Market Overview

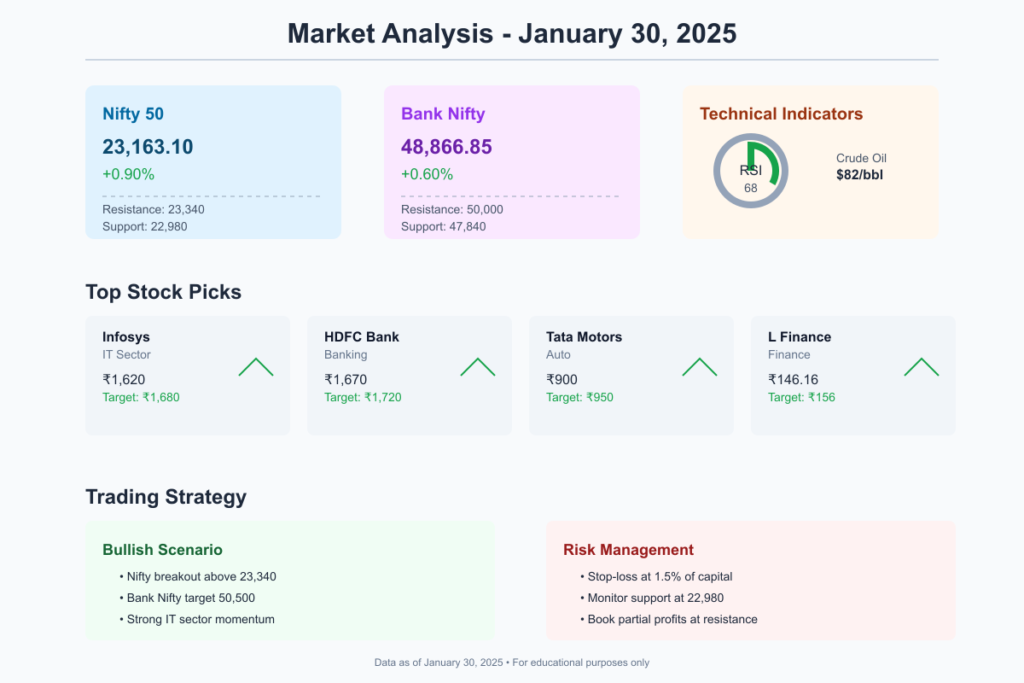

As we step into the trading session on January 30, 2025, the Indian stock market remains in focus following a strong performance in the previous session. On January 29, 2025, the Nifty 50 index closed at 23,163.10, reflecting a 0.9% gain, while the S&P BSE Sensex ended at 76,532.96, up by 0.83%. The Bank Nifty index also witnessed positive movement, closing at 48,866.85, up 0.6%.

The rally was driven by strong performances in the Auto, Realty, IT, and Pharma sectors. Broader indices also gained momentum, with midcap and small-cap indices rising between 2.3% and 3.4%, signaling increased investor confidence.

Global Market Cues and Economic Factors

The U.S. Federal Reserve‘s stance on interest rates and the upcoming Union Budget 2025 are the key external factors influencing Indian markets. Additionally, oil price fluctuations and foreign institutional investor (FII) activity continue to play a significant role in market sentiment.

- Wall Street closed higher, with the Dow Jones up 1.2%, the S&P 500 rising 1.5%, and the Nasdaq Composite climbing 2.0%.

- Asian markets opened mixed, with Nikkei 225 posting marginal gains, while Shanghai Composite remained flat.

- Crude oil prices remain stable at $82 per barrel, ensuring no immediate inflationary pressure.

Nifty 50 Technical Analysis

The Nifty 50 has been trading within a range-bound structure, with strong support and resistance levels dictating price action.

- Immediate Resistance Levels: 23,280 – 23,340

- Immediate Support Levels: 23,000 – 22,980

- Crucial Breakout Level: A decisive move above 23,340 could trigger an upward rally.

- Downside Risk: If Nifty breaks below 22,980, it could witness further correction towards 22,750.

- Key Indicators: The Relative Strength Index (RSI) stands at 68, indicating bullish momentum, but a slight caution for overbought conditions.

Bank Nifty Technical Analysis

Bank Nifty has been consolidating, and a breakout is likely in the coming sessions.

- Key Resistance Levels: 49,500 – 50,000

- Key Support Level: 47,840

- Breakout Zone: If Bank Nifty breaks above 50,000, it could rally towards 50,500.

- Bearish Signal: A break below 47,840 could indicate weakness.

- Moving Averages: The 50-day EMA is 47,200, acting as a major support.

Sectoral Analysis & Stock Picks for January 30, 2025

1. IT Sector

- Positive outlook with rising demand in AI and cloud computing.

- Infosys (₹1,620): Looks strong above ₹1,600; target ₹1,680.

2. Banking Sector

- HDFC Bank (₹1,670): If it sustains above ₹1,650, expect a move towards ₹1,720.

- ICICI Bank (₹1,095): Holding above ₹1,080 is crucial for further upside.

3. Auto Sector

- Tata Motors (₹900): A breakout above ₹915 can take it to ₹950.

- Maruti Suzuki (₹12,050): Support at ₹11,800; bullish above ₹12,100.

4. Breakout Stock for Today: L&T Finance Ltd

- Current Price: ₹146.16

- Resistance Levels: ₹149, ₹153

- Target: ₹156

- Stop-loss: ₹141

- Reason: Bullish breakout from sideways consolidation.

Action Plan for Traders

- Monitor Breakout Levels: Stay prepared for a move above 23,340 (Nifty 50) and 50,000 (Bank Nifty).

- Set Stop-loss Orders: Protect capital by keeping strict stop-loss levels.

- Stay Updated: Follow macroeconomic data, especially FII/DII activity and global trends.

- Focus on Sectors: IT, Auto, and Banking remain strong performers.

- Risk Management: Avoid aggressive leveraged positions ahead of the Budget.

Frequently Asked Questions (FAQs)

View For Today

Q1. What is the outlook for Nifty 50 on January 30, 2025?

Nifty 50 is in a bullish phase but faces resistance at 23,340. A breakout above this level could take it towards 23,500.

Q2. Is Bank Nifty expected to break 50,000?

Yes, if momentum continues and Bank Nifty crosses 50,000, expect a rally towards 50,500. Support is at 47,840.

Q3. Which stock is best for intraday trading today?

L&T Finance Ltd looks promising for an intraday trade with a target of ₹156 and a stop-loss at ₹141.

Q4. Should I invest in IT stocks today?

Yes, Infosys and TCS are showing strong momentum, with potential 2-3% upside in the near term.

Q5. What is the best risk management strategy for today’s trading?

1. Keep stop-loss at 1.5% of capital.

2. Avoid trading during high volatility periods (first and last 30 minutes of the market).

3. Diversify trades across sectors.

Q6. Is the market overbought or still in a buy zone?

The market is in an overbought zone, as RSI is above 65, but momentum remains strong. It’s advisable to book partial profits at higher levels.

Q7. How should I trade Bank Nifty options today?

Buy CE (Call Option) above 49,500 for a target of 50,200.

Buy PE (Put Option) below 47,800 for a target of 47,200.

Conclusion

With global cues being favorable and bullish momentum continuing, today’s session could see Nifty testing 23,340 and Bank Nifty aiming for 50,000. Traders should remain cautious, set strict stop-loss orders, and focus on breakout levels for informed trading decisions. Stay tuned for more updates as market conditions evolve!

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Please consult a registered financial advisor before making investment decisions.