonstrated strong financial resilience and robust execution capabilities in Q3 FY25. The company’s order book strength, strategic expansion into IT & digital services, and growing infrastructure investments indicate a positive outlook for FY25 and beyond.

For investors, L&T remains a fundamentally strong stock with a long-term growth trajectory. However, investors should monitor factors such as interest rate trends, commodity price fluctuations, and global macroeconomic conditions before making investment decisions.

Final Verdict: L&T is well-positioned for long-term growth, making it a compelling choice for investors seeking stability and expansion opportunities in India’s evolving economic landscape.

You might also be interested in: IndiaAI Mission: India’s Bold Step Towards AI Leadership